Gold Price Outshines Risk Assets as U.S. Stocks Approach Critical Inflection Point

Gold regains its shine as U.S. stocks tumble. | Image: Shutterstock.com

The price of gold rallied Wednesday, extending its recovery to two days after stocks plunged over dismal economic data.

Gold Rallies; Silver Follows

Bullion shot above $1,500 a troy ounce, reaching a high of $1,511.30 on the Comex division of the New York Mercantile Exchange. The December futures contract was last up $16.50, or 1.1%, to $1.505.60 a troy ounce.

The yellow metal has rallied as much as 2.6% over the past 48 hours, managing to regain its shine after a brief volatile stretch.

Silver futures rallied all the way up to $17.73 a troy ounce, rallying as much as 2.5%. The grey metal was last spotted at $17.64, having gained 34 cents, or 2%.

Gold’s premium over silver narrowed by 0.6% on Wednesday to 85.21. That means 85.21 ounces of silver are needed to purchase one ounce of gold.

Stocks See Volatile Dump Over Economic Risks

The Dow and broader U.S. stock market plunged anew on Wednesday after dismal jobs data raised fresh fears that the world’s largest economy was sliding into recession.

At its lowest point during the day, the Dow Jones Industrial Average (DJIA) was off nearly 600 points.

The S&P 500 Index of large-cap stocks fell more than 2%, with all 11 primary sectors reporting losses.

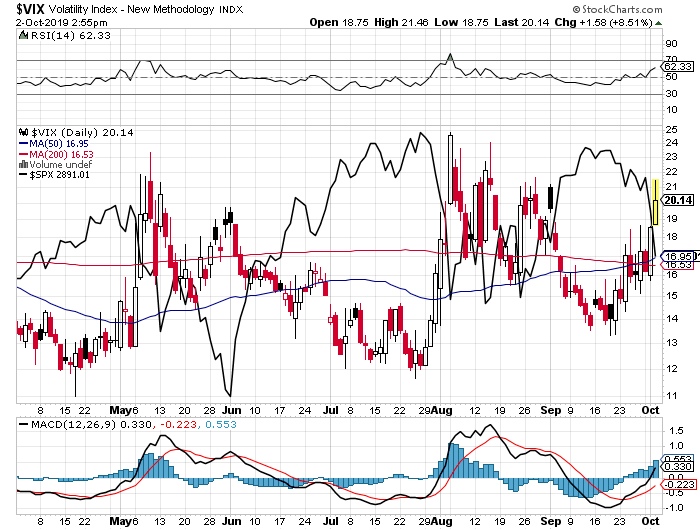

A measure of implied volatility known as the CBOE VIX rose back above 20, which is a major inflection point for risk sentiment. That’s because anything above 20 implies above-trend volatility in the U.S. stock market.

VIX trades on a scale of 1-100, where 20 represents the historic average. The so-called “fear index” trades inversely with the S&P 500 Index roughly 75% of the time and is considered an accurate proxy for where the stock market is headed over the next 30 days.

The volatility gauge climbed more than 10% on Wednesday, reaching a high of 21.46. That would have marked the highest settlement in nearly three months.