Not Just Bitcoin: FAANG Stocks are Down $1 Trillion from Yearly Highs

Ek claims that Spotify is unfairly targeted, solely because it is a competitor to Apple Music. | Source: Shutterstock

As the crypto market reels from a weeklong downturn that has forced the bitcoin price to its lowest point in almost 14 months, it appears that traditional markets do not intend to welcome investors back with open arms.

Markets Erase Year-to-Date Gains

Following yet another decline on Tuesday, the Dow Jones Industrial Average, S&P 500, and Nasdaq have now erased their 2018 gains heading into Black Friday weekend.

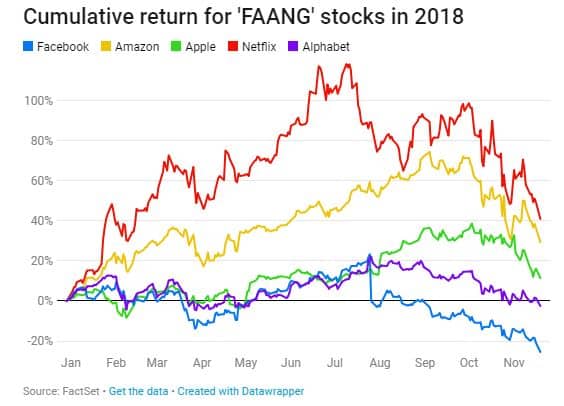

The sell-off has been even more pronounced among FAANG stocks, with tech stalwarts Facebook, Amazon, Apple, Netflix, and Google (Alphabet) now firmly in a bear territory after descending more than 20 percent from their 52-week highs. Collectively, FAANG stocks have shed than $1 trillion from their yearly highs, marking a remarkable shift since the beginning of Q3.

Chipmakers Nvidia and AMD have suffered severe losses as well, with the companies — perhaps dishonestly — blaming bearish forecasts on reduced demand from cryptocurrency miners, who use their GPU chips to mine ASIC-resistant cryptocurrencies such as monero (XMR).

“Short term, unexpected weakness in the tech sector could have a significant impact on the global economy, adding to what already looks like a soggier macro environment,” said Dario Perkins, managing director of global macro at TS Lombard, in a note cited in CNBC . “Additional retrenchment in the FAANGs could also undermine the broader US stock market.”

Risky Assets Retracing from 2017 Bull Run

Cryptocurrencies, as CCN.com reported, have been hit even harder, on a percentage basis at least. This week’s sell-off dropped the cryptocurrency market cap below $150 billion, with the bitcoin price briefly sinking to $4,218 on Coinbase — its lowest mark since the first week of October 2017.

Noting the correlation between the tech and crypto retracements, Mati Greenspan, senior market analyst at eToro, said that it’s “impossible to shake off the feeling that somehow the current sell-off in tech stocks is somehow related to what we’re seeing with the cryptos.”

He explained that he believes the market’s recent movements find their root in the 2008 financial crisis, the aftermath of which saw central banks inject large amounts of capital into the economy in an attempt to stabilize the financial system.

“Much of this money has by now found its way into various markets, often times with little research on the part of the investor as to what the value of the assets should logically be,” he said. “The year 2017 was an exceptional year for high risk assets, including cryptos and tech stocks,” he added. “In 2018, we’re seeing is a retracement of that.”

The moves will certainly jolt short-term speculators back into reality, as they can no longer simply assume that a dollar invested today will be worth more than that tomorrow. However, Greenspan reminded investors that long-term returns are “much more predictable.”

“With this in mind, it’s important to note that a lot of this cash is still on the sidelines looking for a home. So, whenever these markets do find themselves their respective bottoms, there’s still a mountain of capital that could potentially be put to work. The only question that nobody can answer with certainty is exactly where those bottoms may be,” he concluded. “If things turn around now, it would certainly be a very bullish sign, but it’s also entirely possible that this could last a while longer.”

Featured Image from Shutterstock