Massacre Monday: Ethereum, Bitcoin Prices Lead Market Retreat after China Bans ICOs

The cryptocurrency markets plummeted on Monday following a report that the Chinese central bank had issued a blanket ban on initial coin offerings (ICOs). The bitcoin price fell 5%, while the ethereum price took an 11% dive. The altcoin markets fared equally as bad, with 91 of the top 100 cryptocurrencies declining for the day.

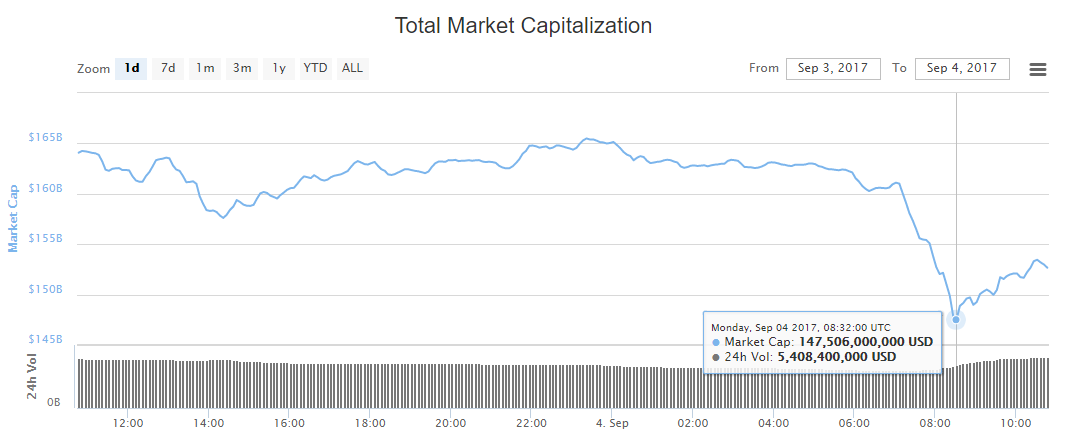

This widespread investor panic caused the total value of all cryptocurrencies to plummet. Yesterday, the total crypto market cap was $164 billion–a $16 billion decline from the all-time high it set on September 2. But the news that the People’s Bank of China (PBoC) had decided to ban ICOs sent the crypto market cap careening below $150 billion.

According to the report, all token sales are forbidden within the country, and organizations which have already completed ICOs are instructed to return all investor funds. This is likely an impossible task, since organizations have doubtlessly already spent a portion of those funds.

Bitcoin Price Slips Below $4,400

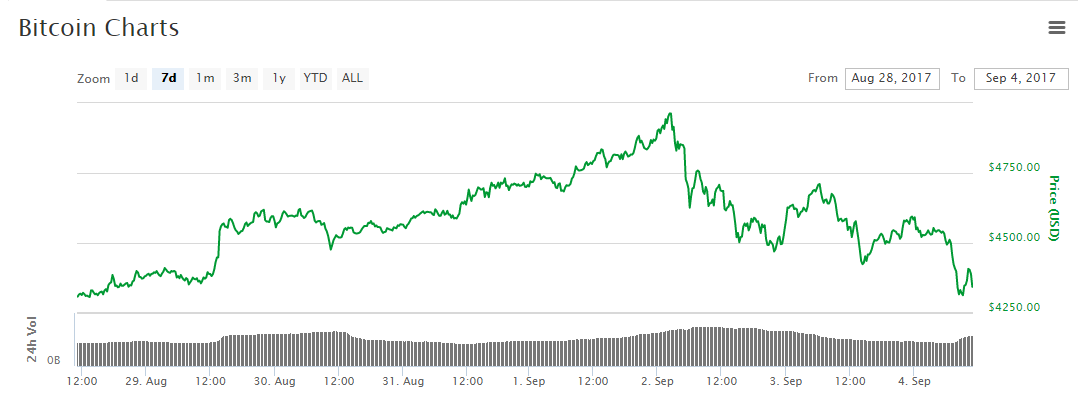

The bitcoin price weathered the storm better most cryptocurrencies, but it still took a 5% hit. This intensified the sell-off that began when the bitcoin price touched $5,000 on September 2. Since that point, the bitcoin price has plunged nearly $700. At present, the bitcoin price is $4,344, which translates into a $71.9 billion market cap.

