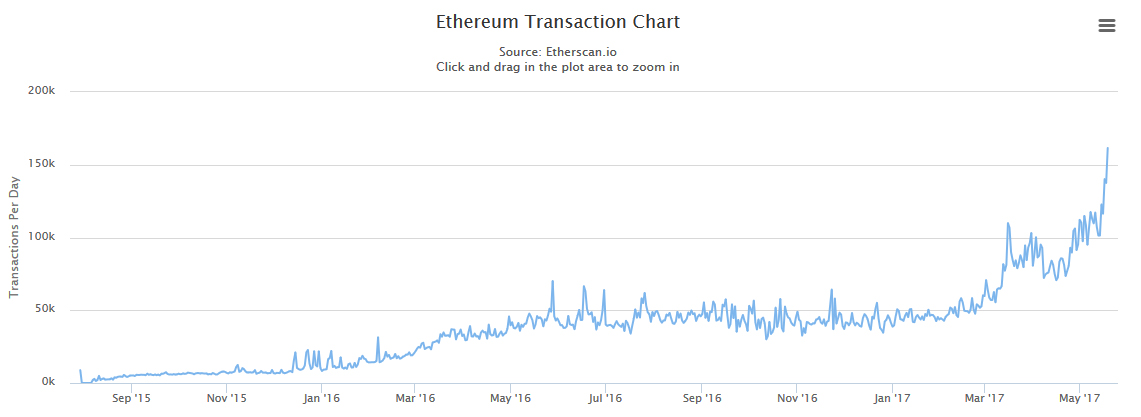

Ethereum Now Handles More Than 50% of Bitcoin’s Transaction Volumes

Ethereum’s transaction volumes have now reached around 161,000 a day, up this month from around 100,000, in a sign of growing use and increasing utility of the barely two years old network.

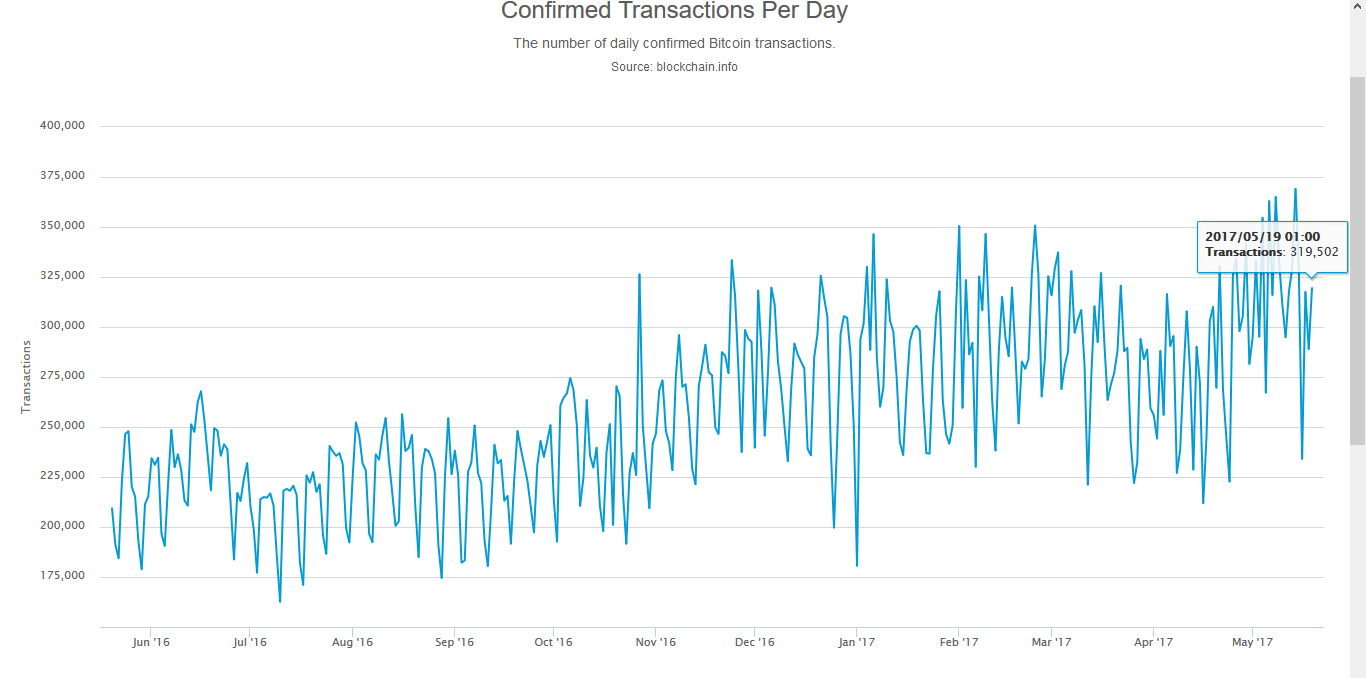

Transaction volumes on bitcoin, on the other hand, have sort of leveled. Yesterday it handled around 319,000, but it varies up and down due to its backlogs which might be forcing users to not transact.

That means ethereum is now handling more than 50% of bitcoin’s transaction volumes, transferring yesterday nearly $2 billion worth of value without any congestion or backlog as eth transactions usually confirm in seconds.

The increase in volume corresponds to a considerable increase in price, with the currency yesterday experiencing a jump from around $87 to $122, showing a strong correlation between transaction levels and price.

Ethereum’s market cap, however, has not yet reached 50% of bitcoin’s, currently standing at around 36%, with both currencies moving up recently as bitcoin now stands within touching distance of $2,000, a doubling from a few months ago.

Ethereum has had a lot of recent news, but it’s not clear why bitcoin is increasing considering its backlog of around 200,000 that continues for the fourth day running, high fees, as well as a number of businesses moving to other chains while bitcoin hasn’t seen any new ones or new projects.

It may be because of recent front page publicity due to the ransom attacks, while ethereum has attracted attention more because of the many new projects that have and continue to launch as well as the Ethereal Summit yesterday.

Can Eth Handle the Volume?

Eth’s rate of adoption is fairly remarkable with its transaction volumes far higher than any other digital currency, except for bitcoin. Some merchants have even began accepting it for commerce, but most of the volume probably comes from smart contracts.

At this rate of growth, it might overtake bitcoin’s transaction volumes, not least because bitcoin can’t currently handle any more. Unlike bitcoin, it would continue operating normally, but next year or in 2019 it might begin needing more capacity.

That is planned to be provided in two ways. One of them is Raiden, a second layer protocol similar to the Lightning Network, which can be used by smart contracts and repeated payments businesses. It was in alpha last year and plans to launch any time now.

The second scaling method is on-chain with Vitalik Buterin stating they plan to use “a combination of sharding schemes, random sampling, heavy use of Merkle proofs and asynchronous calling in order to increase the potential transaction throughput from ~10-20 transactions per second to over 100,000.”

That should be plenty of capacity if achieved with plans to increase it gradually through proof of stake and sharding. So the network should be able to handle demand with its current version probably working fine at 1 million transactions a day while future versions might handle a billion or more.

Featured image from Shutterstock.