Failing Wars of Dollars; The Bitcoin Price to Come

In the beginning, there was Fiat, and Fiat was government. Through fiat, all things are priced. Dollars, it turns out, are blasphemy.

“Just get Congress to pass a bill authorizing the printing of full legal tender treasury notes . . . and pay your soldiers with them and go ahead and win your war with them also.”

All government law is fiat. Fiat is a decree. When used for currency, it is a recognition of the value of paper and ink by law. Governments officially recognize a sovereign currency as legal tender and accept payments of debt only in that currency. Fiat also gives the government the power to decide how much debt you owe. Historically, this has worked great for government and its ability to fund wars – at great cost to its people.

All government law is fiat. Fiat is a decree. When used for currency, it is a recognition of the value of paper and ink by law. Governments officially recognize a sovereign currency as legal tender and accept payments of debt only in that currency. Fiat also gives the government the power to decide how much debt you owe. Historically, this has worked great for government and its ability to fund wars – at great cost to its people.

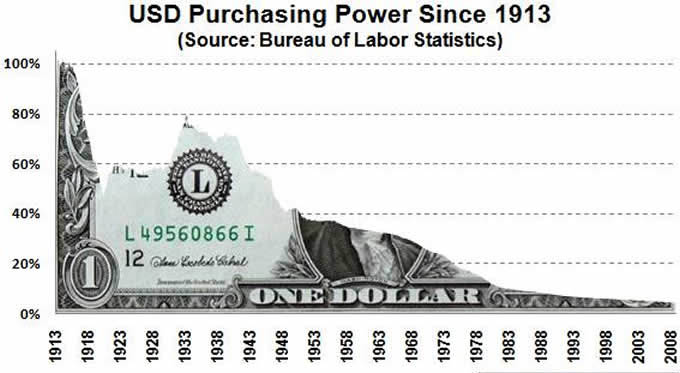

The U.S. Constitution grants Congress the power to coin money and regulate its value. The United States government recognizes the Dollar as its official currency. In return for a deal struck in 1907, that control of the Dollar passed to a private bank. Since then, the buying power of the Dollar has plummeted 97%.

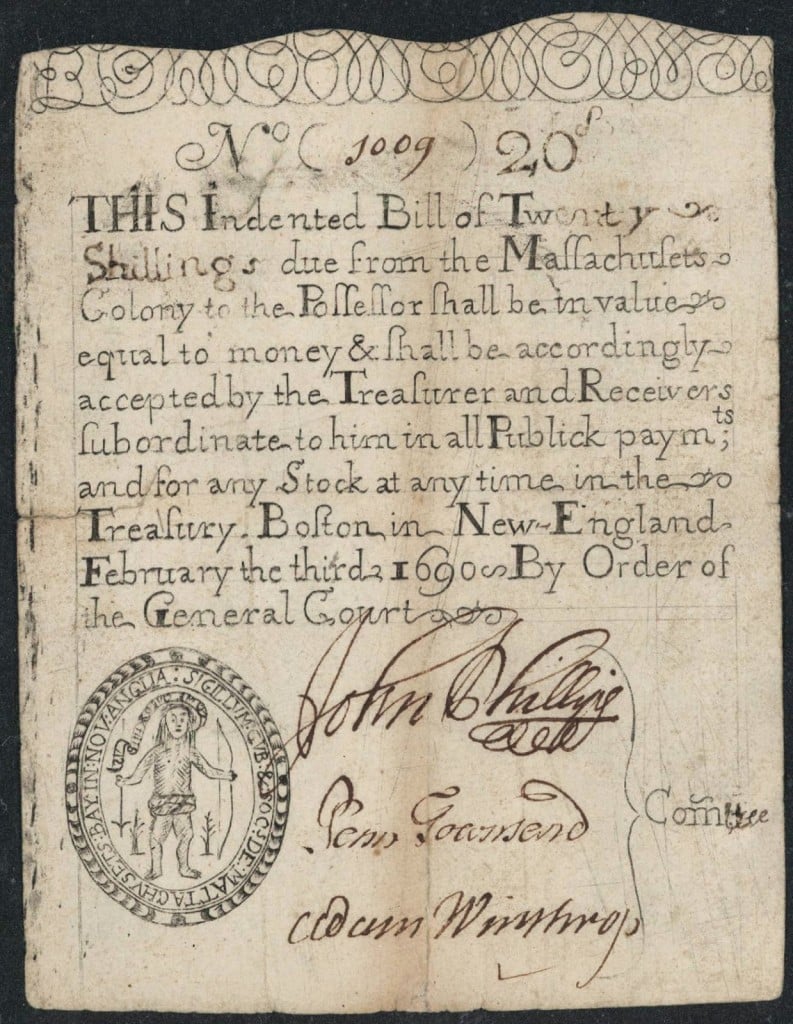

Dollars are not the first currency used in the United States. Fiat currency has bloody roots on U.S. soil older than the country itself.

