The People Have Spoken: Apple Pay Loses to Bitcoin by TKO

At today’s funeral proceedings, we are here to mourn the passing of a not-so-new technological program. In history’s wake, here lies the centralized carcass of Apple Pay, the establishment’s last gasp attempt to head off “The Future of Money”, Bitcoin, as the next-generation of payment technology. Would anyone like to say a few words on the behalf of the deceased? Anyone? Anyone? Bueller?

At today’s funeral proceedings, we are here to mourn the passing of a not-so-new technological program. In history’s wake, here lies the centralized carcass of Apple Pay, the establishment’s last gasp attempt to head off “The Future of Money”, Bitcoin, as the next-generation of payment technology. Would anyone like to say a few words on the behalf of the deceased? Anyone? Anyone? Bueller?

Alright, I will say a few words on behalf of the deceased before being officially laid to rest.

A Few Words About The Apple Pay That Never Was

Some would say that Apple Pay and Bitcoin are not competitors, but I’d bet to differ. Bitcoin’s primary application in the mainstream is as a currency and form of payment, which Apple Pay is, just without being a currency. They both are used to buy goods and services through smartphones, and are both used worldwide by merchants and consumers to do commercial transactions, so they are as close to direct competitors as you can get for things that are so different at their core. The main difference is that Bitcoin can do infinitely more than Apple Pay can. Apple Pay is a one-trick pony, and Bitcoin may know an infinite number of digital tricks. It is really 5-10 years ahead of our time. Kinda like comparing a juggling court jester and a mystical grand wizard, with a table full of elixirs and potions.

I have owned several Apple products since 2009 and am a big fan of their company and operating systems, once led by the late, great Steve Jobs. The Apple Pay concept was fairly sound if unoriginal. The outline should be recounted here for posterity since the vast majority of you have already forgotten the concept or passed on it outright. Take all of the usual suspects, primarily the ”Big 6” of the banking cartel (J.P. Morgan Chase, Bank of America, Wells Fargo, Citibank, Barclays and Capital One). Add the merchant card processing cartel (Visa, Mastercard, and AMEX). Sprinkle in plenty of technologies that other companies have already been using for years, under different names (Near Field Communication, Touch ID and Secure Element). Then, make Apple the centralized payment structure, the ring leader, looking to capitalize on the strength of the once innovative Apple. Pretty much anything Apple has touched in the last generation, from the iMac to iPod, to iPhone, to iPad has been an unqualified market success. Plus, just to make sure they didn’t miss a trick, recruit heavy-hitting merchants like McDonald’s, Whole Foods, and Disney, among others for a merchant network to feed upon. Stir and serve hot.

What’s that? It didn’t work? Why didn’t it work? Hard to say. I wrote an article about Apple Pay last September and was 50/50 on its prospects. Back then, I said it was a fast train on the old railroad tracks, just looking to take people for a ride. As a Bitcoin proponent, it was actually a no-lose situation for me and “The Future of Money”. If Apple Pay does take off, and people become quickly comfortable paying through NFC and their smartphones, Bitcoin can be brought in as a white knight competitor, later on. Bitcoin does the same thing as Apple Pay without bank fees and identity theft issues to contend with. Your transactions are reconciled, by all parties involved, in minutes, not overnight or the next business day. Your personal and financial information is not passed around non-secure merchant and bank systems like a basket at a church pew, and transaction fees are virtually non-existent. It does the same things Apple pay does, only faster, better, and more securely. It would probably work more in Bitcoin’s favor if Apple Pay did catch the market sleeping.

