Pfizer Stock Surges as CEO Plans to Profit From Covid-19 Vaccine

Pfizer could be one of the first pharmaceutical companies to develop a viable vaccine for Covid-19. It fully intends to profit from this endeavor. | Image: REUTERS/Carlo Allegri/File Photo

- Pfizer stock is rallying after its CEO Albert Bourla defended plans to sell its Covid-19 vaccine at a profit.

- Critics argue that pharma companies shouldn’t profit from coronavirus vaccines, mainly when they receive government money.

- This likely won’t stop Pfizer, which expects Covid-19 to be a seasonal illness like the flu.

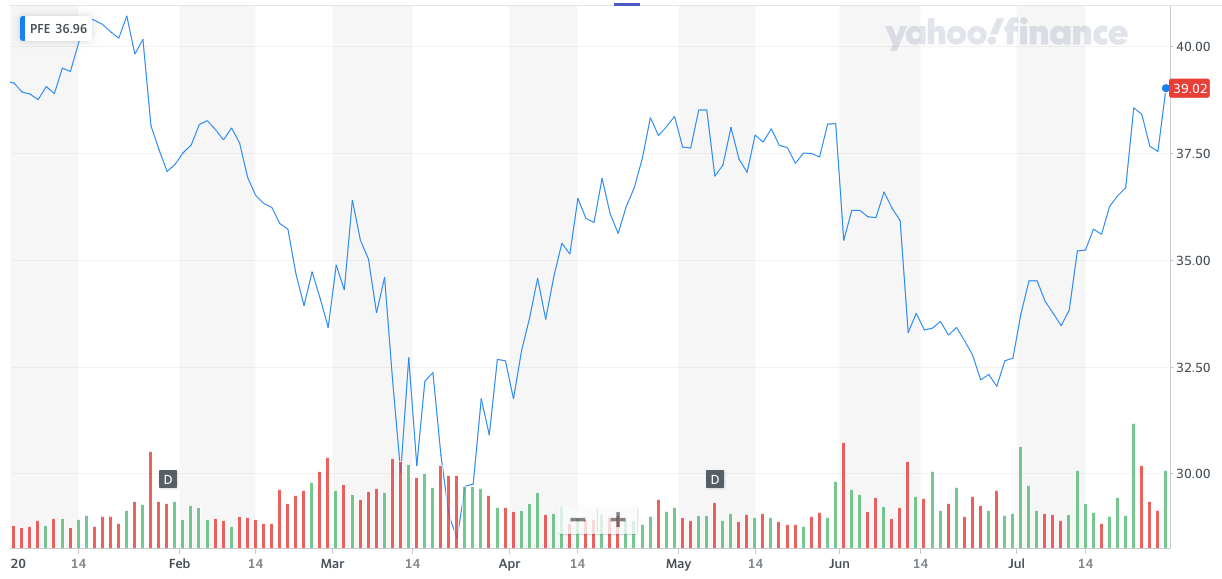

Pfizer (NYSE:PFE) stock jumped nearly 4% Tuesday after the CEO said pharmaceutical companies should profit from Covid-19 vaccines. The New York-based firm is one of the front runners in the race to produce a viable vaccine, yet President Donald Trump recently signed executive orders intended to limit drug prices.

Chief executive Albert Bourla says he expects Covid-19 to be a seasonal illness. This means there will be a long-term, recurring demand for a vaccine. It also means that, if pharma companies do sell coronavirus vaccines at high margins, they’ll enjoy huge profits.

Critics argue that pharmaceutical companies shouldn’t profit from Covid-19 vaccines because they receive government funding. Public subsidization and private profits are nothing new.

Pfizer Stock Climbs Amid Aggressive Covid-19 Profiteering

President Trump signed four executive orders last week aimed at keeping U.S. drug prices in line with prices overseas. His actions come amid concern that pharma companies may take advantage of Covid-19 desperation to profiteer .

Some companies–such as AstraZeneca and Johnson & Johnson–have pledged to sell any viable coronavirus vaccine at no profit .

Pfizer isn’t one of them. It signed a deal with the U.S. government last week to deliver 100 million doses of its potential vaccine at the cost of $1.95 billion. Analysts suggest this represents a markup of between 60% and 80% .

Speaking with Barron’s, CEO Albert Bourla took serious issue with the idea that pharmaceuticals shouldn’t profit from Covid-19 vaccines:

It think it’s very wrong. You need to be very fanatical and radical to say something like that right now … Who is finding the solution? The private sector … is along [the] way to find more solutions for therapeutics and vaccines. So how can you say something like that?

Regardless of the ethics of profiting when the world is on its knees, Pfizer stock is doing very well. The company announced adjusted earnings of 78 cents per share Tuesday, noticeably better than the forecast of 66 cents.

This news, combined with Bourla’s bullish statements, pushed Pfizer’s stock above $39 on Tuesday. It traded higher in Wednesday’s pre-market session.

Stock Is Up, But Ethics Are Low?

Since a March 23 low of $28.49, PFE has climbed by 37%. It will likely rise even higher if its vaccine is effective. Not everyone is happy about this.

Although Pfizer claims it hasn’t received public funding related to the development of its Covid-19 vaccine, some argue that its $1.95 billion deal with the U.S. government is effectively public funding.

Then there’s the view that excess fear has intentionally been whipped up so that pharmaceutical companies like Pfizer can profit.

While the Covid-19 pandemic is certainly unprecedented in modern history, profiteering on the back of government help isn’t. The global fossil fuel industry, for example, receives $5 trillion in subsidies per year . Then there’s Wall Street, which enjoys rising stocks on the back of quantitative easing.

This doesn’t justify what Pfizer is doing. It’s just meant to underline the fact that it’s nothing extraordinary. Pfizer will sell its vaccine at a profit, and there’s probably little we can do about it.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.