Dow Surges 316 Points, Why Apple’s Earnings are Leading the Charge

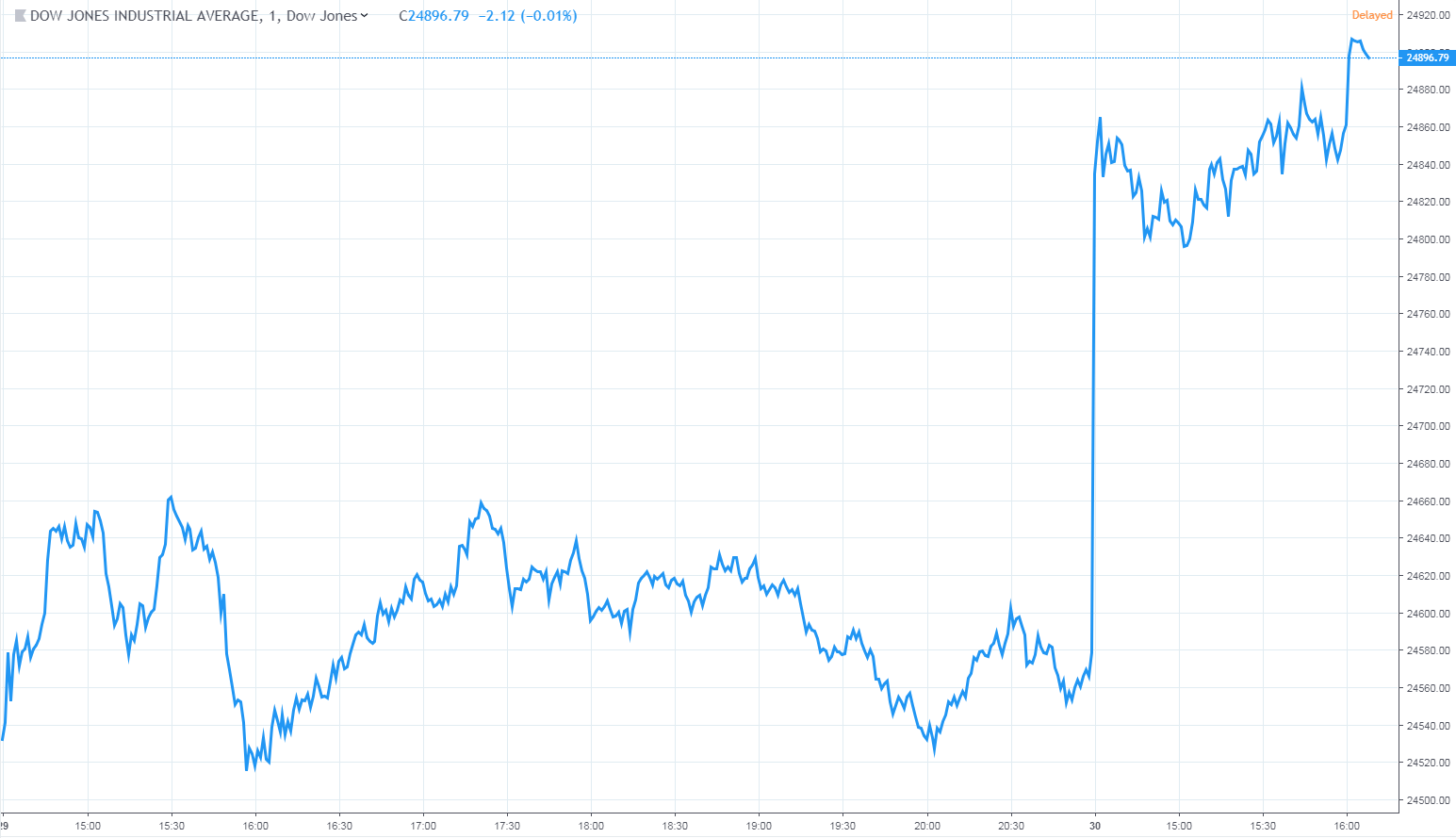

The Dow swung a remarkable 550 points as the stock market bellwether fought off crushing losses to salvage the week's final trading session. | Source: Shutterstock

The U.S. stock market catapulted higher on Wednesday, as investors rallied behind a series of upbeat earnings reports from some of Wall Street’s biggest companies.

Flush of Green for Dow Index

All of Wall Street’s major indexes reported strong gains on Wednesday, building off a positive pre-market session for Dow futures. The Dow Jones Industrial Average is up 316 points, or 1.3%, to 24,896.79.

The broad S&P 500 Index gained 0.8% to 2,660.67. Ten of 11 primary sectors reported gains, with information technology and consumer discretionary leading the advance.

Booming tech shares lifted the Nasdaq Composite Index to higher ground. The tech-driven average climbed 1% to 7,096.27.

A measure of implied volatility known as the CBOE VIX edged lower during the morning session, as calm returned to Wall Street. The so-called “fear index” touched a session low of 18.51 on a scale of 1-100 where 20 represents the historic average.

Doomsayers Were Wrong About Apple

Shares of Apple Inc. (AAPL) surged on Wednesday after the company reported earnings and revenue that were mostly in line with tapered down forecasts.

The Cupertino, California-based company earned $4.18 per share on revenue of $84.3 billion. Both numbers were just ahead of forecasts calling for $4.17 on sales of $83.97 billion. Revenues for the flagship iPhone came just below forecasts, but service sales outpaced expectations.

Apple’s naysayers were planning for the worst after the company lowered its guidance for the December quarter over slowing China sales. This triggered a double-digit plunge in the share price and raised serious red flags about the company’s future in emerging Asia.

Also Read: Apple’s Warning Sinks Wall Street

CNBC’s Jim Kramer commented on the earnings call, which occurred after the closing bell on Tuesday: “The conference call was dysfunctional. They didn’t know what to do,” he said, referring to the analysts that expected a more bearish quarter for the iPhone maker. “Analysts had their tails between their legs. They cut and run.”

Earnings Optimism Builds

Apple wasn’t the only source of earnings optimism on Wednesday. Fellow Dow blue-chip Boeing Co (BA) posted much better than expected profit and revenue results and issued strong guidance for 2019. Strong quarterly results from Advanced Micro Devices (AMD) also boosted investors’ confidence.

S&P 500 companies are on pace for a blended earnings growth rate of 12.2% for the December quarter, according to FactSet . As of Friday, 22% of S&P 500 companies had reported actual results. Among them, 71% posted better than expected earnings and 59% reported positive revenue surprises.

Featured image courtesy of Shutterstock. Chart Via TradingView.