On-Fire ONEOK Set to Surpass All-Time High Amidst 30% Surge

ONEOK (OKE) is in a strong uptrend. It's very possible that the stock could soon surpass a key resistance level, which would send it flying. | Source: Shutterstock

ONEOK (OKE) has been in a strong uptrend ever since it posted lows of $18.84 in December 2015. During this bullish rampage, the stock managed to print an all-time high of $71.99 in July 2018. Since then, the bulls have been struggling to take the stock to greater heights.

David Blair noticed OKE’s inability to convert resistance of $70 into support.

While some traders are bearish on OKE, we are taking the contrarian stance. It is possible that ONEOK could take out the resistance and print a fresh all-time high.

ONEOK (OKE) Flashing Multiple Bullish Patterns

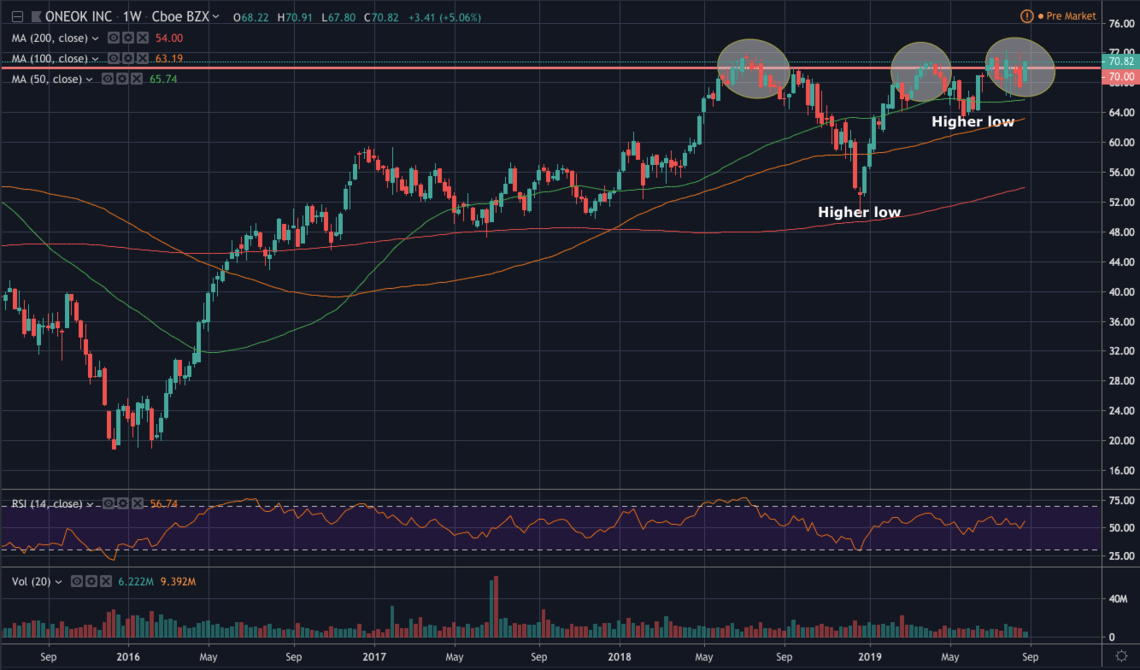

It is true that buying shares at resistance levels is not a wise investment strategy. However, this principle should be reconsidered once the stock forms higher lows while consolidating near the resistance. This tells us that bulls are preparing for a big push.

We’re seeing these signs develop in OKE.

The weekly chart reveals that OKE is painting an inverse head-and-shoulders pattern. This structure indicates that the bulls are using higher lows to push the price up and breach the neckline of $70.

While bulls have been unsuccessful in convincingly piercing the resistance, we believe that it could be only a matter of time before they do. The supply area of $70 has been tapped multiple times over the last year. This suggests that the resistance is nearly drained.

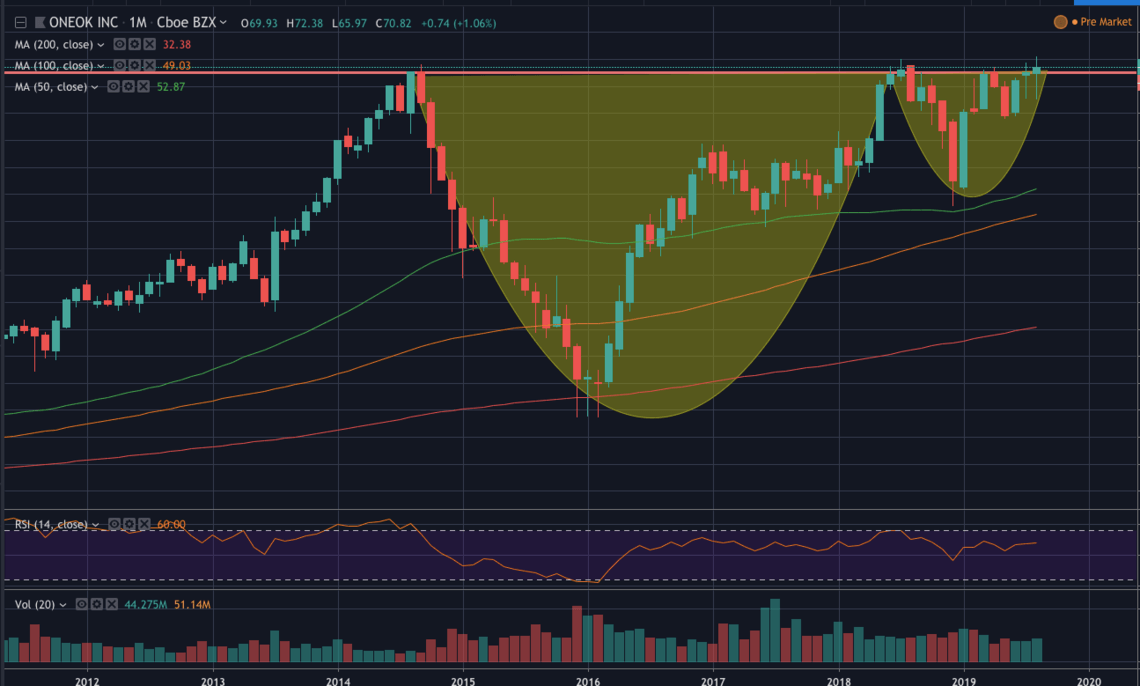

Also, a look at the longer timeframe reveals a larger bullish formation.

The monthly chart shows that the security is brewing a large cup and handle pattern. Thus, a convincing breach of the $70 resistance will likely attract investors who are currently staying on the sidelines.

Analyst: Sees ‘$104 as the Next Reasonable Target’

In addition, Ian McMillan, CMT , an analyst in the RIA industry, shared his stance on CCN.com. He said:

“Although energy has been a horrible space to be in for the last few years, recently select MLPs have held up pretty decently and ONEOK (OKE) happens to be one of them. From a technical perspective, we are currently sitting below resistance around the $72 area, going back to 2014. If we were to break above this level, and hold, I think you could look at $104 as the next reasonable target on the upside.”

This is our case for why ONEOK is threatening to breach its all-time high.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.