Novogratz on Near-Term BTC Consolidation: ‘Trees Don’t Grow to the Sky’

Bitcoin bull Michael Novogratz believes that the bitcoin price is headed to a narrow trading range of between $7K and $10K even as the price hit $9K today. | Source: YouTube/WallStreetWeek

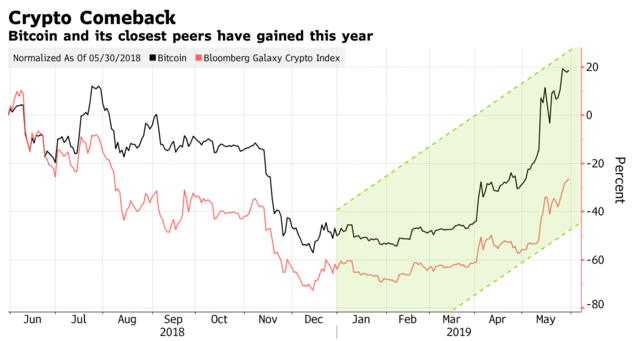

By CCN.com: Mike Novogratz’s expectation for bitcoin price consolidation is starting to look more feasible since BTC abruptly took a dive today. The high-profile trader believes bitcoin is poised for near-term consolidation to a narrow range despite recent market momentum.

Novogratz, who is at the helm of crypto merchant bank Galaxy Digital, reportedly held a conference call today discussing his firm’s Q1 performance. According to Bloomberg , the Wall Street veteran believes that the bitcoin price “probably consolidates somewhere between $7,000 and $10,000,” adding:

“You know, trees don’t grow to the sky. If I’m wrong on that, I think I’m wrong to the upside, that there’s enough excitement and momentum that it could carry through.”

Novogratz hasn’t abandoned his long-term bullish outlook on bitcoin. It’s just in the near term, he expects that there could be some consolidation. And he’s not closing the door to the possibility of BTC breaking out of the range he described. It is perhaps a more sobering outlook than to the moon, but it is also one that appears to be quite realistic.

That excitement he’s talking about has a little something to do with some major technology companies dipping their toes into the crypto space. Microsoft is building an ID platform on the Bitcoin blockchain while Facebook is poised to launch its own cryptocurrency for payments, GlobalCoin. All of this, Novogratz says, is positive for crypto mainstream adoption. While some have argued that crypto doesn’t need validation, Novogratz suggests these brands offer some heft to the market, saying they “both were wild credentializers for this space.” He added:

“We have gone from, you know, crypto as an experiment, is it real? Is it tulips? To crypto is going to be a substantial part of the financial and consumer infrastructure of the world.”

Galaxy Digital’s Performance

After being frostbitten by the crypto winter, Galaxy Digital is back in the black. The firm generated Q1 net income of $12.9 million vs. reportedly losing millions during last year’s market downturn. Bitcoin’s triple-digit percentage increase year-to-date has generated a great deal of excitement across the ecosystem.

“We really do feel significantly better about the business.”

Novogratz recently clarified that Galaxy Digital’s decision to sell a $71.2 million stake in Block.one was a reflection of the firm taking profits “to rebalance our portfolio.”