‘Buy the Pullback’ in Bitcoin, Ethereum: Fundstrat’s Sluymer

Leading cryptocurrencies are all trading in the green today, as Ethereum takes the recent development of a possible regulatory crackdown in stride. After falling from the $1,000 level to as low as $300 this year, Ethereum has been on the comeback trail.

That momentum could have been marginalized by reports that US regulators are considering classifying the No. 2 digital currency by market cap as a security, similar to how they view the tokens that enter the market through initial coin offerings (ICOs). Meanwhile, just last week US Securities and Exchange Commission Chairman Jay Clayton basically put the kibosh on the notion that bitcoin could be a security.

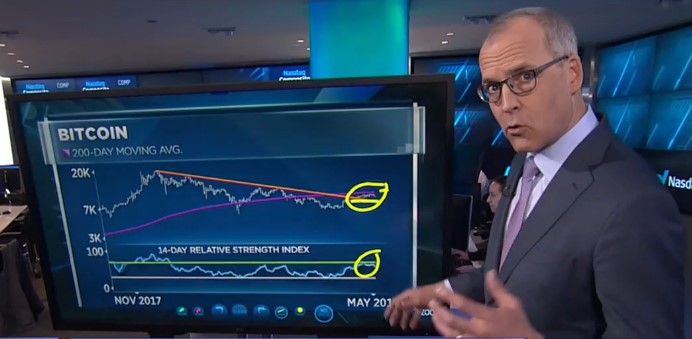

But Ethereum has emerged largely unscathed by those reports, and its return to near the $700 level is a good technical indicator, according to Fundstrat Global Advisors’ Robert Sluymer on CNBC . Any selling in Ethereum was likely a function of the digital currency being overbought, similar to bitcoin over the past week or so. With bitcoin, he points to a “tremendous amount of support between $8,200 and $8,400.” He adds that “the downtrend that was in place since January is now reversing.”

“The question is, ‘are we seeing a bigger bubble? Or is this a bottoming phase?’ And we think this is a bottoming phase that’s taking hold and that you want to buy the pullback from the short-term overbought,” said Sluymer.

Sluymer reflected back on bitcoin’s plight that included a 70% decline in price from 2017’s high, which pressured other cryptocurrencies as well. All of that is in the rear-view mirror now as things are looking up from a technical perspective.

“It was a combination of regulation concerns, taxes, a break in price — all of that came together in the perfect storm,” he said, pointing to the “bottom in February” that was retested in March and again last month. “It looks like a low to me,” Sluymer said.

Not the Nasdaq

Meanwhile, Sluymer dispelled the myth that any bubble that had formed in the bitcoin price and subsequent downtrend from the first quarter was not akin to the dot-com bubble at the turn of the century. For one, bitcoin came on the scene less than a decade ago, and therefore can’t really be compared to an index like the Nasdaq that has been trading for more than 40 years .

Secondly, the amount of institutional capital that has poured into the Nasdaq cannot be compared to that coming into bitcoin either. Institutional investors remain largely sidelined on cryptocurrencies until a formal regulatory framework takes shape, a move that could even bring Nasdaq to enable cryptocurrency trading as an exchange.

Featured image from Shutterstock.