Gold Price Flashes Oversold Signal Following Massive Correction

Gold's yearlong rally took a pause this week, as risk appetite lowered demand for haven assets. | Image: Shutterstock

Gold’s yearlong surge took a pause this week, as investors exited risk-off assets in favor of stocks on the belief that the United States and China are inching toward a new trade agreement.

The yellow metal is down almost 5% from its September peak.

Gold Price Corrects Lower

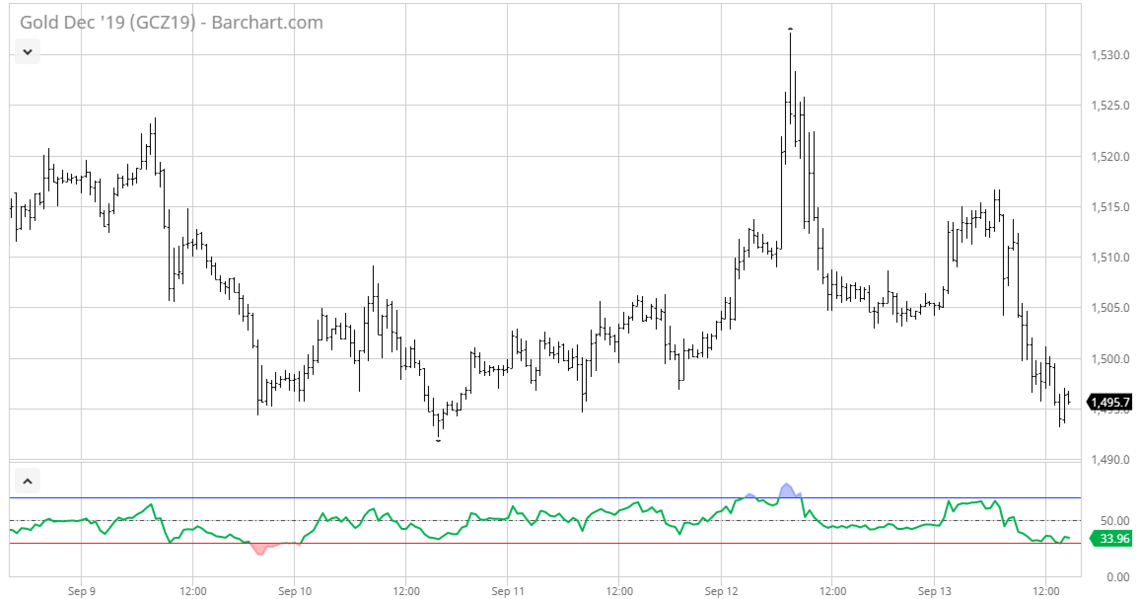

Gold for December settlement, the most actively traded futures contract, bottomed at $1,493.10 a troy ounce on the Comex division of the New York Mercantile Exchange, the lowest in over four weeks. It would later consolidate right around $1,494.00 a troy ounce.

The latest slide dragged gold’s price closer to oversold levels on the relative strength index (RSI). The commodity is still up more than 16% year-to-date.

Silver – a commodity that has outperformed gold in recent months – also fell on Friday. The December contract for the grey metal plunged 66 cents, or 3.7%, to $17.52 a troy ounce.

Trade Optimism Fuels Risk Appetite

Bullion is plunging along with Treasury bonds after the United States and China exchanged ‘goodwill gestures’ ahead of next month’s planned trade meetings.

On Friday, China announced through Xinhua news agency that it will exempt American soybeans, pork and other commodities from its latest round of tariffs. The move offers negotiators a fresh start as they forge ahead with their October summit.

“We hope that the United States is as good as its words and will fulfill its promises, in order to create favorable conditions for cooperation in the agricultural field,” Xinhua said in a Friday news release.

The U.S. and China remain very far apart on several contentious issues, including Chinese industrial policy and intellectual property. Talks broke down in May after China reportedly walked out of an agreement that President Trump said would have been good for both countries. Talks have been at a virtual standstill ever since.