The Lightning Network Could Solve The Bitcoin Block Size Limit

The Lightning and Liquid networks both make Bitcoin more extensible, but they do so in different ways.

The Bitcoin block size is a hot topic in Bitcoin. Gavin Andresen has been at the center of the heated discussion of how to scale Bitcoin to accommodate higher transaction volumes. The Lightning Network has garnered much support as a possible solution to this problem. The co-authors of the Lightning Network white paper, Joseph Poon and Tadge Dryja, spoke with CCN.com in an interview.

“Most companies can hook into Lightning quickly, since there are minimal changes on backend service providers required,” Joseph Poon told CCN.com. “They just hook into an API daemon running on top of bitcoind.” Even if a service is a hosted wallet, they can use the Lightning Network.

“It enables services like ChangeTip to do micropayments in a way in which the payment itself is decentralized between the service providers themselves,” Poon said. “So maybe in the future, when someone donates you $0.10 in bitcoin, you can spend it instantly on a newspaper article or video who get paid using Coinbase.” This doesn’t seem to be Poon’s preferred method of using the Lightning Network.

“Of course, it’s more fun and preferred to hold the coins yourself and use Lightning directly,” he added. As the Abstract for the white paper to Lightning Network reads:

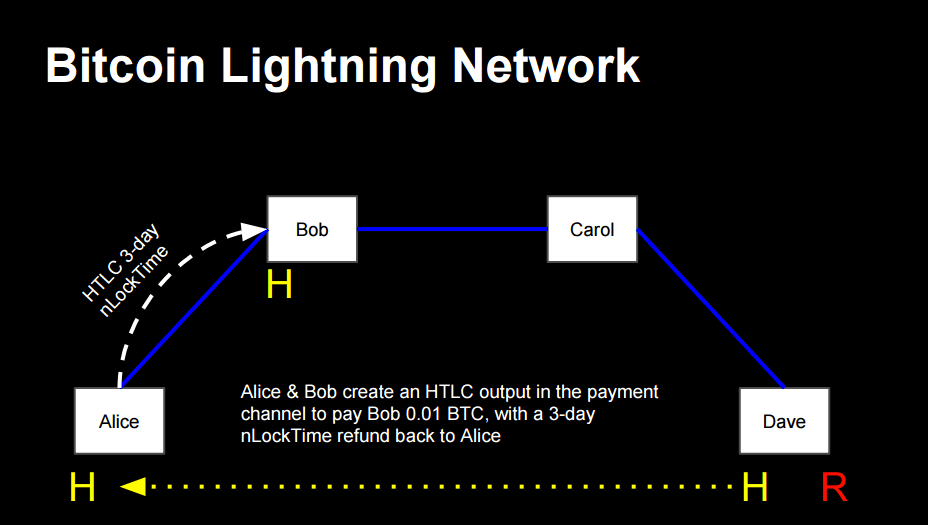

The bitcoin protocol can encompass the global financial transaction volume in all electronic payment systems today, without a single custodial 3rd party holding funds or requiring participants to have any more than a computer on a home broadband connection. A decentralized system is proposed whereby transactions are sent over a network of micropayment channels (a.k.a. payment channels or transaction channels) whose transfer of value occurs off-blockchain. If Bitcoin transactions can be signed with a new sighash type which addresses malleability, these transfers may occur between untrusted parties along the transfer route by contracts which are enforceable via broadcast over the bitcoin blockchain in the event of uncooperative or hostile participants, through a series of decrementing timelocks.

Poon continues: “I think multiple examples with a clear use case would help one understand what a smart contract means. The thesis for the Lightning Network when it comes to smart contracts is that what matters is the enforcement. You can digitize contracts all you want, but if it’s not enforceable, it’s meaningless. Lightning Network is rebuilding micropayment infrastructure into a globally interconnected decentralized Smart Contract system.”

He suspects the really interesting things to come will be multi-party organizational systems. “But great care needs to be made making these things in a responsible, secure way, as we are very early in understanding the building blocks on how to think about the problem,” Poon said. Where Lightning helps most is instant micro-payments.

“OpenBazaar and communications platforms may have some benefits with instant micropayments,” Poon says of projects that have discussed using the Lightning Network. “I think there’s a need across many communications platform to use micropayments to use flow control and anti-spam protection. This can certainly help with decentralized systems vulnerable to spam since Bitcoin in a way is stored/fungible Proof-of-Work hashcash. However, if you want to buy a house on OpenBazaar, you should probably just be using on-chain Bitcoin transactions.” He also believes soft-forks will be necessary.

“Getting the soft-forks in,” Poon says.”Short-term, Rusty’s suggestion to use OP_CHECKLOCKTIMEVERIFY and OP_CHECKSEQUENCEVERIFY will help and create a working implementation. Longer term, some malleability soft-fork and resolving large-scale systemic DoS attacks is necessary. I think there’s lots of development lately with writing code, which is very constructive towards having implementations ready as soon as the new opcodes are in bitcoin.” There are some security concerns when it comes to the Lightning Network.

“Yes, the primary risk is with systemic denial of service attacks where transactions that need to get in by a certain time/block-height do not do so,” said Poon. “This can be mitigated with some timelock soft-fork – as suggested by Greg Maxwell – or by putting Lightning in a fed-pegged sidechain. Currently, the problems aren’t explored to the point where I wouldn’t suggest holding significantly more funds than you would cash in your wallet. The risk is a tail-risk but is not impossible.” Pragmatic approaches to common open-source problems are something Poon suggests.

“In every technology, there are risk models such as Bitcoin’s miners requiring 51% be honest miners, but the risks should be best mitigated and eliminated in the future as best they can,” he said.

What are your thoughts on the future of Bitcoin & The Lightning Network?

Featured image from Shutterstock.