Regulators Must Have Died and Made Crypto Exchanges King

While it may have a nice ring to it, the Crypto Ratings Council is nothing more than Libra Association 2.0. | Credit: Romolo Tavani/Shutterstock.com

The battle cry of the cryptocurrency industry has been one of decentralization, or one without any centralized authority. It is this distinguishing feature that sets the blockchain space apart from other sectors and cryptocurrencies like bitcoin from other assets. No central bank, bankers, or government controls it, and unless your Nouriel Roubini it’s hard not to appreciate this push toward democracy and decentralization. When the industry begins to compromise, that’s when the crypto waters and Satoshi Nakamoto’s vision begin to get muddied. It’s possible that crypto market leaders moved one step closer to muddying that vision today.

According to a report in The Wall Street Journal , leading crypto exchanges – including but not limited to Coinbase, Circle, Kraken, and Bittrex – have decided to band together and create a system that ranks digital currencies based on their likeness to securities. They even have a catchy name – the Crypto Ratings Council. While it may have a nice ring to it, this consortium is nothing more than Libra Association 2.0, a group of entities influencing at best and controlling at worst the fate of “decentralized” digital currencies.

Ain’t That a ‘Kik’ in the Head

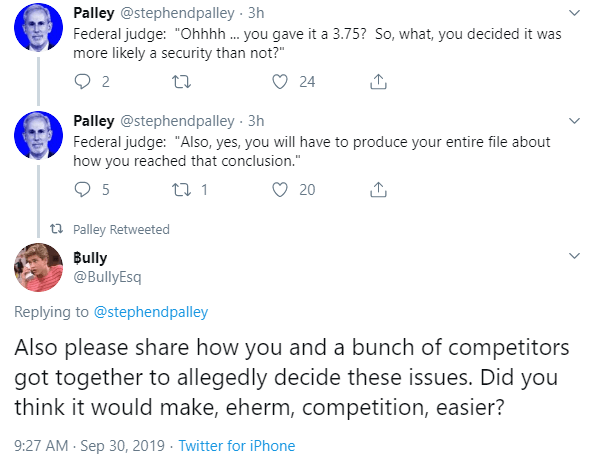

Crypto exchanges are no doubt looking to fill a void left by inadequate regulation that coupled with an SEC that remains ready to pounce on blockchain startups has threatened to cripple industry growth. They have arguably crafted a Howey Test of their own while regulators sit on their hands about developing an updated version of the archaic securities formula.

On the one hand, you might be tempted to commend the exchanges for doing something so more blockchain startups such s Kik don’t have to deplete their own resources and get a black eye trying to fight the SEC. But on the other hand, it’s difficult to ignore the irony of the situation.

Marco Santori , president and chief legal officer at Blockchain.com, chalks it up to a “series of legal conclusions, devoid of reasoning…a scattershot blast of facts aimed haphazardly out of Howie’s four short barrels.” Santori falls short, however, of dismissing the concept. He tweeted:

“Worse, the Council consists of many of the major custodians: Kraken, Coinbase, Circle, etc. who do business in the US. These mostly hollow ratings are very likely to be persuasive across the industry. A powerful black mark on your asset, or an undeserved seal of approval.”

Santori, however, goes on to suggest that the crypto industry should “applaud their effort” because it’s the “best we’ve got.” Sadly, without any trace of Satoshi Nakamoto, he may be right.