In Exactly 1 Week, Bitcoin Will Have Suffered its Longest Bear Market in History

Bitcoin price is on course for its longest period of stagnation in its history. | Source: Shutterstock

By CCN.com: If the Bitcoin price remains below $16,000, down 20 percent from its all-time high at $20,000 by February 2, it will have suffered the longest bear market in its ten-year history.

In traditional markets, a 20 percent decline from the all-time high is considered a bear market. Since January 2018, Bitcoin has been in a bear market, unable to recover above key resistance levels and experiencing a 12-month intense sell-off.

What Can Bitcoin Investors Expect?

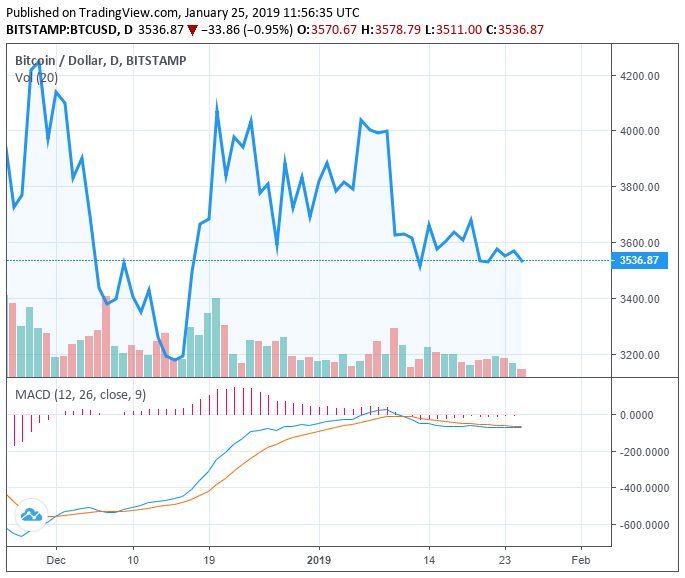

Since November 2018, the Bitcoin price has declined from above $6,000 to mid-$3,000. At its lowest yearly point, the price of BTC dropped by more than 47 percent within a two-month period, recording one of its steepest short-term falls in recent years.

Josh Rager, a cryptocurrency technical analyst, stated that in one week, under the assumption that the price of BTC will remain in a tight range between $3,500 to $4,000, Bitcoin will officially set a new correction record.

The analyst said :

BTC correction record: On Feb 2nd, we are likely to break the record for longest Bitcoin correction: 410 days (from Nov 2013 to lowest price at Jan 2015) Very soon, you will be able to say that you survived the longest crypto market correction in BTC history

Currently, the longest correction in Bitcoin’s history is the 420-day bear market the asset experienced throughout 2013 to 2015.

In the short-term, traders generally see the price trend of BTC weighing to the upside. A cryptocurrency trader with an online alias “Mayne” suggested that due to the resilience of BTC in the mid-$3,000 region, a potential recovery could be in play.

However, the trader also explained that the weak rebound of BTC above the $3,500 level and the lower highs the asset have recorded throughout the past several weeks could leave the asset vulnerable to an abrupt decline in value.

“I don’t have a super clear read on PA right now. Longs make more sense than shorts down here in my opinion. Bulls – Holding above key HTF support – Any selling below being bought up – Clear upside target above yearly open. Bears – Lower highs – Bounces weak,” the trader said .

Bitcoin ETF Withdrawal Proved Crypto Winter

On January 24, CCN.com reported that following the withdrawal of the CBOE and VanEck’s Bitcoin exchange-traded fund (ETF) proposal, the price of the dominant cryptocurrency barely moved.

Speaking to CCN.com, Alex Krüger, a cryptocurrency analyst and economist stated that the stability of BTC subsequent to a highly anticipated event showed the lack of trading activity and overall interest in the market.

With analysts expecting the price of BTC to remain stable in a low price range throughout the first two quarters of 2019, Bitcoin is en route to establishing a new record for the longest bear market in its history that surpasses the current record by at least five to six months.

Price Charts from TradingView .