Dow Stuck in No Man’s Land as Trump Scrambles to Strike China Trade Deal

The Dow took nearly 100 points in losses on Wednesday while Donald Trump continues to push a new trade deal with China. | Source: AP Photo / Susan Walsh

The Dow and broader U.S. stock market trended lower on Wednesday, as President Donald Trump set his sights on a comprehensive trade agreement with China. At this stage, a China trade deal is the only thing that can help save the current two-month rally for stocks

Dow Trades Lower; S&P 500 and Nasdaq Follow

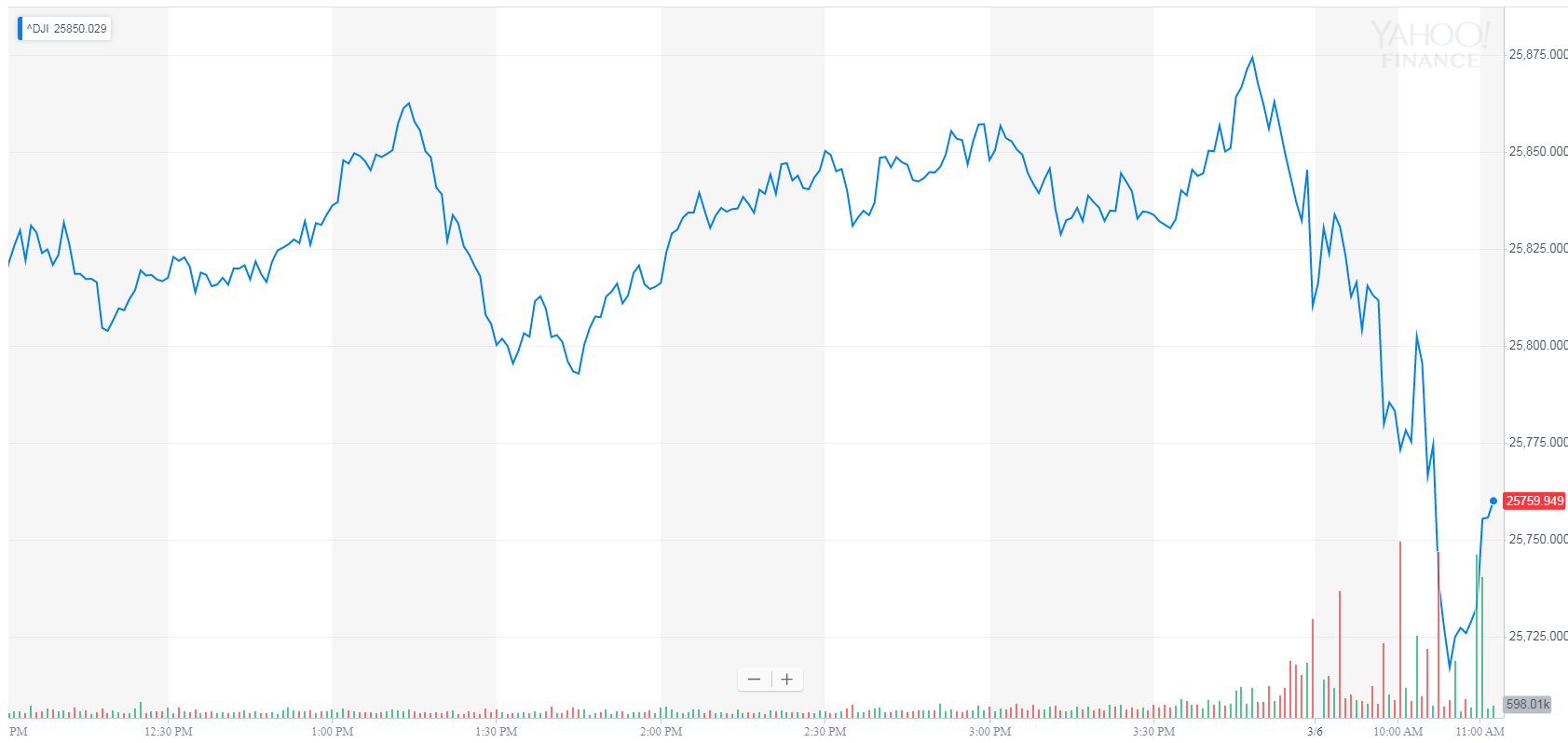

Wall Street’s major indexes opened slightly higher on Wednesday but quickly reversed course, mirroring a choppy trading session for Dow futures. The Dow Jones Industrial Average was down by as much as 100 points before paring losses – only to slip once more. As of 11:41 a.m. ET, it was down 96.13 points, or 0.37%, to 25,710.50.

The broad S&P 500 Index of large-cap stocks declined 0.44% to 2,777.34. Eight of 11 primary sectors headed lower, with energy shares plunging 1.2% on average. Energy stock fell in lockstep with oil prices after the U.S. Energy and Information Administration (EIA) reported a much bigger than expected rise in commercial crude inventories.

Hacked.com has the latest: Oil Prices Slip as U.S. Crude Inventories Surge .

Health stocks were also down more than 1%. Consumer staples fell 0.3% as a category.

The technology-focused Nasdaq Composite Index was also down Wednesday, falling 0.72% to 7,521.77.

A measure of implied volatility known as the CBOE VIX rose 4% to 15.33, still below the historic average but well above the recent five-month low. VIX trades inversely with the S&P 500 Index roughly three-quarters of the time.

Trump Eyes China Trade Deal

China and the United States are in the final stages of a comprehensive trade agreement, The Wall Street Journal reported Sunday. According to the latest conversations, both countries could remove some tariffs imposed last year provided that other conditions are met.

Washington is prepared to remove almost all sanctions against China if Beijing agrees to change its industrial policy, which the Trump administration says gives domestic firms an unfair advantage over their American counterparts.

Intellectual property protection for American businesses is also a major sticking point. U.S. Trade Representative Robert Lighthizer said last week that provisions on intellectual property accounted for nearly a third of the 100-page working document that is guiding trade talks between the two countries.

A comprehensive trade deal would be a home run for the Trump administration, which is hoping to rekindle investor optimism following a disastrous fourth quarter for Wall Street. At this stage, a trade deal is the market’s best shot of returning to record highs. That’s because U.S. corporations will likely face a profit crunch in the first quarter.

Attention now shifts to jobs data, with the Labor Department scheduled to release its February nonfarm payrolls report on Friday. Employers are forecast to have added 178,000 workers last month. Unemployment is also projected to tick lower, likely as a result of workforce dropouts.