Report Says U.S. Shale Industry May Collapse, But Oil Price Is Rising

The U.S. shale industry has proven resilient in the face of changing market dynamics. | Image: pan demin/shutterstock.com

- Institute for Economics and Peace warns that global pandemic could cause a collapse of the U.S. shale oil industry.

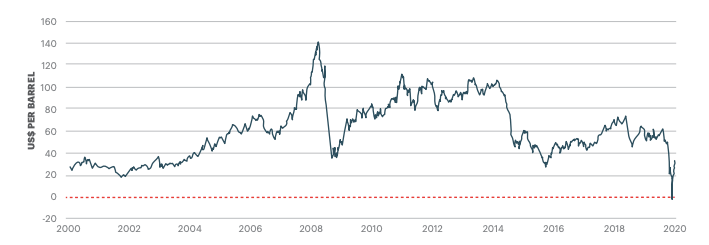

- The industry is facing falling oil prices and low demand, with prices turning negative at the end of April.

- Despite rising debt levels and bankruptcy fears, the oil price has grown steadily over the past month on hopes of a global economic rebound.

The U.S. shale oil industry is at risk of collapsing, a new report has warned. The Institute for Economics and Peace says the global pandemic may keep oil prices at historically low levels, forcing U.S. shale oil companies into bankruptcy.

The warning comes after oil futures entered negative territory in April amid a Russia-Saudi Arabia price war .

Still, the collapse of the U.S. shale oil industry is very much a worst-case scenario. Despite the April collapse, WTI for July delivery has risen 115%.

Collapse Of The U.S. Shale Oil Industry

Writing the latest report in its Briefing Series , the Sydney-headquartered Institute for Economics and Peace had mostly bad news for the U.S. shale oil industry:

The sharp fall in oil prices will affect political regimes in the Middle East … which may result in the collapse of the shale oil industry in the US.

Looking at the causes of the current oil price crisis, the report’s authors highlighted a massive fall in demand:

On 20 April the price of crude oil turned negative for the first time in history. Demand had collapsed so rapidly that overstocked producers were willing to pay buyers to take away excess inventory.

The report points out that WTI traded at $17 per barrel at the end of April, well below the $60 per barrel average in 2019.

In light of this, the U.S. shale oil industry looks like it’s in danger. The Institute for Economics and Peace isn’t the first organization to warn of collapse and bankruptcy. In April, Rystad Energy’s head of shale research Artem Abramov voiced a similar warning :

$30 is already quite bad, but once you get to $20 or even $10, it’s a complete nightmare. At $10, almost every US E&P company that has debt will have to file Chapter 11 or consider strategic opportunities.

Oil Price Recovery

Likewise, Fitch identified 25 U.S. oil companies most at risk of bankruptcy in May . Meanwhile, anonymous investors warned that many shale oil firms burned through cash during boom years, making themselves more vulnerable now.

Although the situation seems dire for U.S. shale, it’s far from critical. The oil price has been rising steadily since late April. At the same time, U.S. shale oil companies have been turning their wells back on in recent days.

At the end of April, WTI for July settlement hit a low of $17.60. They’ve since rebounded to around $38 after hitting a high of $40 earlier in the week. That’s a rise of 116%. Similarly, the oil price has risen by about 46% over the past month, and 3% over the past week.

The oil price also has other good news to celebrate. The OPEC+ group of oil-producing companies agreed to extend its production cut two days ago . This means that the 10% global supply cut will continue to the end of July.

By extension, it also means oil prices should remain stable. And with the gradual reopening of the global economy buoying stocks , it seems highly unlikely that the U.S. shale oil industry will collapse.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com.