The Global Economic Recovery Depends on Airlines. They’re Failing

Air travel could witness permanent demand destruction due to the pandemic. That's going to hurt several major sectors of the economy. | Image: Michael A. McCoy/Getty Images/AFP

- Air travel will remain depressed as long as coronavirus is a risk.

- Even when the pandemic has subsided, airlines will struggle.

- The hardships airlines face will trickle down to other segments of the global economy.

A strong post-coronavirus recovery has been notably absent in one vital sector—air travel.

Families determined to enjoy a summer holiday are mostly opting to visit nearby destinations that can be reached by car. That’s in large part because of the hassle and risk that flying presents in a world plagued by Covid-19. This shift is evident among airline stocks, which have largely missed out on the equities rally.

With fewer passengers and limited routes, most air carriers are dramatically slashing costs at the expense of their workforce and suppliers. That’s causing a trickle-down effect that will become painfully evident in several sectors over the next few months.

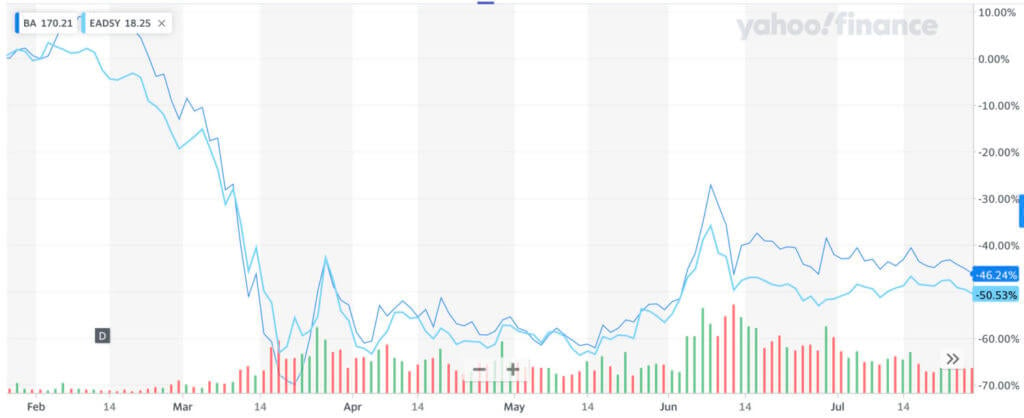

Boeing, Airbus Hit By Air Travel’s Coronavirus Decline

Plane makers are the first casualty of declining air travel. Both Boeing (NYSE:BA) and Airbus (OTCMKTS:EADSY) are stuck with finished jets that no one wants . Boeing is running out of places to store the planes.

Most of the plane makers’ biggest customers are halting new jet purchases. Delta (NYSE:DAL) isn’t accepting new orders for the remainder of the year. United Airlines (NASDAQ:UAL) says it won’t take on any new aircraft until 2023. American Airlines (NASDAQ:AAL) is still negotiating when it will accept 17 of Boeing’s MAX aircraft, which are still grounded due to safety concerns. Whether this will eventually translate into a search for the best private jet companies instead of commercial airlines remains to be seen.

Suppliers Face Brutal Demand Drop

This sudden drop in demand is having a direct impact on suppliers like Rolls Royce (OTCMKTS:RYCEY) and General Electric (NYSE:GE) that manufacture aircraft engines. Due to the slowdown, Moody’s cut its credit rating for Rolls Royce , bringing the firm’s bonds down to junk status.

GE has been significantly reducing its workforce within the aviation department to cope with reduced demand for jet engines. The firm has already cut roughly 10% of its aviation workforce , but more layoffs are likely as it will take years for demand to return.

Oil Price Decline Likely

It doesn’t end there, though. Bank of America doesn’t see the demand for jet fuel returning to pre-pandemic levels until 2023. That slow return to normalcy for air travel could be detrimental to oil prices, which are already in a fragile state.

Jet fuel makes up roughly 8% of the world’s daily oil needs . Coupled with a decline in gasoline and diesel consumption, that could be detrimental to the commodity’s overall recovery.

The International Energy Agency is expecting global oil demand to remain roughly 2.6 million barrels per day below pre-pandemic levels through 2021. A sharp drop-off in jet fuel and kerosene demand makes up three-quarters of that shortfall .

Consumer Behavior Likely to Stick

Even that bleak estimate assumes that road travel will be getting back to normal through the end of 2020. That’s a possibility if the pandemic is kept at bay, but a second wave would see those estimates sharply lower.

OPEC members, who control around 80% of the world’s oil supply, have found themselves adjusting to a new normal in which the decline in oil demand is a permanent change . According to one delegate, changing consumer behavior caused by the pandemic is likely to stick around for good:

I don’t think it will go higher than 110 million barrels per day by the 2040s. This is permanent demand destruction.

That could be disastrous for the airline industry and everyone who depends on air travel. There have already been rumblings about a permanent shift among businesses to require less face-to-face interaction.

International business trips are seen declining by up to 40% , according to the Climate Group’s survey. Almost 90% of the businesses surveyed said overseas travel would be minimal even if pandemic-related restrictions are eased.

Business travelers make up around 12% of the airline industry’s passengers , but business customers are the most profitable for airlines as they generate the largest margins. With that in mind, a return to normalcy for airlines, their suppliers, and the global oil industry is looking increasingly unlikely.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.