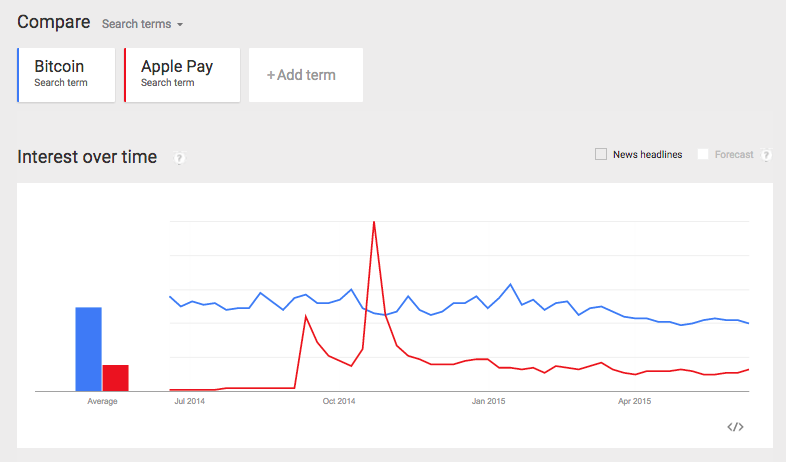

If Apple Pay falls by the wayside, as the provided chart shows, Bitcoin has no real competition to wade through. It grows through the market from the grass roots, organically, by word of mouth, as the Internet did 25 years before it. Either way, Bitcoin remains strong and viable both now, and in the future.

Bitcoin should have been vulnerable to a market attack last fall. 2014 was supposed to be this horrible year for Bitcoin, based on not just the drop in dollar price, which is not really of great import. The number of scandals that have befallen the digital currency since Mt. Gox’s collapse in February of last year, plus all the negative press should have left Bitcoin weakened and ripe for the plucking. Plus, the mining companies lost last year due the drop in dollar value made 2014 the most difficult year in Bitcoin’s brief history. Yet, ever since Apple Pay was released last September, Bitcoin has seen new companies, new countries, and new national discussions about its innovations. Venture capital is at an all-time high, and the pump-and-dump exchanges risks that have plagued the market have subsided.

Bitcoin should have been vulnerable to a market attack last fall. 2014 was supposed to be this horrible year for Bitcoin, based on not just the drop in dollar price, which is not really of great import. The number of scandals that have befallen the digital currency since Mt. Gox’s collapse in February of last year, plus all the negative press should have left Bitcoin weakened and ripe for the plucking. Plus, the mining companies lost last year due the drop in dollar value made 2014 the most difficult year in Bitcoin’s brief history. Yet, ever since Apple Pay was released last September, Bitcoin has seen new companies, new countries, and new national discussions about its innovations. Venture capital is at an all-time high, and the pump-and-dump exchanges risks that have plagued the market have subsided.

Since the initial press blitz by Apple and the supporting corporations last fall, Apple Pay has had its issues with fraud cases. It has generated no buzz. No businesses, industries, or even online forums have been built around it by consumers. 27% of Apple Pay users said the terminal didn’t work they tried to use Apple Pay in a recent poll . Almost half said it took too long to do a transaction, and over 40% couldn’t get help from a merchant when they ran into problems. Finally, Apple Pay has no original, nascent technology to fall back on. It is just another payment system in a field of payment systems. Apple Pay was not here to innovate for the market, but to try to manipulate a saturated market. Merchants themselves even prefer to use Bitcoin to Apple Pay, so the outcome was fait accompli.

The Internet itself grew from the bottom up. Word-of-mouth carried the Internet to global technology leadership. It wasn’t cast down by multi-national corporations as this technology that you should use to enrich them. If your new tech is good, word will get around. Bitcoin didn’t have anyone writing press releases and media campaigns for it. It just makes sense and has a concept that The People can believe in, and even take part in, personally, through mining operations, big and small. Bitcoin might very well be 5-10 years ahead of its time, but its best days are ahead of it, and it’s not going anywhere, despite the wishes of the establishment and the uninformed.

Apple Pay has reserved the burial plot right in-between MySpace and Google+. In modern technology, you don’t really die in a literal sense, you are just forgotten and ignored until your maker puts you down. Five years from now, Bitcoin will be running the world of digital payment technology, while Apple Pay will simply be forgotten. A cautionary tale of what could have been, but never was. Apple has proven it is far from perfect, especially without their iconic leader at the helm. It’s ok for them to lose. Bitcoin was going to come out on top, either way. Nice try, but the customer is always right. Literally, and figuratively, Apple Pay loses in the free market to Bitcoin by technical knockout, and this was definitely the best thing for all concerned. The world doesn’t need another centralized, multi-national corporate establishment payment system.

The People are smarter, and more edcuated because of the Internet, than the establishment give them credit for. And an educated consumer is Bitcoin’s best customer.

How will you remember Apple Pay? Have you ever used it, or know anyone who has? Share above and comment below.