Elizabeth Warren Accidentally Just Made the Case for Bitcoin

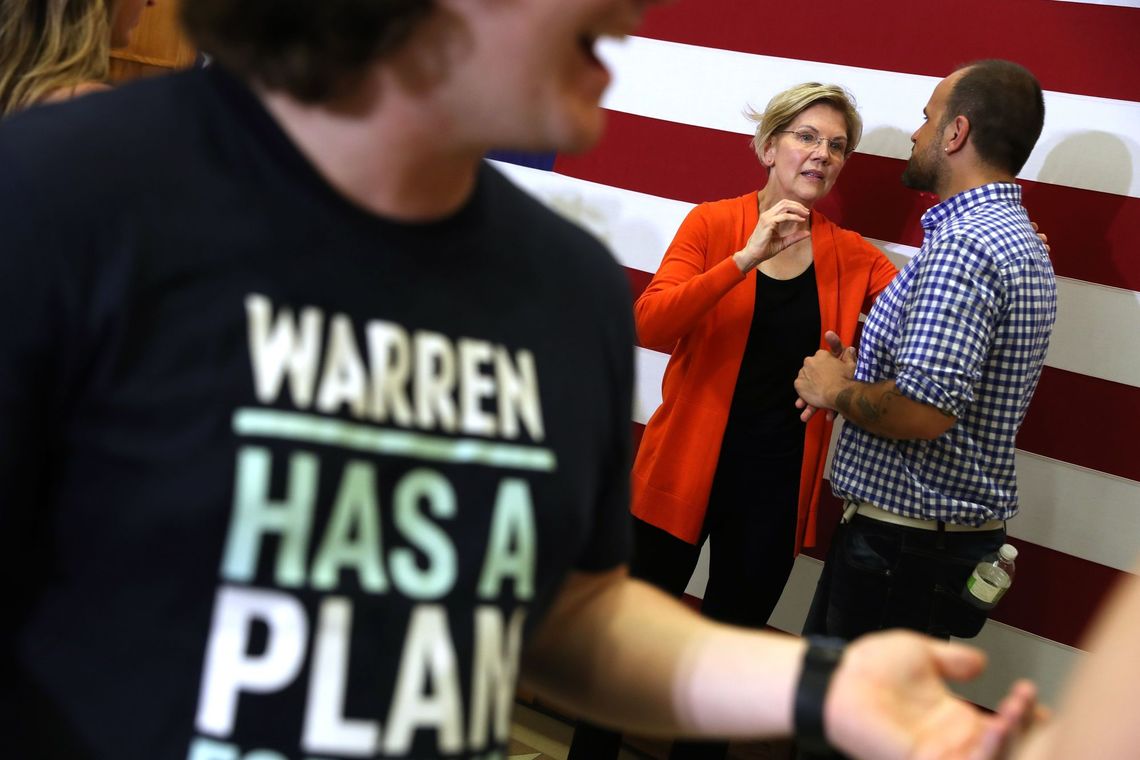

Elizabeth Warren warns that the US economy is on the brink of a painful crash. Little does she know she just made the case for Bitcoin. | Source: Justin Sullivan / Getty Images / AFP (i), Shutterstock (ii). Image Edited by CCN.com.

Elizabeth Warren’s team released a blog post today with the apparent intention of scaring people into voting for the Democrat, but “The Coming Economic Crash — And How to Stop It” may have a different effect altogether for those getting interested in Bitcoin.

Bitcoin and Facebook have been in the news regularly as of late, with some lawmakers and bankers fearing the upheaval of the global financial system as a result of the latter’s Libra project.

Elizabeth Warren’s Inadvertent Crypto Pump

Warren picks a perfect time to talk about the US economy’s uncertain outlook. From a crypto perspective, at least, it almost qualifies her as a shill.

Warren et al. write:

“When I look at the economy today, I see a lot to worry about again. I see a manufacturing sector in recession. I see a precarious economy that is built on debt — both household debt and corporate debt — and that is vulnerable to shocks. And I see a number of serious shocks on the horizon that could cause our economy’s shaky foundation to crumble.”

What better hedge against a crumbling voodoo economic system than an alternative based on science?

Warren cites several problems in the US economy and how her policies will alleviate them. At the heart of all these problems, though, is the opaque and precarious nature of the central banking system.

Warren’s economic program is less ambitious than some of the ideas espoused by other members of her party. She’d like to raise wages and cancel debt for American households. But all of her policies require some form of government intervention.

For Americans who lived through the 2008 financial crisis she cites at the beginning of the article, waiting on a government plan to work out might not be attractive.

Bitcoin’s Answer to Voodoo Economics

But if they’ve been paying any attention, they may also be learning about cryptocurrency, which offers an independent hedge against all of the problems Warren cites.

- Worried about your wages stagnating? Hold some crypto. Historically, it’s proven to rise year over year with limited exceptions. Many believe it will spike during serious economic crises like the one Warren expects.

- Worried about household debt? Stop borrowing and save crypto instead.

- Do bankers with unlimited power and a lack of transparency concern you? Promote blockchain and transparency, and only vote for politicians who will support both.

- Want a booming economy? Allow blockchain and other growing industries to flourish.

As you can see, Bitcoin is essentially a partial cure-all for the problems Elizabeth Warren highlights. Whether she knows or not, the left-leaning, nanny-state Democrat has made the case for Bitcoin in highly effective terms.

Bitcoin was born after the last great financial crisis. It has yet to be tested against a new one, but its performance in Venezuela has been a useful situation to observe.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.