Dow Surges Toward Record High after DowDuPont Spinoff

More than 75% of the S&P companies that have reported surpassed earnings estimates. | Source: Shutterstock

The Dow outpaced the broader U.S. stock market on Thursday, as shares of the recently divided Dow Inc. (D) surged in anticipation of a new cyclical growth period for the plastic maker.

Dow Jumps as Traders Go Rabid

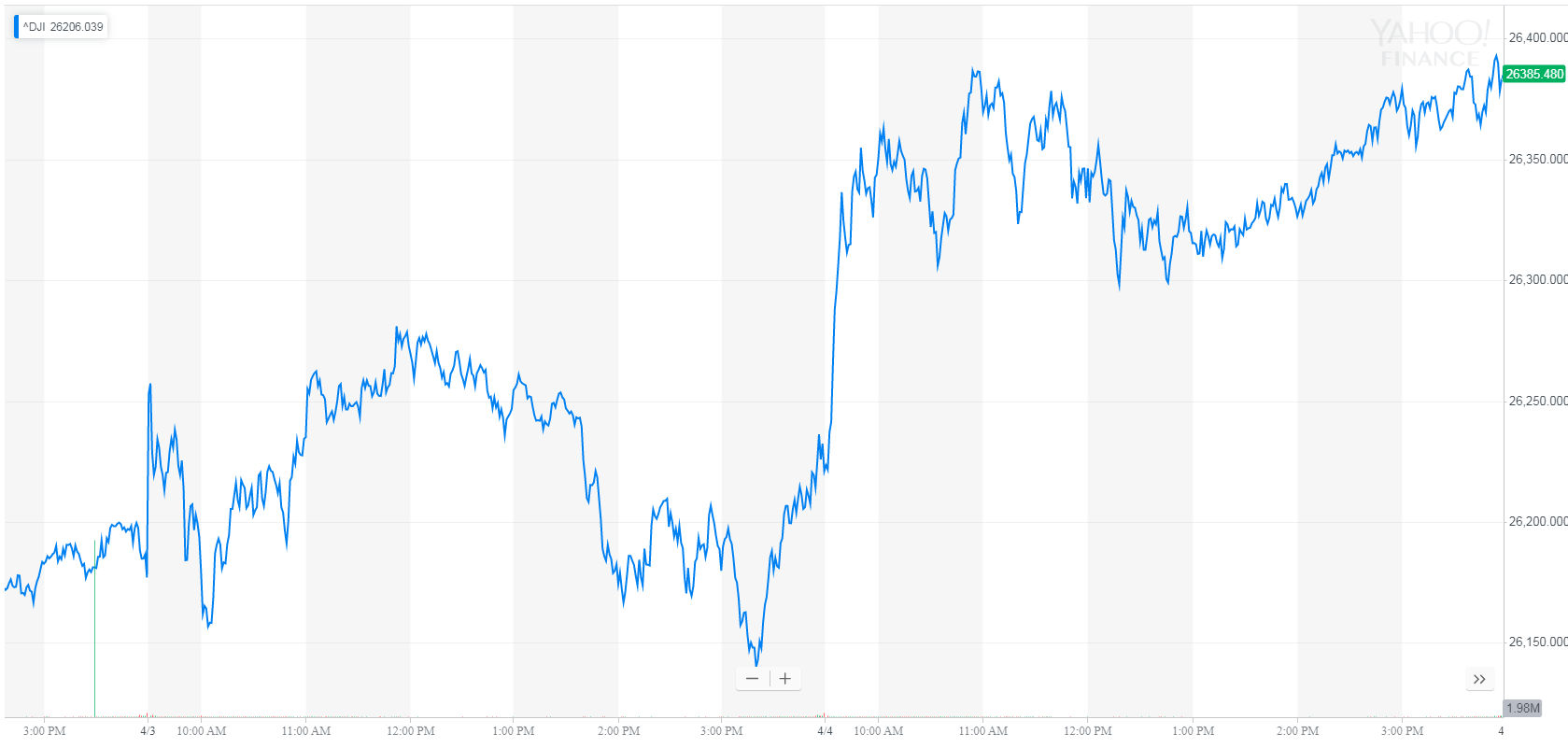

The Dow Jones Industrial Average rose by as much as 172 points, reflecting a strong pre-market for U.S. stock futures. The blue-chip index settled up 166.50 points, or 0.6%, at 26,384.63.

Shares of Dow Inc. climbed 4.3%. Boeing Co (BA) jumped 3% after the airline manufacturer claimed it had successfully tested new software for the Boeing 737 MAX. Other notable gainers included The Walt Disney Co (DIS) and ExxonMobil Corp (XOM), which rose at least 1.3% during the session.

The broad S&P 500 Index edged up 0.2% to 2,879.39. Seven of 11 primary sectors contributed to the rally, with materials shares gaining 0.9%. Energy shares gained 0.8% on average while communication services and discretionary stocks rose 0.7% apiece.

The Nasdaq Composite Index fell 0.1% to 7,891.78, largely due to slumping tech shares.

Dow Inc’s Bullish Value Proposition

It has only been three days since Dow Inc. has traded as an independent chemical company, but investors are flocking to the stock ahead of an anticipated growth phase in the coming year.

“Dow offers a compelling value opportunity,” Goldman Sachs Group Inc. said in a research note, as quoted by Bloomberg . “In addition to a promising cyclical positioning, we believe the transformation from ‘old’… to ‘new’… suggests more shareholder friendly capital allocation and a leaner more focused cost structure.”

Dow is expected to get a significant boost through 2020 thanks to a rebounding plastics business. The stock, which is currently valued at less than $60, has been given a target of $71 by Goldman analyst Robert Koort.

By spinning off from DowDuPont Inc., Dow replaces the former parent company in the DJIA. The spinoff has been in the works ever since Dow Chemical Co. and DuPont Co. agreed to merge back in 2017. The deal all along was to re-divide the parent company into three new companies serving the commodities, agriculture, and specialty products sectors.