Everyone’s Hodling Bitcoin: Only 1.3% of Transactions are Payments in 2019

Nobody wants to use bitcoin as a currency while it continues its bull run. | Source: Shutterstock

By CCN.com: Research by Chainalysis finds that only 1.3% of bitcoin transactions so far in 2019 came from merchants. The remaining 98.7% of volume is all on the exchanges.

That means almost no one is using bitcoin to buy things. The bitcoin economy is still mostly about speculation, not a global payments system. The figures are based on data from New York-based blockchain researcher Chainalysis Inc. and are based on the first four months of 2019.

In an email to Bloomberg , Kim Grauer, senior economist at Chainalysis, says:

“Bitcoin economic activity continues to be dominated by exchange trading. This suggests Bitcoin’s top use case remains speculative, and the mainstream use of Bitcoin for everyday purchases is not yet a reality.”

Hodling BTC An ‘Uncomfortable Reality?’

Olga Kharif, who writes a tech column for Bloomberg, says in her report that bitcoin’s price rally masks this “uncomfortable reality.” She writes:

“That’s become the main dilemma with cryptocurrency. Bitcoin needs the hype to attract mass appeal to be considered a viable electronic alternative to money but it has developed a culture of ‘hodlers’ who advocate accumulation rather than spending.”

However, it could be that the new economics of a vigorously deflationary currency like bitcoin that drive this market behavior, not peer pressure. At the bottom of the culture of “hodlers” who advocate accumulation one may find it is the “invisible hand” of Adam Smith who guides these economic decisions based on specialized knowledge and self-interest.––and a rather self-evident economic principle called “Gresham’s Law.”

Bitcoin and Gresham’s Law

“Bad money drives out the good.” -Sir Thomas Gresham (1519–1579), English financier during the Tudor dynasty

What bitcoin hodlers know — or think they know — is that bitcoin is “good money” while dollars are “bad.” That’s not necessarily because they just like bitcoin, or don’t like dollars, or just happen to be inveterate contrarians.

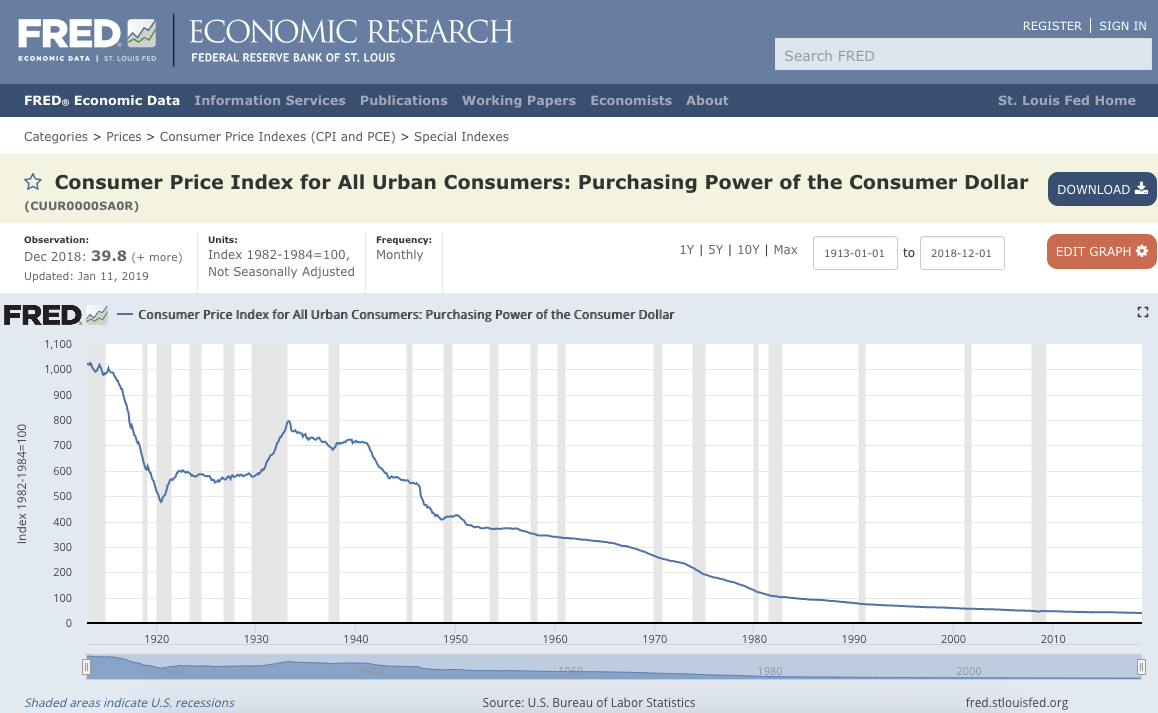

It’s because banks designed the U.S. monetary system for dollars to lose an average of 3% of their value every year as the Federal Reserve that issues them steadily expands the money supply. The Fed gives newly issued dollars to Federal Reserve banks (like Bank of America or JP Morgan Chase) to lend at a profit. When they begin to circulate, they drive down the value of every dollar in your bank account.

Since the Berlin Wall fell in 1989 U.S. dollar inflation averaged 3.22% . That may not seem like much in the short term, but it means that prices double every 20 years. In other words dollar inflation steals half your money every two decades.

By contrast, no central authority issues bitcoin. It has a fixed supply that will max out after 21 million bitcoin are issued. People will spend it differently than they spent dollars throughout the 20th and early 21st century. They will even if bitcoin becomes a major global merchant and personal payment solution.

It’s not necessarily uncomfortable or a problem for bitcoin that people are reluctant to spend it. They might not value their $7 more than a green-mermaid branded sugary coffee drink. But they know their 0.00083 BTC is a scarce and precious digital asset.