China’s ICO Ban Sends Ethereum Price Plunging

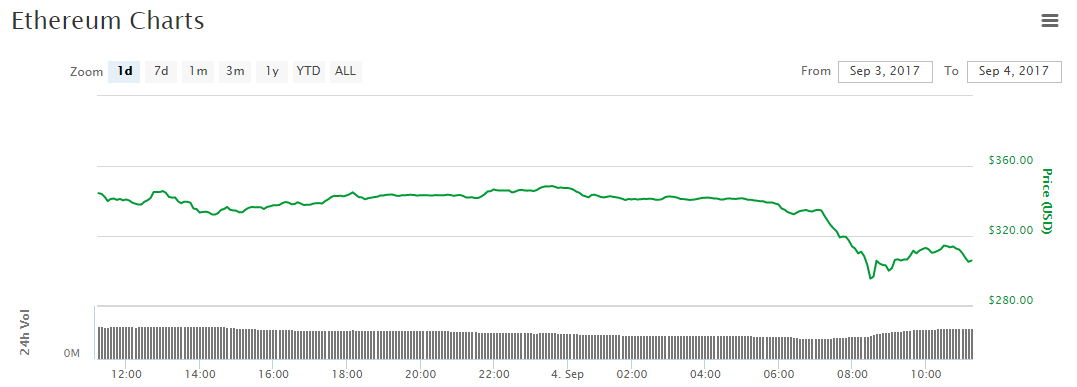

China’s ICO ban confirms investor fears that the nation does not intend to reconsider its hostile posture toward cryptocurrency and will have ripple effects throughout the entire market. However, decentralized smart contracts platforms such as Ethereum and NEO will bear the brunt of the damage. Following news of the ban, the ethereum price plunged 12% to $304. This is a nearly $90 decrease from last week, when the ethereum price climbed as high as $390. At present, ethereum has a market cap of $28.7 billion.

Unfortunately, the ICO squeeze might not be isolated to China. South Korea–home of the world’s highest-volume cryptocurrency exchange–is considering strengthening its bitcoin and digital currency regulations. Reportedly, the regulators want to “punish” ICOs.

