Fed ‘Hyper Activism’ Is Setting Up the Stock Market to Fail: €2T Strategy Chief

The Fed’s liquidity boost is taking on truly epic proportions – and creating systemic imbalances in the stock market. | Image: TIMOTHY A. CLARY / AFP

- A major global asset manager warns the stock market is in trouble.

- He says the Fed’s zero rates until 2022 will fuel a risk assets bubble.

- The Federal Reserve is getting hyperactive in subtler ways as well.

The Federal Reserve won’t stop goosing the engine with 0% interest rates. Not until the economy has recovered. The Fed announced Wednesday, “the Committee decided to maintain the target range for the federal funds rate at 0 to 1/4 percent.”

On Mar. 24, Reuters Business News called this the Fed’s money bazooka . That is a massive understatement. It’s more like the Federal Reserve’s money volcano.

In three months, the Federal Reserve’s balance sheet rose from $4 trillion to $7 trillion. The central bank announced Wednesday that the money tsunami will go on flooding the financial system. The stock market will float in torrential liquidity, indefinitely :

The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.

And they nailed down some expectations and time frames. The Federal Reserve is committed to holding interest rates to essentially zero until 2022 .

Strategy Chief’s Stock Market Warning

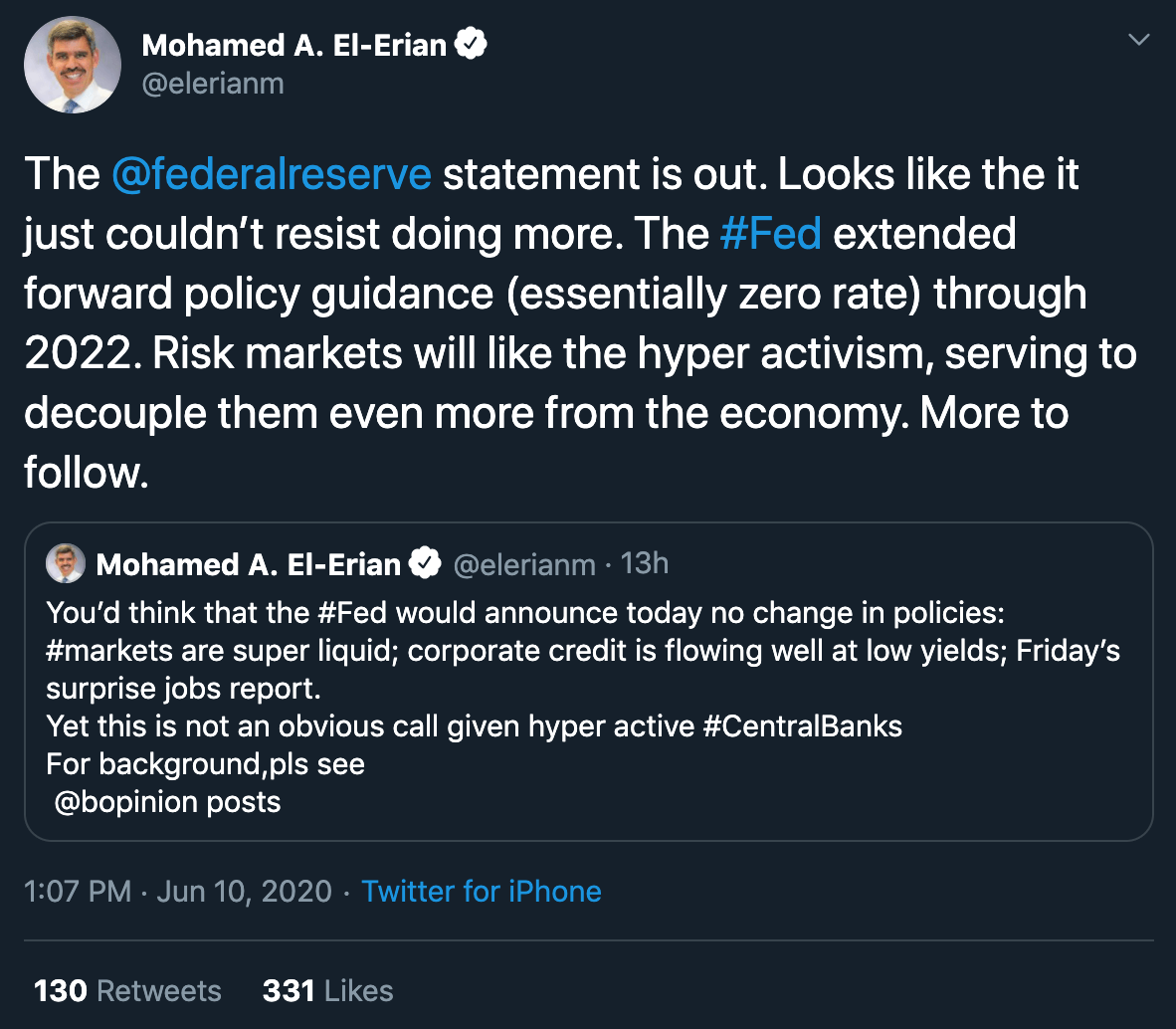

Mohamed El-Erian, chief strategist for Munich-based Allianz, warned the very assets that will like the ultra-dovish Fed policy will be put at risk by it:

Allianz is a German Eurasian-African insurance and asset management giant. The company has 2,268 billion euros in assets under management . It serves 85 million customers .

El-Erian is wary of the Federal Reserve creating a stock market bubble, or making one worse. Wall Street is undoubtedly among the risk markets he sees decoupling even further in price from real economic and financial value as the dollar glut inflates asset prices.

Referring to the stock market in an interview Monday, he told CNBC :

For me personally, it’s an uncomfortable bet to continue to bet on a huge recovery.

The extraordinary scale of the Fed’s intervention is quite conspicuous and intentionally so. Fed Chair Jerome Powell even gave an interview on NBC’s “Today” show .

But the Federal Reserve is entering an era of hyper activism in more subtle ways.

Fed Expands Powers With Corporate Bond ETF Buys

The Federal Reserve made some relatively small purchases in the corporate bond ETF market in May . It’s not much compared to other interventions, such as the Fed’s new mortgage-backed securities buying spree, with a price tag of $59.9 billion .

And it’s a typo on the enormous $2 trillion CARES Act. So considering the kind of weight the Fed is deploying in subprime mortgages, it’s just dipping its toe into the investment-grade corporate bond ETF market. But the stock market could be next.

It seems like no big deal after everything else that has happened this year. But the Federal Reserve is exercising an unprecedented form of intervention into the financial system and economy.

Not long ago, buying mortgage-backed securities was an unprecedented operation by the Federal Reserve. But it has gone from unprecedented in January 2009, to necessary, routine, and expected a decade later.

Emergency measures often become permanent contingencies. Government relief fosters reliance on government. These risks would accompany Fed purchases in the publicly-traded stock market.

The roughly $3 billion in corporate bond ETF shares the Fed holds in total is a quiet test run of a new capability. But it’s already causing distortions in capital markets.

After the Fed revealed which ETFs it purchased, investors disproportionately bought those funds . The Fed has now exercised an unprecedented operation. With that comes the potential to deploy liquidity through these new channels at a grander scale. And give an unearned benefit in the form of a monetary subsidy to specific holders of certain ETFs at greater scale. This picking of winners and losers could have unintended consequences in the stock market.

Former Fed Chair Janet Yellen recently said Congress should consider allowing the Fed to buy stocks . If the Federal Reserve moves on to the stock market next, that could keep equities floating longer, but at the potential risk of further decoupling stocks from the economy.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com.