Dow, Bitcoin Flash Green as US Stock Market Guns to Extend Winning Streak

The stock market is on the verge of a major recovery. Here's why Wall Street has suddenly turned bullish despite numerous macro threats. | Source: Shutterstock

Both the Dow and the bitcoin price flashed green on Friday, as the US stock market fought to extend its two-month winning streak and crypto traders mulled whether a 14-month downturn has finally come to a close.

Dow Futures Mount Triple-Digit Recovery

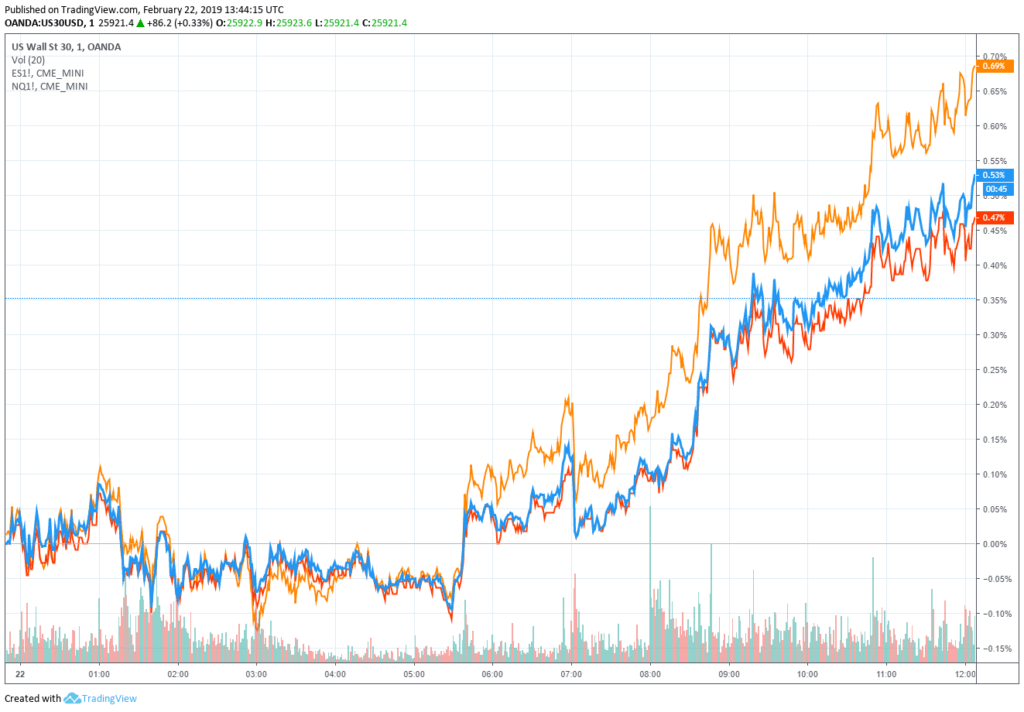

As of 8:45 am ET, Dow Jones Industrial Average Futures had gained 105 points or 0.41 percent, implying a 97.37 point jump at the opening bell. S&P 500 futures rose 0.34 percent, and Nasdaq futures climbed 0.42 percent during the bullish pre-market session.

On Thursday, the US stock market endured moderate losses, with the Dow falling 103.81 points or 0.4 percent to close at 25,850.63, the S&P 500 losing 0.35 percent to close at 2,744.88, and the Nasdaq ending the day at 7,459.71 following a 0.39 percent decline.

But while the Dow ultimately ended the trading session more than 100 points in the red, it did mount a noticeable recovery in the hour before the closing bell, and that rally has carried over into Friday’s pre-market session.

The Dow is currently riding an eight-week winning streak, its longest in nearly two years. Having closed at 25,883.25 on Feb. 15, the index should enter the day comfortably above that mark. If the stock market can hold its pre-bell gains, the Dow will extend its weekly winning streak to nine.

That said, the Dow is also testing the 26,000 mark, which seems to have provided the market with psychological resistance. A bounce off 26,000 could thrust the index back below last Friday’s close.

Stock Market Counts on Trump Extending Trade War Deadline

On Friday afternoon, US President Donald Trump will meet with Chinese Vice Premier Liu He , after which he is expected to announce an extension to the March 1 trade deal deadline. That announcement would likely give the stock market a bit of juice before the closing bell.

