Meteoric Dow Races Toward Record as Earnings Crush Brutal Forecasts

The Dow surged on Thursday after weak US data rekindled hopes of future interest rate cuts from the Federal Reserve. | Source: REUTERS / Brendan McDermid

By CCN.com: The Dow and broader U.S. stock market surged on Tuesday, as investors rallied behind stronger than expected earnings results from the likes of United Technologies Corp (UTX) and Twitter (TWTR).

Dow Pounds Toward Record Levels

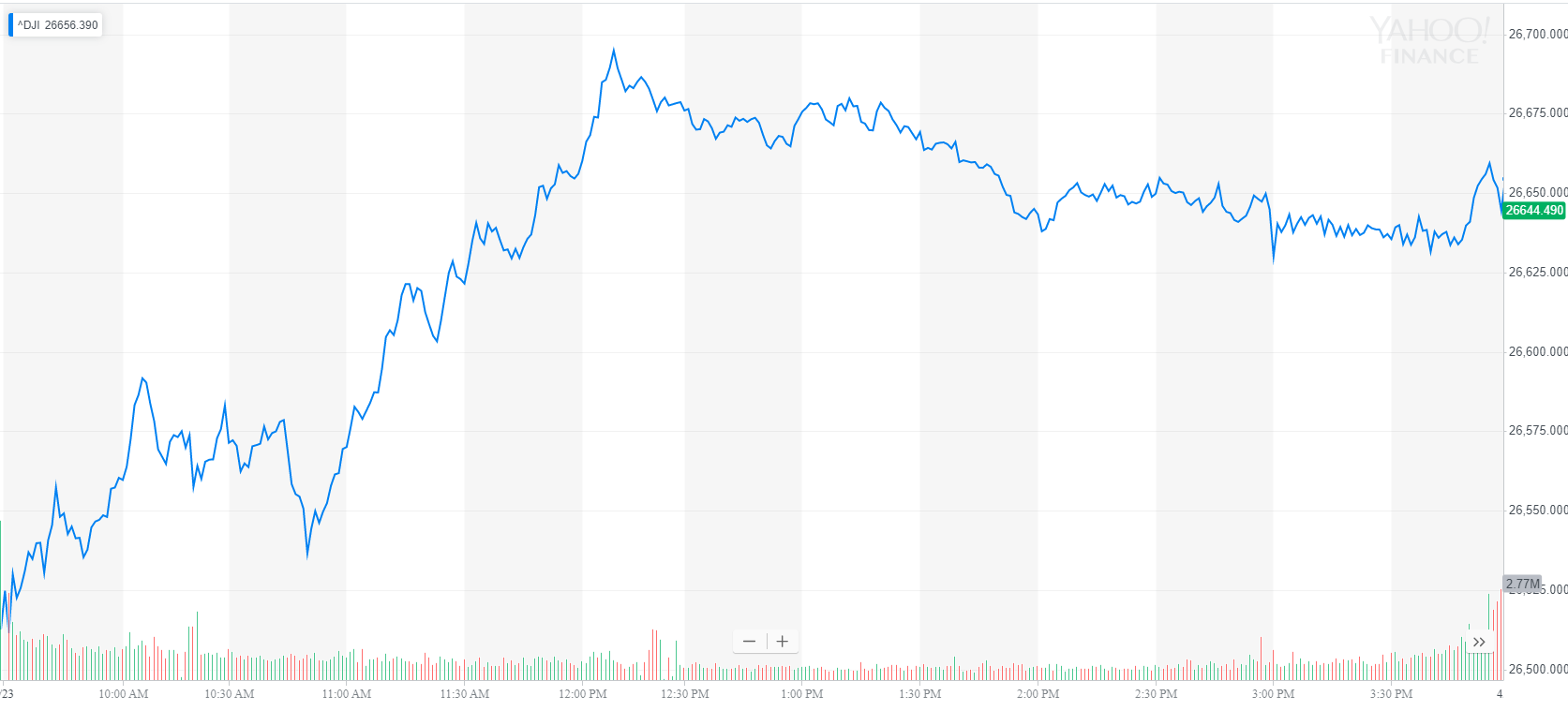

All of Wall Street’s major indexes reported big gains. The Dow Jones Industrial Average surged triple digits, mirroring a strong pre-market for U.S. stock futures. After jumping 184 points, the blue-chip index pared gains to settle up 145.34 points, or 0.6%, at 26,656.39.

The broad S&P 500 Index posted a new record high, gaining 0.9% to 2,933.68. Ten of 11 primary sectors contributed to the rally, led by health care.

The technology-focused Nasdaq Composite Index surged 1.3% to 8,120.82, joining the S&P 500 in record territory.

Wall Street Earnings Outshine Bearish Forecasts

Investors were in a stock-buying frenzy after a pair of high-profile companies reported better than expected financial results, easing concerns that first-quarter earnings would be the weakest in years.

Social media giant Twitter Inc. (TWTR) said daily active users reached a record high in the first quarter, as revenues shot up 18% to $787 million. Net income more than tripled compared with a year earlier, reaching $191 million. Unlike previous quarters, where Twitter became profitable because of lowering costs, the social media platform benefited from stronger business drivers, and a one-time deferred tax payment.

Dow blue-chip United Technologies Corp (UTX) earned $1.91 in adjusted earnings per share on revenue of $18.37 billion, the Farmington, Connecticut-based company reported Tuesday. Analysts had called for per-share earnings of $1.71 on revenue of $17.99 billion.

A deluge of corporate earnings will make their way through the financial markets this week, with Facebook Inc. (FB), Amazon.com Inc. (AMZN), and Microsoft Corp (MSFT) scheduled to report.

Market watchers will also be keeping their eye on economic data, with the U.S. Commerce Department scheduled to release preliminary GDP data on Friday. The U.S. economy likely expanded just 1.8% annually in the first quarter, down from 2.2% in the previous three months. If the forecast holds, it would mark the third consecutive quarter of slowing growth.