Here’s Why Mark Cuban Is Right About Amazon – And Why Morgan Stanley Is Wrong

Dallas Mavericks owner Mark Cuban is ultra-bullish on Amazon shares. He believes the e-commerce giant will benefit from behavioral changes once the coronavirus lockdown ends. | Image: Sean M. Haffey/Getty Images/AFP

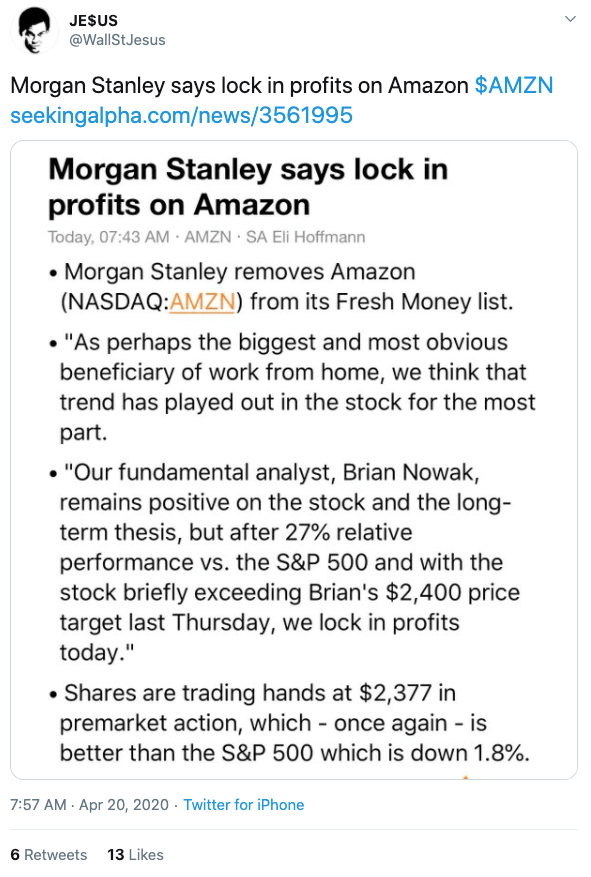

- Morgan Stanley says that it’s time to lock in profits on Amazon.

- Mark Cuban that the e-commerce company has more upside potential.

- The fundamentals appear to be in Cuban’s corner.

Is it time to take profits on Amazon (NASDAQ: AMZN)? Shares of the e-commerce and cloud computing titan are up nearly 30% year-to-date. In comparison, the S&P 500 is down almost 13% over the same stretch. Analysts are now saying AMZN has run its course.

Mark Cuban disagrees–and it appears that the fundamentals are on his side.

Morgan Stanley Says to Lock In Profits on Amazon

Investment bank Morgan Stanley believes the narrative that has pushed Amazon to a new all-time high has lost its steam. After removing the stock from its Fresh Money list, the financial services giant writes ,

As perhaps the biggest and most obvious beneficiary of work from home, we think that trend has played out in the stock for the most part.

Amazon’s stock has surged since widespread stay-at-home orders forced millions of Americans to rely on the e-commerce company to deliver essential goods. With AMZN trading above $2,800, Morgan Stanley thinks that the lockdown narrative is already priced in.

Be that as it may, there are other drivers that can contribute to Amazon’s growth. Cuban is right to assume that the company’s shares are likely to skyrocket.

Cuban Says Amazon Will Benefit from Lockdown Behavioral Change

The “Shark Tank” star is ultra bullish on Amazon. In a CNBC Fast Money interview, Cuban says that the company will keep grinding higher even if shares are already up big this year:

I think it goes up, up, up, up, up… People who weren’t comfortable dealing with Amazon for consumables, for food, for produce even, I think they’ve gotten to that habit now…I think Amazon just takes off. The stock is only going to go up.

The Dallas Mavericks owner says that people will continue to rely on Amazon even after the lockdown.

The greatest fear factor is going to be going back … to the small to medium-sized businesses because they don’t know what protocols they have in place to keep them as consumers safe.

It’s no secret that demand for Amazon’s services has skyrocketed over the last few weeks. The e-commerce giant is hiring 175,000 workers as sales hit $11,000 per second . Cuban believes this trend will continue even after the economy reopens, and that’s bullish for AMZN.

Amazon Is Expected to Post Stellar Q1 Earnings

It would seem that Amazon is built to profit in a time of a global pandemic. While many companies are projecting significantly lower sales for Q1 of 2020, the e-commerce company is one of the few firms that will very likely report growth in areas of its core business.

Analysts estimate that Amazon’s revenue for the quarter ending March will surge by 21.9% to over $70 billion compared to $59.7 billion in 2019. Sales of Amazon Web Services are expected to climb more than 30%, while revenue from its subscription segment should grow 29%. Also, analysts see a 19% uptick in online sales, with third-party sales climbing 27%.

Overall, Amazon looks fundamentally strong. Mark Cuban is likely correct in saying that AMZN will take off.

Disclaimer: The opinions expressed in this article should not be considered trading advice from CCN.com. The writer does not own Amazon shares.