On the other hand, today’s pre-bell rally could indicate the extension has already been priced in to some extent. If so, the Dow could falter if Trump fails to make a firm decision to postpone the deadline, which would see the US hike tariffs on $200 billion worth of Chinese imports.

‘Avalanche’ of Fed Speeches to Drop on Friday

Further bolstering the Dow as it seeks to extend its winning streak is what ZeroHedge has termed an “avalanche of Fed speakers,” with eight different Federal Reserve officials (including five FOMC voters) scheduled to take the stage, and – in the cynical words of the pseudonymous Tyler Durden – “sprea[d] the dovish gospel among BTFD algos everywhere.”

There was a time not so long ago when this would have been bearish for stocks; however, the Fed’s dovish tilt has buoyed the market over the past several months, and there’s no reason to expect today will turn out any different.

$4,000 Mark Remains in Bitcoin’s Crosshairs

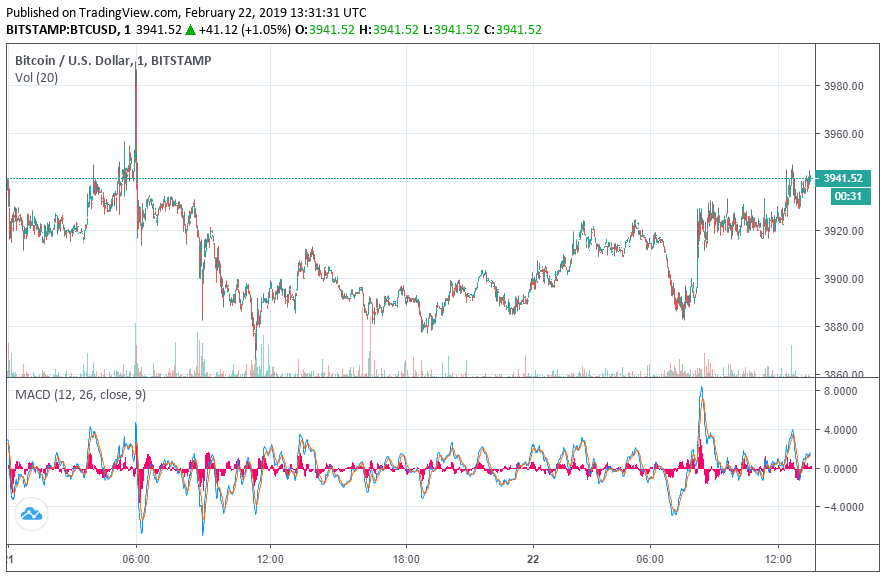

The cryptocurrency market remains relatively quiet heading into Friday’s US trading session, with most large-cap assets recovering from an intraday dip to post minor day-over-day increases.

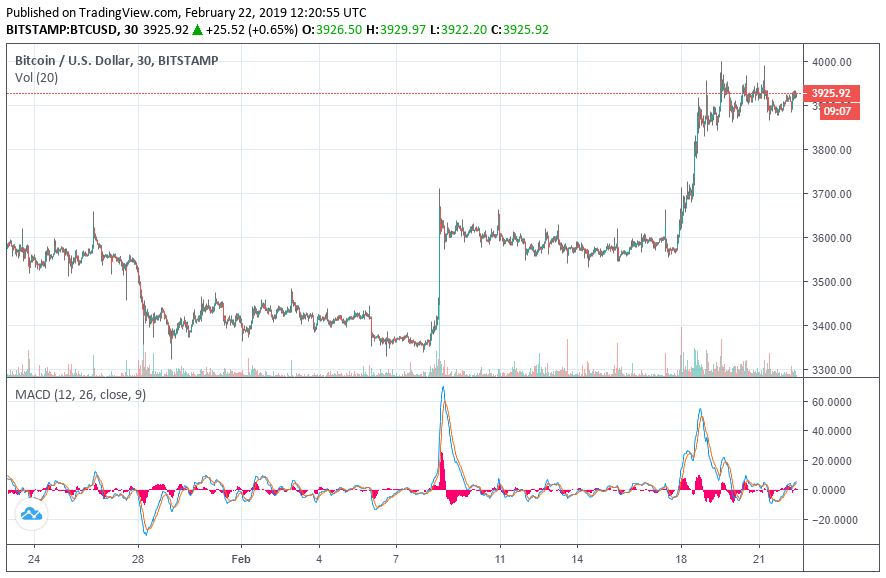

The bitcoin price made a brief run toward $4,000 on Feb. 21 when a single five-minute candle saw launched the asset as high as $3,990. However, the rally stalled, and bitcoin ultimately declined as far as $3,866 over the next several hours before mounting a comeback. Overall, the crypto market has been quiet this week while bitcoin continues to consolidate in the $3,900s.

