The Rally: Ethereum, Bitcoin Prices Lead Markets to $20 Billion Advance

The crypto markets rallied on Saturday, thrusting off the fear, uncertainty, and doubt caused by China’s antagonistic stance toward bitcoin exchanges. The bitcoin price led the advance, leaping as much as $800 at one point during the day. The ethereum price joined the surge, climbing more than $50 for a 17% daily gain. Altogether, an astonishing 92 of the top 100 cryptocurrencies experienced 24-hour increases greater than 10%.

Prior to the rally, closure notices from prominent Chinese bitcoin exchanges–including BTCC–had caused the total cryptocurrency market cap to sink below $100 billion. However, two of the country’s largest exchanges–OKCoin and Huobi–announced that they are suspending CNY trading pairs by the end of October but did not say they were suspending all trading. This led to speculation that these exchanges will be allowed to remain open and provide cryptocurrency-to-cryptocurrency trading pairs to their users.

Although this scenario is not a certainty, it provided traders with some optimism, and the crypto market cap began to storm back up to its previous-day levels. In the past 24 hours, the total value of all cryptocurrencies has risen about $24 billion–from $99 billion on September 15 to $123 billion on September 16.

Bitcoin Price Leaps to $3,600

The midweek market crash forced the bitcoin price as low as $2,946, and several analysts predicted it could fall as low as $2,500 before initiating a recovery. However, the bitcoin price has defied those bearish predictions–at least for now–and has recovered 16% in the past day alone. At one point on Saturday, the bitcoin price even broke past $3,800, although it has since tapered to a present value of $3,597. Bitcoin now has a market cap of $59.6 billion.

Ethereum Price Eyes $250

The downturn had affected ethereum even more steeply than bitcoin. On Friday, the ethereum price dipped below $200 for the first time since late July. This represented a two-week decline of 49%. The afternoon optimism led ethereum to a 17% rebound, and the ethereum price now sits at $247, which translates into a market cap of $23.4 billion.

Bitcoin Cash Price Spikes 24%

Bitcoin cash has a great deal of support within China, so the regulatory uncertainty surrounding Chinese bitcoin exchanges had caused the bitcoin cash price to fall nearly 50% between September 9 and September 15. At its low-point on Friday, the bitcoin cash price dropped to $302 and fell behind Ripple in the market cap rankings. However, it has since recovered more than 24% to $431, enabling it to reclaim the third-largest market cap.

Aside from the general market upswing, bitcoin cash has benefited from two positive announcements that have the potential to increase liquidity and adoption. Several days ago, European bitcoin exchange Bitstamp revealed it will add support for bitcoin cash by the end of the month. On Friday, BitPay enabled users to begin spending and storing bitcoin cash in their Copay wallets.

92 Coins Post Double-Digit Gains

Saturday’s rally breathed life back into the floundering altcoin markets. Nearly every top 100 cryptocurrency posted double-digit gains, including every top 50 coin–excluding Tether, whose value is pegged to USD.

The Ripple price rose 10%, which was the smallest gain of any top 10 cryptocurrency. Litecoin, on the other hand, recovered from Friday’s crash with a 27% surge. The litecoin price is now trading at $48, giving the coin a market cap above $2.5 billion.

The Dash price posted a 21% advance, rising to $284. NEM and Monero rose 16% and 18%, respectively, while IOTA ticked up 17%.

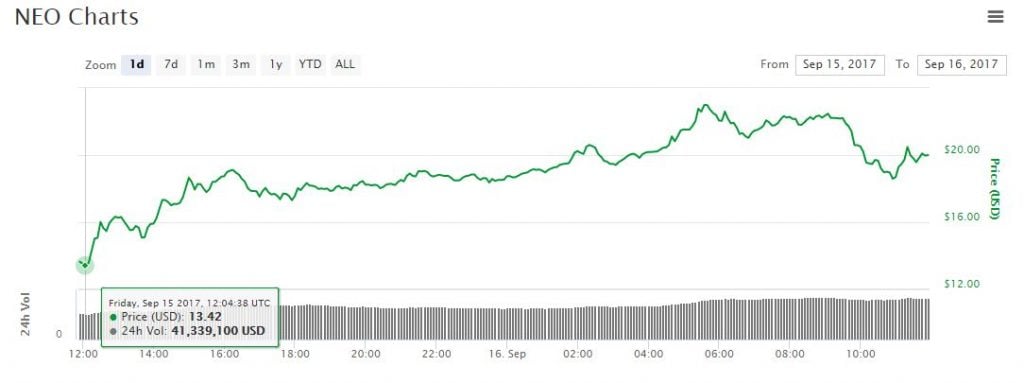

Both NEO and OmiseGO vaulted over ethereum classic with rallies exceeding 30%, forcing it out of the top 10 for the first time in recent memory. NEO rose a top-10 best 36% to just under $20, while OmiseGO leaped 30% to $10.