Altcoin Markets Bleed

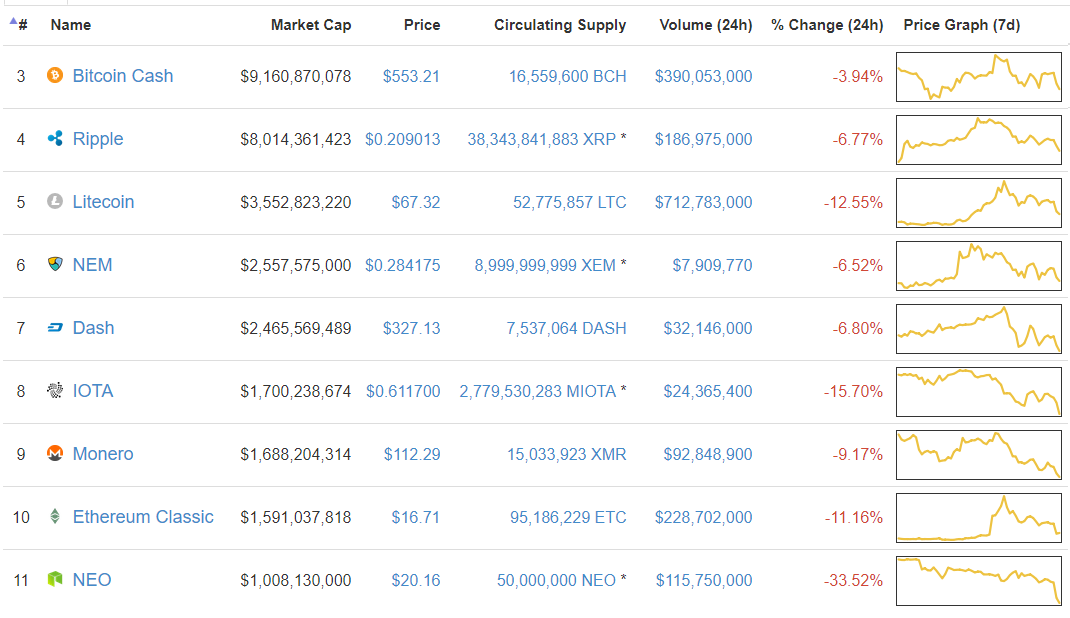

News of the ICO ban devastated the altcoin markets. No top 25 coin increased more than 1% for the day, and 91 of the top 100 coins engaged in a comprehensive retreat.

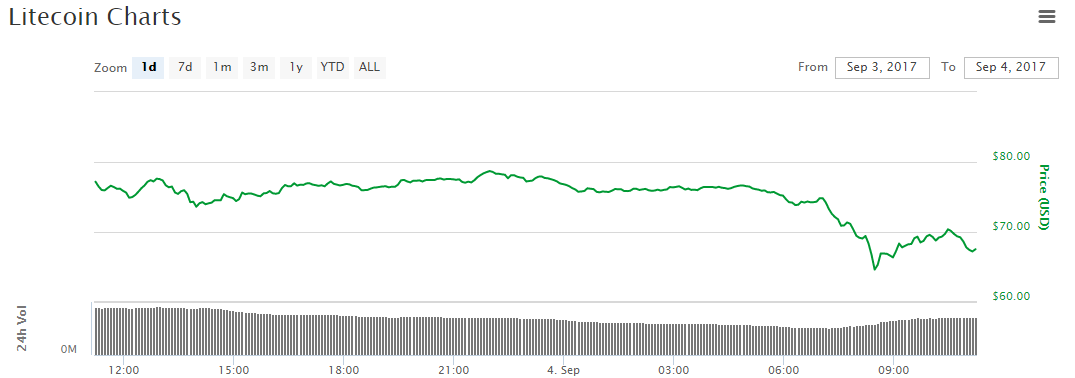

In a twist of fate, the bitcoin cash price–which only declined 4%–returned the best single-day performance of any top 10 coin. The Ripple, NEM, and Dash prices fell 7%, while the litecoin price plunged 13% to $67. The litecoin price has declined almost $30 since peaking above $90 last week.

Eighth-ranked IOTA dropped 16% to $0.612, reducing its market cap to $1.7 billion. The Monero price fell 9% to $112, and 10th-ranked ethereum classic dropped 11% to about $17.

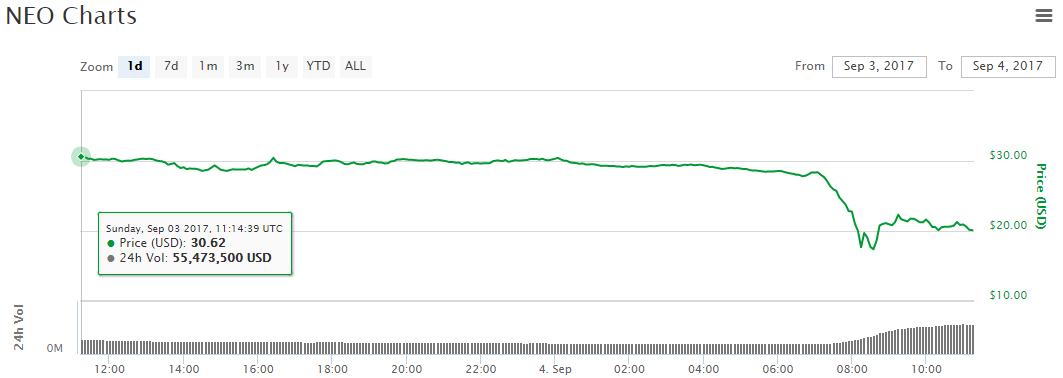

NEO–the “Chinese Ethereum”–was absolutely pummeled by the report of the ICO ban. The NEO price fell to $20. This represents a single-day decrease of 34% and a weekly decline of almost 50%.

Terracotta warriors image from Shutterstock.