NEO Price Jumps 50%, Defies China ICO Ban Following Bitfinex Listing

The NEO price surged 50% on Thursday following its listing on bitcoin exchange Bitfinex. NEO is now trading above $30, despite the fact that the China ICO ban remains in full force and the startup has begun issuing refunds to ICO contributors.

NEO Price Surges 50%

On Monday, the People’s Bank of China (PBoC) ruled that initial coin offerings (ICO) are illegal and that startups must refund all ICO investments to contributors. This ruling brought temporary devastation to the crypto markets, but it particularly affected NEO, an open-source blockchain startup that has been dubbed the “Chinese Ethereum.” Between September 2 and September 4, the NEO price plunged from $34 to $19–a decline of nearly 50%. This crash was made more significant by the fact that the NEO price was already in decline, having peaked at an all-time high of $50 in mid-August.

Today, the NEO price began to recover to its pre-ban levels. The advance was sudden; in just 8 hours, NEO increased by nearly 50%, rising from about $20 to a high of $34. This restored NEO’s market cap to about $1.7 billion, putting it within striking distance of 10th-place ethereum classic.

NEO Commits to Regulatory Compliance

There are several factors behind the NEO price rally. The first is that NEO leadership has begun to respond to the China ICO ban. In a statement issued shortly after the PBoC announcement, the NEO Council committed to complying with regulations:

Compliance is inevitable after the blockchain industry matures to a certain stage. From the very beginning, we decided to be compliant with laws and regulations in terms of the choices of design philosophy, consensus mechanism and governing model. These choices made us well-prepared for challenges and opportunities waiting ahead.

They added that they will issue refunds to any investor who purchased tokens during the NEO ICO. In their monthly report–which was released this morning–the Council further discussed the ban and reiterated that its platform has far more use cases beyond ICOs.

As a little reminder, we would also like to emphasize that NEO has other use cases much more than serving as an ICO platform. The blockchain revolution has just begun and the technology with using digital tokens and smart contracts is still sound and have many use cases, regardless of how these tokens are issued and distributed. We welcome and encourage teams to continue their projects on the NEO platform.

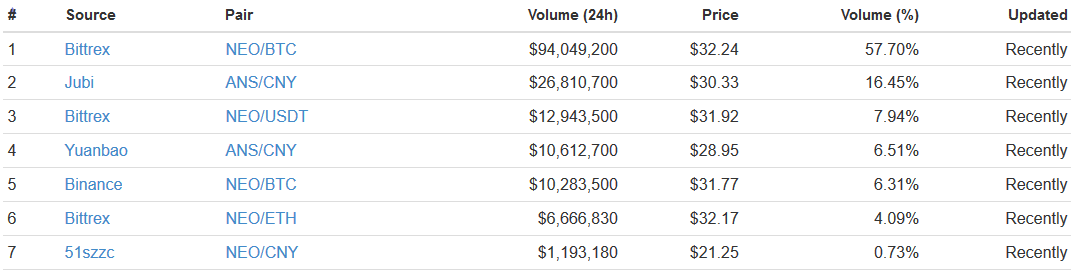

NEO Listed on Bitfinex

Another factor influencing the rally is bitcoin exchange Bitfinex’s decision to add NEO to its platform . As of this morning, NEO can be swapped with USD, BTC, and ETH. This move will provide increased liquidity for NEO and gives the token its first exposure to a major USD market (excluding the USD-pegged Tether). This trading pair diversification will mitigate the impact that NEO/CNY pairs have on the token’s global average price.

Finally, there have been rumors circulating on NEO social media channels that China will weaken its stance on ICOs and provide a path to legalization. These rumors are thus far unsubstantiated and would be uncharacteristic of standard PBoC operating procedure. Nevertheless, this speculation could be influencing the NEO price.