Report: Crypto Exchanges in South Korea Scrambling to Survive as Bear Market Hits Hard

South Korea's biggest bitcoin exchange was hacked for the second time in less than a year, and this latest incident exposes a major threat to crypto exchanges. | Source: REUTERS/Kim Hong-Ji/File Photo

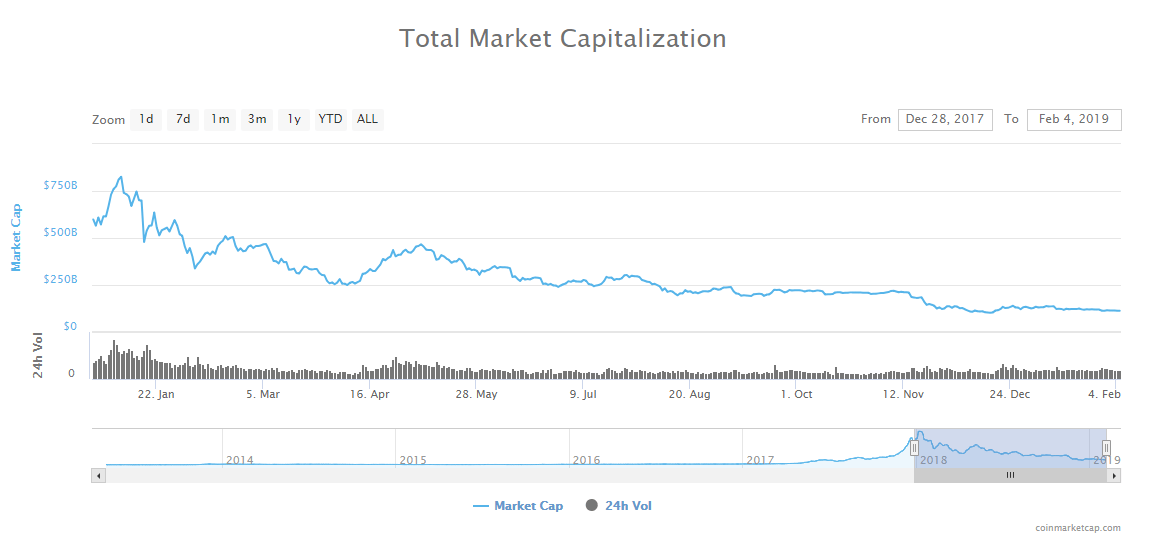

According to a local publication Blockinpress , crypto exchanges in South Korea are struggling to adjust to changing market conditions and the 14-month-long correction.

Since January 2018, the global crypto exchange market has seen a rapid decline in volume. With the exception of Bitcoin and Ethereum, the majority of both major digital assets and tokens have seen a 50 to 90 percent decline in daily volume.

Local Crypto Exchanges Considering Laying Off Employees

The report revealed that the country’s largest exchanges in the likes of Bithumb and Korbit are evaluating voluntary resignation of at least 10 percent of their employees.

Speaking to the publication, industry insiders said that crypto winter has hit the local market hard. Trading activity has declined significantly and the overall interest in the market has subsided.

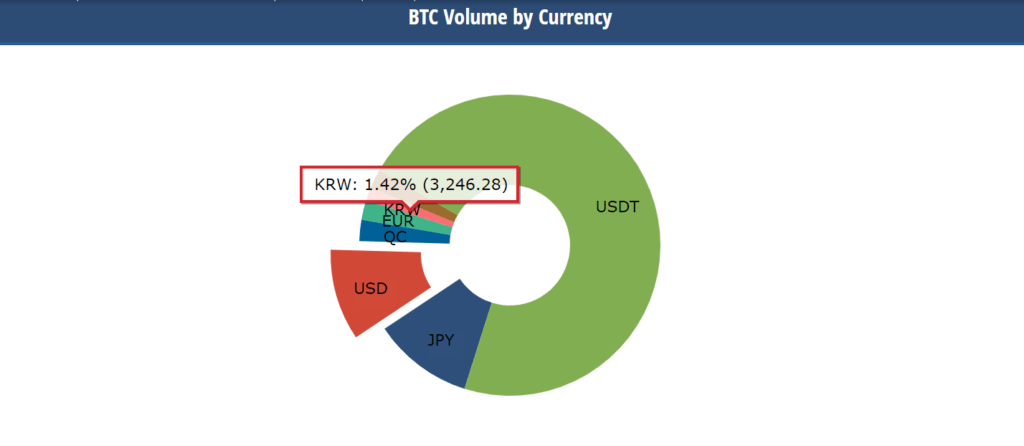

While the effect of the extended bear market has been similar in most major markets including the U.S., Japan, and Switzerland, it has been specifically intense in South Korea.

Previously, Korbit CEO Tony Lyu said that in the financial market of South Korea, word spreads quickly. Once one person is invested, because of the tight network of individuals in the country, everyone else begins to invest in the asset class or the industry.

“Word just spreads really fast in Korea. Once people are invested, they want everyone else to join the party. There’s been this huge, almost a community movement around this,” Lyu said .

The country’s leading exchanges Bithumb, UPbit, Korbit, Coinone, and Gopax are performing better than smaller exchanges, which are seeing a much worse situation.

An executive of a minor exchange in South Korea who asked for anonymity told Blockinpress that the trading volume of cryptocurrencies has dropped by more than 90 percent.

Most cryptocurrency exchanges rely on transaction, withdrawal, and order fees that incur on the platform. When the volume of digital assets declines, the main source of revenue of exchanges drops substantially.

Factors Behind the Struggle of Exchanges

Several industry insiders have said that the pace at which digital asset exchanges are solving industry-wide problems has slowed down.

In the bear market, exchanges generate less revenue and profit that may lead companies to eliminate certain initiatives to cut down on costs.

Considering that the cryptocurrency sector is still at its infancy, one exchange executive said that exchanges need to continue working on addressing issues including money laundering and liquidity.

“The pace at which exchanges are addressing core problems this year is not as fast as previous years. The sentiment around the crypto sector remained negative when the government of South Korea refused to get involved. Now, the government is putting in efforts to improve investor protection and the structure of the local market,” the executive said .

Not all initiatives have been cut back, however. This week, as CCN.com reported, Bithumb, Upbit, Corbit, and Coinone established an alliance to crackdown on money laundering.

By sharing the database of suspicious transactions and addresses, the four biggest digital asset exchanges in South Korea intend to eliminate criminal usage of cryptocurrencies in the local market.

“The joint AML initiative is expected to produce significant results as all four exchanges currently employ effectual user protection and fraud detection practices,” an official statement read.

Some newly venture-backed companies are also emerging with the intent of securing a share of the digital asset exchange market while it is struggling to adapt to the bear market.

Still, as Barry Silbert, the founder and CEO of Digital Currency Group (DCG), said, venture capital deals are falling apart due to crypto winter and it has proven to be a difficult period for both startups and investment firms.

“We’ve seen half a dozen fundraising deals fall apart over the past month after the lead pulled out. All is not well in crypto VC investor land Good time to remind founders that a signed term sheet does not equal cash in the bank,” Silbert said in December.