Massachusetts Invades Canada, Eh

In 1690, New York, Massachusetts, and Connecticut sent military expeditions into Canada. Starting with Port Royal, 800 men led by Sir William Phips were to loot and pillage through Quebec and Montreal.

Also Read: Bank of Canada Looking Into Issuing Digital Currency Like Bitcoin

Port Royal was defended by 70 soldiers. Its fortifications were unfinished, and canons were not in place. When Phip’s force landed, over half the Port Royal soldiers were absent. There was no resistance, the governor of Port Royal surrendered.

Although Phip’s made a verbal agreement to leave private citizens, their property, and religious worship alone, his honor was short-lived. His men looted the town, destroyed livestock, desecrated the local church and Phip’s personally ordered the peasantry to swear and oath to William and Mary of England before establishing a new government.

Massachusetts printed £7,000 to finance Phips, establishing the first fiat currency by declaring 5% markup when using it to pay debts to the state. The colony pegged the value of the currency to a silver Spanish coin – Reales, referred by the colonists as Dollars.

The success of the Massachusetts’ currency was short-lived. The loot recovered by Phips from Port Royal would only last so long. Later that year, two thousand more Massachusett’s troops were to invade Quebec. Delays and harsh weather caused the invasion to fail, miserably. Without any plunder, there was no way to pay the troops. Massachusetts began printing more.

Paper currency in Massachusetts suffered horrible inflation. In 1690, a Spanish Reale was worth 6 Massachusetts shillings. By 1742, a Reale was worth 924 shillings. The printing never stopped, currency reboots occurred multiple times. After a bailout from the Bank of England had failed to rescue the currency, British Parliament restricted the use of paper money in Massachusetts.

Massachusetts issued no currency until 1775 when Paul Revere issued Soldier’s Notes, and later Continentals, to fund soldiers for the Battle of Bunker Hill.

Not Worth a Continental

Following the example set by Massachusetts, in 1775 the early US federal government issued its currency, too. Continental currency or Continentals, funded the American Revolution. By 1850, over $240,000,000 had been issued. A Continental held 1/40th its original value. One year later they ceased circulating as a currency, becoming effectively worthless.

Benjamin Franklin wrote an essay, “Of the Paper Money of America,” arguing the issuance and inflation of Continentals had effectively been a tax on Americans. With similar sentiment, the Quakers in Pennsylvania banned Continentals, citing their passivism did not permit them to pay war taxes.

Also Read: Cost of Paper Money: $200 Billion, Time to Phase Out and Introduce Bitcoin?

Inflation of colonial currency was notorious; Adam Smith calls it out specifically in “Wealth of Nations.”

“The paper currencies of North America consisted, not in bank notes payable to the bearer on demand, but in government paper… and though the colony governments paid no interest to the holders of this paper”.

“The government of Pennsylvania, indeed, pretended, upon their first emission of paper money, in 1722, to render their paper of equal value with gold and silver by enacting penalties against all those who made any difference in the price of their goods when they sold them for a colony paper, and when they sold them for gold and silver; a regulation equally tyrannical, but much less effectual than that which it was meant to support.”

Thanks, Pennsylvania. All you had to do was stay off a list.

Dollars Ain’t ‘Murican, Amigo

In 1792, Alexander Hamilton commissioned a report into the amount of silver in a Spanish Reale. Congress defined the U.S. Dollar by this amount, about 24 grams of silver. The value of the Dollar was defined by Spanish currency.

Until the Civil War, private currency was issued in the United States. This form of paper money was redeemable for gold and silver specie, or coinage. The value of the paper money rests on the ability of the issuing organization to exchange it for specie (coinage) – a system of trust.

Abraham Lincoln changed that and nationalized the banking system. In the first months of the Civil War, Lincoln spent the entirety of the government’s tariff and excise income. He borrowed every available dollar from New York banks. It was not until the interest rates of British banks, 24%, so appalled Lincoln that he called for other solutions.

In 1861, Congress issued $50,000,000 in Demand Notes. The ink used to print the currency was green. Thus, they became known as ‘Greenbacks.’ They were not legal tender but were fully redeemable for gold. As Demand Notes were used to pay taxes, they were taken out of circulation.

By 1862, Lincoln realized Demand Notes would not be enough to fund the war effort. Illinois coal tycoon and politician Dick Taylor suggested Lincoln issue paper currency backed by nothing.

“Just get Congress to pass a bill authorizing the printing of full legal tender treasury notes . . . and pay your soldiers with them and go ahead and win your war with them also. If you make them full legal tender… they will have the full sanction of the government and be just as good as any money; as Congress is given that express right by the Constitution.”

United States Notes were issued, backed solely by government Fiat. They resembled Demand Notes, as they were also printed using green ink. At first, they were recognized at a similar value to the gold-backed Demand Notes.

