LocalBitcoins Quietly Removes Anonymous In-Person Crypto Cash Trading

P2P bitcoin trading giant LocalBitcoins is not so peer-to-peer anymore. | Source: Shutterstock

By CCN.com: Peer-to-peer cryptocurrency exchange service LocalBitcoins has completely suspended all physical cash trading on its network. Several traders have since reported having their standing orders canceled forcing them to revert to electronic-only transfer alternatives.

Enthusiasts have long considered LocalBitcoins a haven for decentralized Bitcoin trading. But now it appears the company is losing its edge.

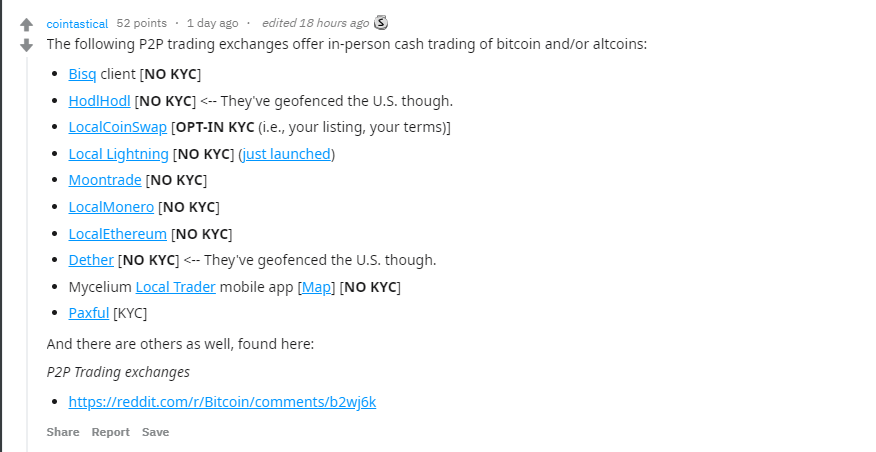

The development has largely flown under the radar with no press releases or official mention of any change. Like all things in cryptoland, however, nothing remains a secret for long. One Reddit user noticed the removal of service and before long a list of viable alternatives appeared:

A Disturbing Trend of Government Clamp Down

LocalBitcoins has been under fire from the cryptocurrency community more recently after introducing Know Your Customer (KYC) features to its platform. The so-called anti-money laundering (AML) feature is supposed to clamp down on fraud which authorities claim is easy to achieve with cryptocurrency.

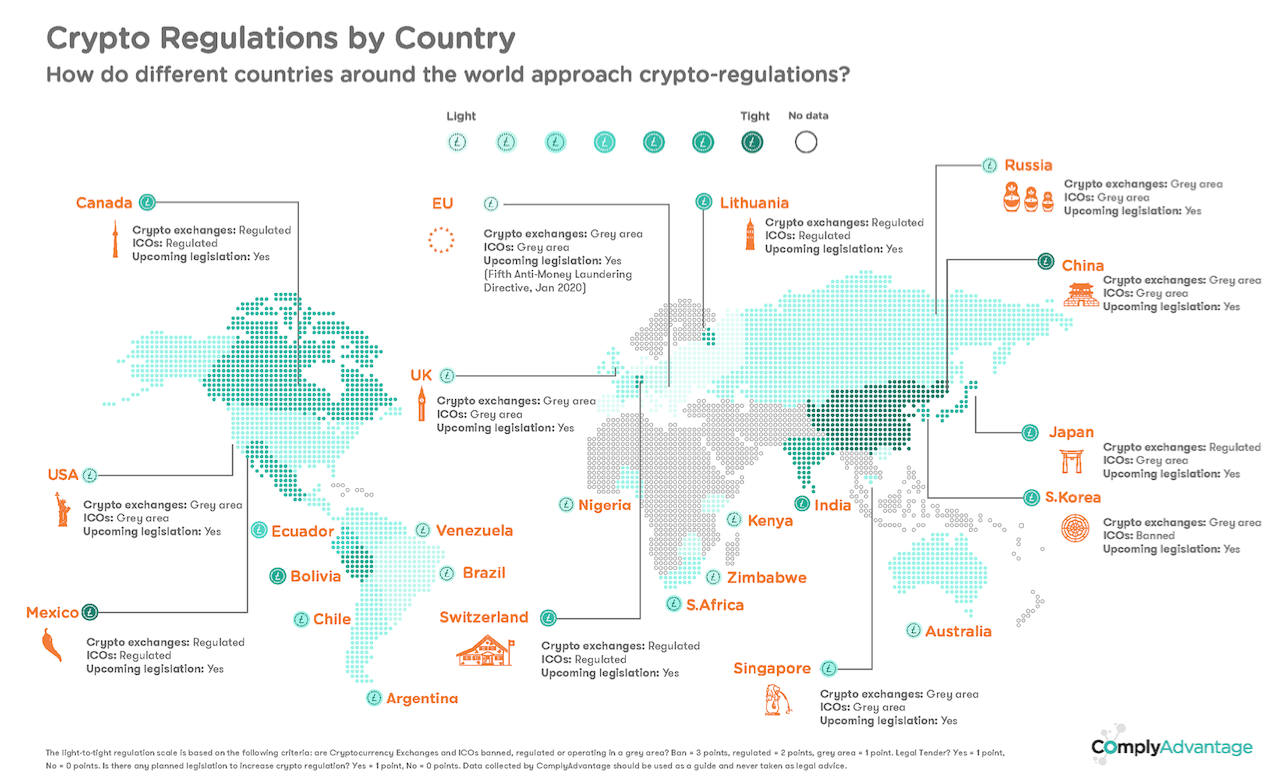

The Helsinki-based exchange appeared to have little choice in the matter as the Finnish parliament approved a proposal for a new act on “Virtual Currency Service Providers” in March. Crypto exchanges continue to come under scrutiny after several other platforms were the target of KYC controversy including the likes of KuCoin and HitBTC.

Finland, along with other European countries has so far been fairly open-minded towards cryptocurrency developments. KYC, however, is a strictly one-way system which essentially allows governments to spy on their citizens. Cryptocurrency holders argue that if the process was reversed they’d probably find a lot more financial skeletons in government closets.

What Was Yours is Now Mine

One of LocalBitcoins major drawcards was its over-the-counter service which allowed parties to buy and sell directly with each other. In person. In cash. As the world rapidly moves to electronic-only service models, cold, hard paper money remains one of the few truly anonymous ways to exchange value.

The choice can’t be too good for LocalBitcoins’ bottom line. Developing countries still have poor infrastructure and rely heavily on cash exchange. Ray Youssef, CEO of competing peer-to-peer platform Paxful has since noticed a significant jump in customer registrations. He also humorously declared that his competitor should probably now change its name:

Anonymous Exchange Not All It’s Cracked Up to Be?

Paxful’s gain is clearly LocalBitcoins loss. That much is true but Paxful is still KYC vetted, leaving traders with fewer and fewer options for the truly anonymous exchange. Cash trading may not be all it’s cracked up to be though and comes with its own set of risks.

Traders have to consider safety issues when meeting in person. There’s also no escrow service so buyers may have to shoot the sh!t with sellers for up to 20 minutes before receiving confirmation of a Bitcoin transfer. Awkward. It’s either that or just use that HODL’ed Bitcoin you had stashed away before all this KYC nonsense hit the streets.

CCN.com reached out for comment from LocalBitcoins but received no word at press time.