Ethereum-Based Maker Surges 50% in 10 Days While Crypto Market Slumbers: What’s Fueling it?

Maker, an Ethereum-based crypto-asset has seen soaring gains in recent weeks. | Source: Shutterstock

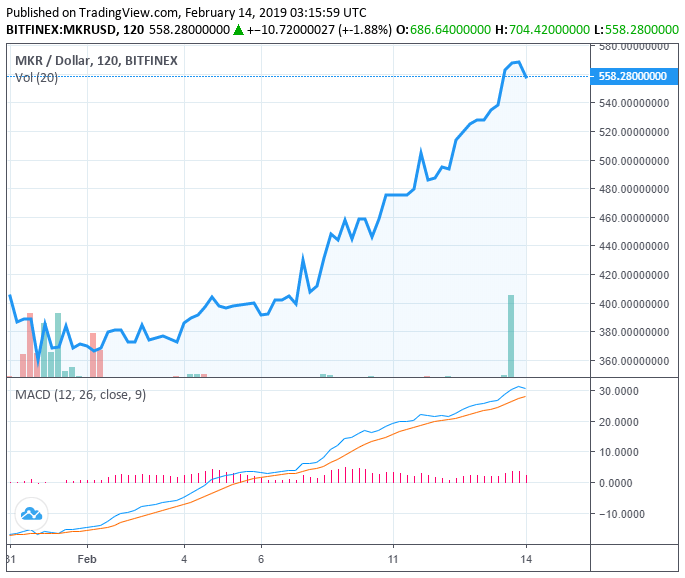

Since February 4, the price of Maker (MKR), a crypto asset that represents a stablecoin, collateral loans, and decentralized governance platform on Ethereum, increased by exactly 50 percent against the U.S. dollar.

In the same time frame, the valuation of the crypto market has slightly increased by 6 percent in a corrective rally fueled by the strong performance of Bitcoin and other major digital assets like Litecoin and Ethereum.

Factors Fueling the Rally of Maker While Crypto Market is Stable

In the last several hours, the price of MKR exceeded $700 on some cryptocurrency market data platforms. But, the price surge reportedly occurred due to an issue in calculating the supply of MKR following the migration of development funds.

Although the actual trading price of MKR did not surge 40 percent overnight, in the past ten days, MKR still recorded a massive 50 percent gain.

Simply put, Maker is a blockchain network that operates a stablecoin and a collateral loans system. The stablecoin of Maker called Dai maintains its value through an algorithm and it is used as the base currency of the loans system.

Dai can maintain its value at a 1:1 ratio to the U.S. dollar because of a mechanism that automatically adjusts the value of Dai depending on market conditions.

“Maker is able to make Dai a Stablecoin due to its Target Rate Feedback Mechanism (TRFM). The TRFM is an automatic mechanism that the Dai Stablecoin System employs in order to maintain stability. The Target Price of 1 Dai is $1 USD, so the Target Rate determines the needed change of price of Dai over time in order to reach the Target Price during a market swing,” explained Sharon Manrique at MyCrypto.com.

Using Dai, users on the Maker loans system put up cryptocurrencies like Ethereum as collateral to borrow capital in terms of USD.

For instance, if an investor puts 10 ETH as collateral to borrow 500 Dai worth $500 and the deadline of the loan is reached, the investor will have to pay back $500 to obtain the 10 ETH collateral.

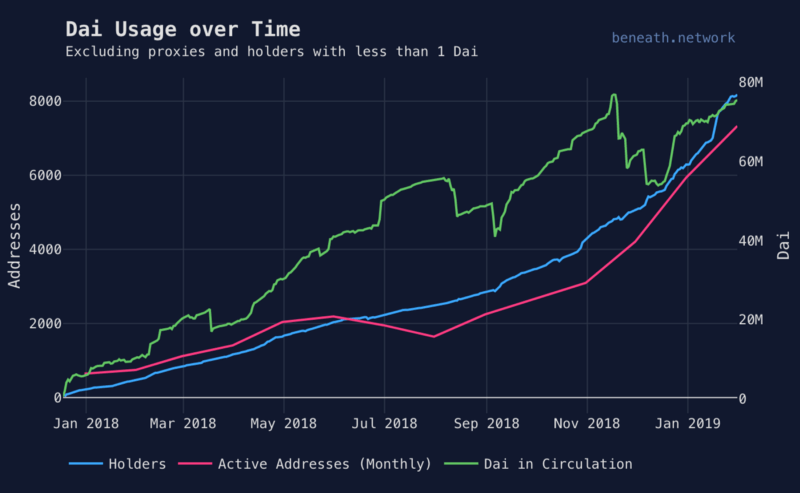

The Maker team revealed that the supply of Dai has increased by around 20 percent per month on average, competing against conventional stablecoins backed by the USD such as Gemini Dollar and Circle’s USD Coin.

The increase in the supply of Dai suggests that more users are utilizing Dai, an algorithm-based stablecoin issued as a token on the Ethereum protocol, over stablecoins backed with physical cash.

Moreover, Dai has been successful in maintaining its value at $1 throughout the past 14 months throughout extreme volatility.

“Dai went live on the Ethereum Mainnet in December 2017. Since then, it has kept a stable peg against USD as the price of Ether fluctuated by more than 94%. Today, more than 1.5% of all Ether is locked up as collateral in support of Dai,” the team explained.

The success of Dai and the overall increase in the user activity of the stablecoin has led the price of Maker to increase, the native cryptocurrency of the Maker blockchain network.

Maker (MKR) provides investors on the blockchain network the ability to participate in important decision making. As an example, MKR holders can weigh in on the sensitivity of the algorithm that maintains the price of Dai stable.

Hence, if the Maker platform and Dai see an increase in adoption, awareness, and user activity, it is reflected by the price of MKR.

How About Other Assets?

In the near-term, traders foresee major crypto assets from recovering momentum against the U.S. dollar.

Cryptocurrency researcher Jacob Canfield stated that a massive number of Bitcoin shorts have started to close, an indicator that shows the growing confidence in the short-term performance of the dominant cryptocurrency.

Click here for a real-time ethereum price chart.

Featured Image from Shutterstock. Price Charts from TradingView .