Did Bitcoin Cash Fail? 500 Days Since the Fork, it Looks Like it Did

Nearly 17 months after the contentious fork that gave birth to Bitcoin Cash, it may be safe to say that the entire purpose of the fork may have been defeated, rendering Bitcoin Cash as little more than just another altcoin. An examination of the available 500+ days worth of data on the bitcoin cash blockchain shows that despite the impassioned arguments and big promises made about its 8 MB block size, it has never come close to filling out this capacity.

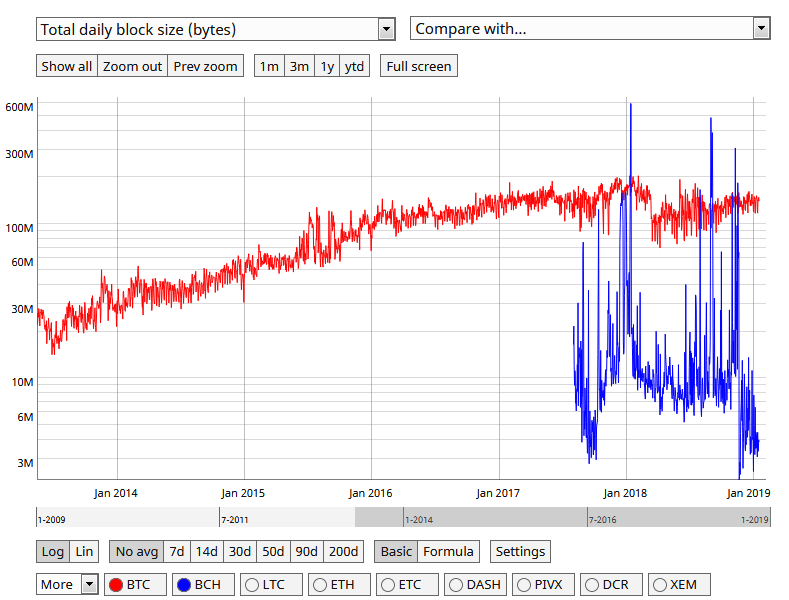

Data from Coinmetrics shows that Bitcoin Cash still remains far behind Bitcoin not only in proportional terms but also in absolute terms as both miners and consumers have overwhelmingly chosen to remain with Bitcoin. Notwithstanding a couple of brief spikes, the market has delivered its verdict over the course of 17 months.

Bitcoin Remains King

It would seem that the Bitcoin Cash fork which took place in the midst of a polarising argument about whether or not to maintain bitcoin’s 1 MB block size has turned out to be an exercise in futility. While the major idea behind Bitcoin Cash (BCH) was purportedly to provide a faster and easier way for transactions to be made using a larger block size as a solution, the market has spoken in the intervening year and a half, and what it has to say is not good news for Bitcoin Cash.

The data shows that far from filling out or even getting anywhere close to its 8 MB block size, BCH has averaged a block size of merely 171 KB since the August 2017 fork. Bitcoin, by comparison, has averaged about 934 KB of its 1 MB block capacity over the past month. In other words, BCH is utilizing just about 2.1 percent of its block capacity and is only averaging about 18 percent of Bitcoin’s block size despite having forked with the express intention of building bigger blocks. Despite any protestations to the contrary, this clearly shows that there is a significant lack of interest in Bitcoin Cash, as has been the case with Bitcoin forks in general.

So far, there has only been a single day on record that has seen BCH block size utilization rise about 50 percent. This took place on January 9, 2018, when BCH block sizes briefly hit 59 percent of the 8 MB capacity before rapidly reverting to mean. Even more tellingly from a market point of view, bitcoin cash has hardly fared any better in terms of investment, managing only about 3.6 percent of the market cap of its ancestor.