Samsung’s Shambolic Smartphone Slump Triggers Apple Stock Warning

Samsung has warned that sales of itss smartphones wiill 'decline significantly' due to the COVID-19 pandemic, similar to Apple's own guidance warning. | Source: Drew Angerer/Getty Images/AFP

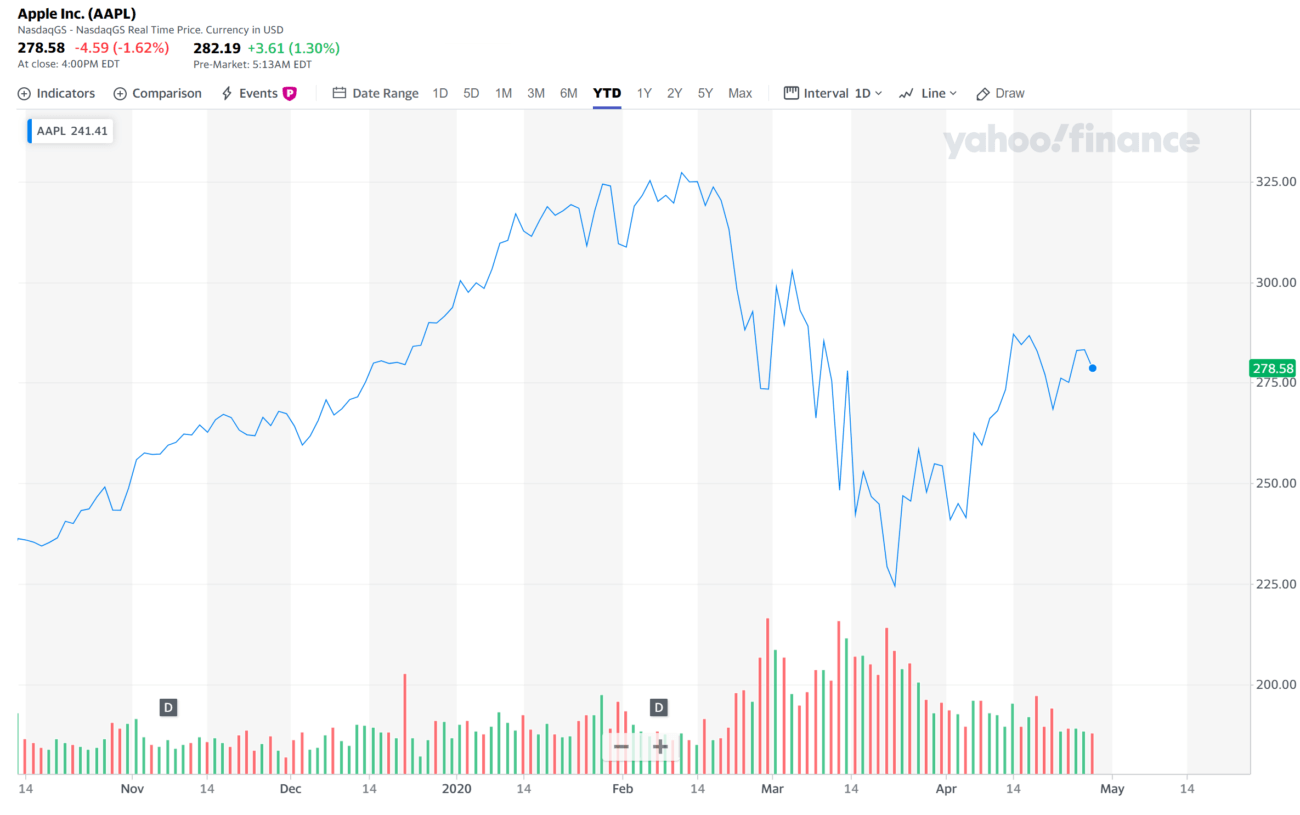

- Apple stock faces a pullback as iPhone manufacturing slows down and Samsung reports gloomy Q2 outlook.

- Global smartphone production and supply chain took a hit in April.

- Apple stock is up 24.1% year-to-date as tech stocks thrive.

Samsung Electronics faces a steep fall in smartphone sales in Q2 due to the coronavirus pandemic. Apple (NASDAQ: AAPL) may see a similarly negative impact on its business as smartphone manufacturing and sales slow down.

Apple saw a significant decline in smartphone production as China’s factory capacity fell by 70% . Year-over-year, Apple recorded a 61% drop in iPhone sales based on data from the China Academy of Information and Communications Technology (CAICT).

iPhone factories in China are forgoing workers as a result of diminishing demand. It indicates that the global smartphone industry is struggling, which places additional pressure on Apple ahead of the earnings season.

Apple stock vulnerable if iPhone sales slump isn’t priced in

iPhone remains as the primary driver of revenues for Apple. In 2019, sales of the flagship phone accounted for 55% of the annual revenue.

Apple focused on diversifying its operations into the streaming and wearable industries in the past two years. It saw that the smartphone sector was plateauing in early 2019 , as it became less compelling for users to buy a new phone every year.

The technological specifications of modern smartphones improved to a point where users do not feel the need to frequently replace their phones.

Apple’s entrance into the wearable space was a major hit. The demand for AirPods Pro increased rapidly, causing Apple to double production by November 2019.

The success of the AirPods series is admirable, but the company’s reliance on iPhones leaves AAPL at risk of a pullback after its earnings release.

Technology stocks including Amazon, Netflix, Apple, and Microsoft have thrived in 2020 despite the economic consequences of the coronavirus pandemic.

But, the uncertainty around reopening the economy and temporary closure of the company’s U.S. retail stores may fuel a downtrend in the AAPL stock.

Samsung is now feeling the pressure of smartphone slump

On April 27, Samsung Electronics reportedly decreased its orders for smartphone components by 50%.

Local mainstream publications in South Korea reported that industry executives foresee a “shock” in the smartphone industry.

The Q1 performance of leading smartphone manufacturers remained strong. For Samsung, the sales of Samsung Galaxy Fold and its flagship Galaxy series showed firm momentum.

The difference between Q1 and Q2 for smartphone producers is the month of April. As coronavirus spread swiftly throughout the U.S. and Europe, it caused a strain on supply chain and an unexpected drop in demand.

Investors remain optimistic in the medium to long-term trend of the U.S. stock market. Yet, the market is not pricing in worse outcomes of the pandemic and the low earnings of key corporations may cause correction entering into Q3.

Apple and Amazon led the stock market uptrend in the first four months of this year. Apple’s challenges in facing a smartphone slump could have a larger effect on the U.S. stock market.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com. The above should not be considered investment advice from CCN.com. The author holds no investment position in Apple or Samsung as of the time of writing.