Government Shutdown Doesn’t Stop Dow Jones from Seeing Best Start Since 2006

The first seven sessions of trading have delivered the best start to a year for the Dow Jones Industrial Average and other stock market indices since 2006.

Government Shutdown Continues, But so Does Dow Rally

800,000 workers went without pay on Friday due to the ongoing government shutdown. It’s now the longest in history with no end in sight. And it’s costing the US around $1.2 billion in GDP every week.

The stock market appears to be completely ignoring this mounting crisis for the government and many of its workers. As of Friday, the Dow, S&P 500, and Nasdaq had seen the highest gains for the first seven sessions of trading since 2006 .

On Friday, the Dow Jones Industrial Average failed to achieve a sixth day of straight gains, ending just 0.02% down. But, that’s just a fraction of a percentage, and the rally continues.

History Says the Stock Markets May Ignore the Shutdown

Decades of data says that stock markets are almost impervious to government shutdowns.

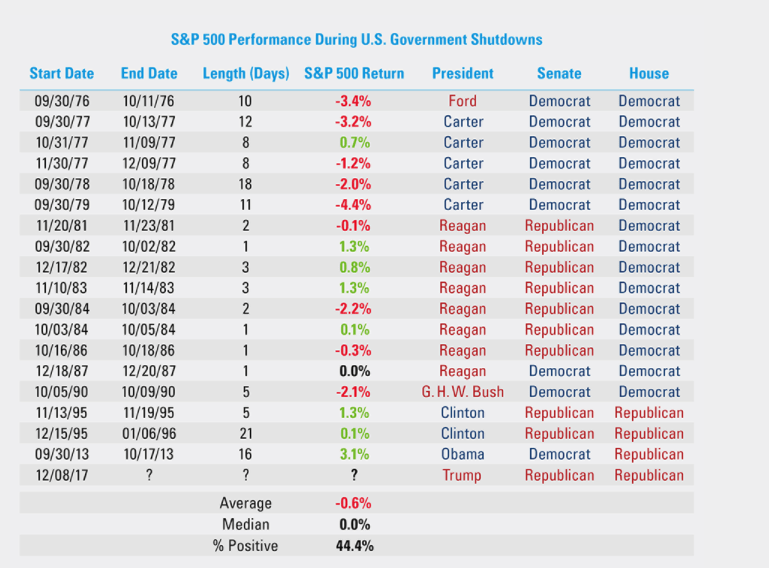

LPL Research studied the equities markets before the threatened 2017 shutdown, and the findings may be surprising.

Ryan Detrick, senior market strategist at LPL, said at the time:

Although a government shutdown sounds scary, the reality is it has been a non-event historically for equities. Going back nearly 40 years, the median return during shutdowns has been exactly flat.

Here are the figures for the performance of the S&P 500 during past government shutdowns up to 2013. The January 2018 shutdown lasted for just two days from January 20-22.

Michael Halloran of Janney Investment Strategy Group wrote last week:

Since 1976, there have been 19 partial government shutdowns ranging from 2-22 days. While economic activity was marginally weaker in the first month after a shutdown, it rebounded quickly in subsequent months. The stock market impact is also marginal with the S&P 500 Index typically flat during shutdowns.

Halloran added:

The last meaningful government shutdown occurred from October 1, 2013 until October 17, 2013. Over that timeframe, the stock market (as measured by the S&P 500 Index) was actually up 2.25%.

The S&P 500 closed just 0.01% down on Friday.

The Dow Jones Holds a Recovery

The Dow Jones Industrial Average, despite a slight dip by the end of trading on Friday, so far appears unaffected by the shutdown. Stock prices of America’s big 30 haven’t yet fallen in response.

This shutdown is now unique for its length, and the longer it continues, the more likely the stock markets will react. Next week will provide a clearer indication. Trade talks, for now, are concluded, and the Federal Reserve is even less likely to raise interest rates. The biggest worry for the upcoming trading week could be the growing cost of the government shutdown and Trump’s reaction to it.

Featured Image from Shutterstock. Price Charts from TradingView .