Throughout 2018, periods of relative quiet frequently preceded major sell-offs. However, there were nine days between bitcoin’s jump above $3,500 on Feb. 8 and its surge toward $4,000 which began on Feb. 17. Consequently, it could be several days before the market makes another strong push.

For now, trading volume seems to be in decline, with 24-hour cumulative trading volume down to $23.6 billion from an early-week peak of $36 billion. Nevertheless, volume remains considerably higher than it was just one month ago when the market saw roughly $15 billion in daily turnover.

Why Ethereum is Quietly Driving the Crypto Market Higher

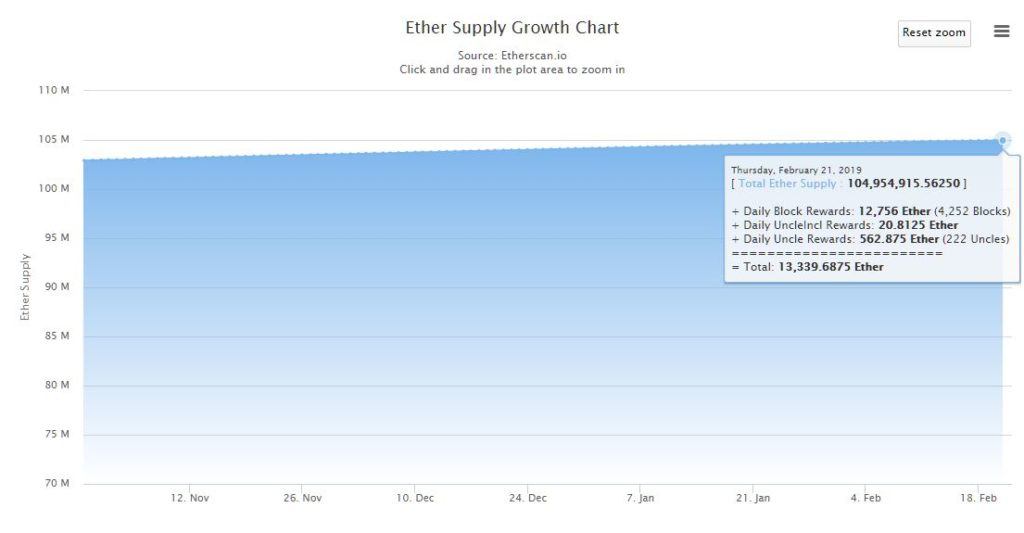

As CCN.com reported, eToro Senior Market Analyst Mati Greenspan has connected the recent crypto market rally to ethereum’s declining supply issuance rate, which has now reached historical lows following the detonation of the network’s difficulty bomb.

Speaking with CCN.com, Greenspan explained that reduced supply coupled with steady demand caused the ethereum price to spike and that this spike rippled throughout the wider crypto market – even though bitcoin and other cryptocurrencies did not face the same supply constraints as ethereum.

Assuming that’s what happened, it looks like traders are searching for an excuse to send the market higher. On the other hand, it could be a stark indication of how retail-driven the cryptocurrency landscape remains, more than a year after the bubble’s collapse.

The activation of the Constantinople hard fork will reduce ethereum’s inflation rate even further, from a present 13,000 ETH per day to around 11,400. However, that doesn’t necessarily mean that the fork will trigger another market jump.

Writing in daily market commentary on Friday, Greenspan said:

“Now, another part of Constantinople is that it’s supposed to reduce the amount of gas needed per transaction. However, it’s not apparent how the new gas fee structure will affect demand.”

“So even though we know supply will be reduced drastically, we don’t know if this will affect bottom line inflation because we don’t know exactly what demand will look like under the new system.”

Bitcoin Price ‘Might Just’ Have Enough Juice to Turn Bullish

So where does the market go from here? $5,000 remains the clear target, and Greenspan says bitcoin’s latest advance “might just be enough” to get it there.

“As far as the rest of the crypto market, this recent rally certainly has the big fish nibbling. We’ve been in the accumulation zone for a while now and this latest push off the floor might just be enough to bring the market out of a slump, but there are several technical levels that need to be broken before that happens.”

Featured Image from Shutterstock. Price Charts from TradingView .