By 1863, the Fiat Greenbacks lost one-third their value compared to gold-backed Greenbacks. Their value waxed and waned with the North’s victories and losses in the war. The lowest point for the Fiat notes came in July of 1864; their value reaching 40% of the Demand Notes. Even after the North’s victory, their value only ever reaching two-thirds that of the Demand Note.

Counterfeiting Inflates the Currency

During the American Revolution, Great Britain ran a counterfeiting operation for American Continentals. Agents that worked for the British government known as “shovers” put as much counterfeit U.S. currency into circulation as they could. The punishment for these American Loyalists shoving counterfeit currency into circulation was hanging.

The use of counterfeit currency in warfare is ancient. The idea relies on increasing the supply of the currency, inflating it, to the point where the opponent can no longer fund their military. Great Britain understood this tactic and their employment was hugely successful. After the Revolutionary War, it’s estimated one-third to one-half of Continentals were forgeries.

Also Read: Congressional Report on Bitcoin: to be considered a possible competitor to U.S. official currency

Even the early Massachusetts governments recognized that it wasn’t hard for the common man to print copies resembling the official government paper. Each of their official papers matched a stub held by the Treasury – similar to a 50/50 gambling ticket or movie stub.

Quantitative Easing, Stimulus, Bail Outs, Counterfeiting was a common, lucrative, crime. Ask any politician or banker.

In 1851, a barrel maker scavenging for materials uncovered a counterfeiting operation outside of Chicago. Upon alerting the local sheriff, he was deputized and successfully tracked and arrested the entire band of counterfeiters. The barrel maker, Allan Pinkerton, became the first detective for the city of Chicago as reward for his part in their apprehension.

During the 1940’s, Allan’s brother Robert formed a successful private security firm. “Pinkerton & Co” provided the majority of security for railroads and stagecoaches financed by Wells Fargo bank. Allan eventually left Chicago, joining his brother. Together, they formed Pinkerton National Detective Agency.

The new agency specialized in private and military contracts, hunting down counterfeiters and train robbers. Eventually, they expanded their services to protecting the U.S. President after uncovering a plot to assassinate Lincoln. The Pinkertons served as the model for what is currently called the U.S. Secret Service.

Legal Tender For All (Military) Debts

Woodrow Wilson signed the Federal Reserve Act in 1913 and established the Federal Reserve as the national bank of the United States. The Federal Reserve Note, known today as Dollars, became official U.S. tender. A year later, World War One began.

The young Federal Reserve issued bonds to fund American efforts from 1917 to 1918. Over $17 billion in bonds were issued, and government waved taxation on up to $30,000 of the interest. Effectively, the Federal Reserve promised to print future currency, in exchange for funding the military industrial complex today.

By 1920, the purchasing power of the Dollar fell 50%. It would recover slightly, to 80%, just before the arrival of the second World War then begins a slow, long, downward decent that accompanies military occupations and imperialism as a foreign policy to where we are today – 3%.

Dollar Adoption is a Forced Ponzi Scheme

Just like New England, the contemporary US monetary policy is a gamble. $8 Trillion worth of federal programs relies on renewing one-year loans with foreign governments.

Just like New England, the contemporary US monetary policy is a gamble. $8 Trillion worth of federal programs relies on renewing one-year loans with foreign governments.

The U.S. can take those loans because the power to print money is the power to siphon the value from every person, business and government storing their wealth in dollars. Ultimately, it can just create that much currency as a last resort.

Although government fiat may restrict or affect a market, it does not have the power to change the law of Supply and Demand. By officially recognizing a currency and enforcing its use a government restricts competition and steers demand toward the chosen currency. Through the creation and destruction of the currency in circulation, it affects the supply.

If someone saves their entire lives for retirement, they are storing the value they could have spent now to make their life easier in the future. When they store their life savings in a currency, they are placing trust in the people who maintain it. If the Federal Reserve inflates the Dollar to the point where one million dollars buys a candy bar, why bother saving for retirement? In an inflationary system, you’re better off spending the currency as soon as you receive it to maximize the purchasing power. Investments are just a gamble, trusting the investments to outpace inflation.

The price of a bitcoin in dollars may skyrocket, but not because of anything in Bitcoin. Bitcoin’s price in dollars will skyrocket because Dollar adoption will decline. As the rest of the world abandons a failing currency, they’ll likely turn to other fiat currencies. That won’t change their circumstance. Fiat will still inflate until it collapses. But it will be another step in a decentralized direction.

The price of Bitcoin to Come is 1 XBT to 1 XBT. Deflationary cryptocurrency is an option, and it peacefully coexists with its inflationary counterpart. With Bitcoin, no central authority can inflate the supply and force the holders to fund a war. One bitcoin will be the same amount of the total supply of bitcoins today as it will be in 100 years. If not Bitcoin, then something else – perhaps whatever the AI robot overlords decide.

Fiat currency is a spectacular tool for elites to steer the economy and fund war. Bitcoin allows you to withdraw from imperialism without moving across political borders.

Sources: Celebrate Boston, Coins , Web of Debt.