Dow Struggles as US Stock Market Wrestles with Cooling Trump Economy

The Dow and wider U.S. stock market struggled on Thursday as Wall Street wrestled with data that suggests the Trump economy is cooling off. | Source: Shutterstock

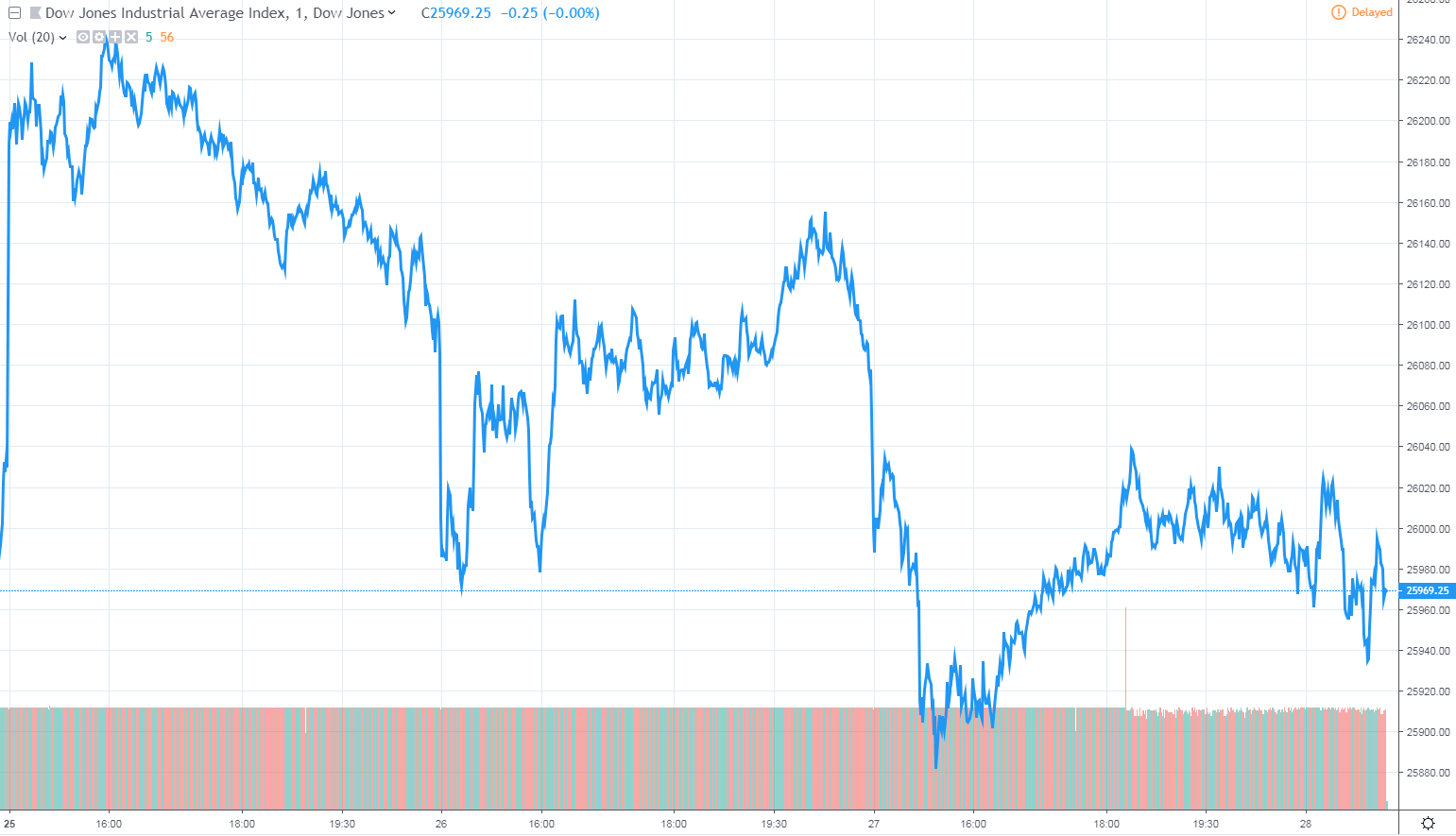

The Dow and wider U.S. stock market struggled for direction Thursday after talks between President Donald Trump and North Korea’s Kim Jong Un ended abruptly, raising the specter of a new confrontation with the hermit kingdom. Better than expected GDP data failed to stoke investor optimism after it became apparent that economic growth had slowed considerably from the first half of 2018.

Dow Struggles to Hold Above 26,000

All of Wall Street’s major indexes struggled, as the Dow Jones Industrial Average swung back below 26,000 through the morning session. The tepid start to the day reflects a rocky pre-market session for Dow futures.

At last check, the Dow had dropped 15 points, or 0.1%, to 25,969.25. A majority of the Dow 30 index members had reported losses, with DowDuPont Inc. (DWDP) falling 2.3%, Shares of Caterpillar Inc. (CAT) also fell 1.3%.

The broad S&P 500 Index declined 0.2% to 2,787.83. Losses were mainly concentrated in five of 11 primary sectors, with materials, energy and discretionary shares all falling at least 0.8%. Real estate, the S&P 500’s smallest category, was the best performer.

The S&P 500 Index faces stiff resistance near 2,800. Read the Hacked.com exclusive: Does this Chart Spell Doom for the S&P 500 Index?

A measure of implied volatility known as the CBOE VIX edged slightly higher through the morning but remained well below the historic mean. VIX, also known as the “fear index,” climbed 1% to 14.85. It peaked above 36.00 just before Christmas Eve when stocks plunged to yearly lows.

Somber Mood on Wall Street

Investors were on edge Thursday after talks between the United States and North Korea suddenly broke down, erasing hopes for a new agreement between the two countries. Earlier this week, the White House talked up a “joint agreement signing ceremony” between President Trump and North Korea’s Kim Jong Un that was scheduled to take place on Thursday.

US Stocks at Risk as Trump Economy Cools Off

Markets were also dissatisfied with the latest reading on U.S. gross domestic product (GDP), which showed better than expected growth but was still much weaker than the first half of 2018. The U.S. economy expanded 2.6% annually in the December quarter following a 3.4% growth clip in Q3, the Commerce Department reported Thursday. Analysts in a median estimate had called for GDP growth to slow to 2.3%.

Although the U.S. economy remains at full employment, a slowing housing sector has raised red flags about consumer spending and the impact of rising interest rates on affordability. Home sales and residential building activity declined sharply in December, the continuation of a trend that first emerged with the rapid rise in mortgage rates.

The Federal Reserve’s benchmark interest rate impacts mortgage rates indirectly as lenders pass on higher costs to consumers. Policymakers signaled last month that they were effectively pausing their rate tightening schedule following the stock market collapse of the fourth quarter. This was further reiterated in the official minutes of the January Federal Open Market Committee (FOMC) meeting, which were released last week.