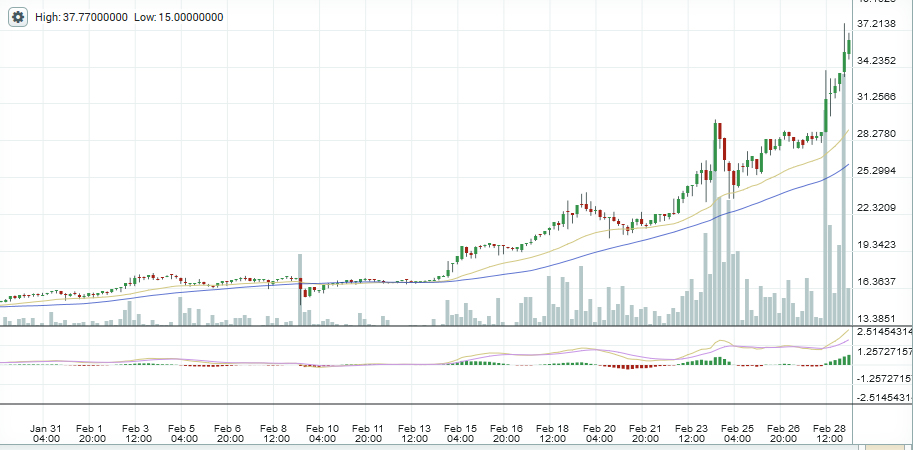

Dash Puzzlingly Skyrockets 450% in 2 Months

Dash has suddenly risen to the third position in digital currency ranking, increasing from around $8 to a stratospheric $37 in two months. It’s market cap now stands just above a quarter of a billion dollars, but is still far away from Ethereum, which has also risen to a total value of $1.4 billion.

The stratospheric rise appears to coincide with the release of a new software upgrade which, on the surface, seems to offer no significant new innovation. Why, therefore, has this currency suddenly risen so quickly and so high?

One cynical reason might be marketing. The digital currency is somewhat unique as it allocates around 10% of its monthly block rewards towards funding projects. One of them is Amanda B Johnson, the former presenter of The Daily Decrypt, who rebranded to “Dash Detailed” after being funded by the Dash network. Another one is Dashforce, which has received around $7,000 to promote the currency on social media.

The Dash network has also given the green light to fund integration with BlockCypher, a hot-wallet service, at a cost of nearly $100,000. Ryan Taylor, Director of Finance for Dash, has further asked the network to “cover the costs of integrating Dash into a major cryptocurrency exchange” in the sum of almost $80,000.

BlockPay and the General Bytes ATM recently integrated Dash, but it is not clear whether either received any payment.

The Curious Story of Dash

Evan Duffield, the founder of what now is known as Dash, sent an e-mail to the bitcoin mailing list on December the 29th 2013, advertising a position for “1 or 2 really good C++ programmer… to help with a for-profit startup.”

As you read the e-mail , you’ll notice some grammatical mistakes, such as “the work you’re done.” It’s not an exception. Such mistakes appear to be far too common and, overall, his writing is awkward at best. For example, in a post explaining the shambolic manner of Dash’s inception, Duffield uses such words as “I’ve have [sic] a rewarding career.”

Dash began on the 19th of January 2014, just weeks after that e-mail. Then, it was called XCoin. Almost two million of them were mined in just 48 hours after a launch that did not even include a windows client. Now, more than three years later, just over seven million coins have been mined in total. Explaining the event, Duffield pleads ignorance :

“We launched later and immediately got stuck on block 42, I was new to the Bitcoin codebase and wasn’t sure what I missed so I announced we’d relaunch later.

When we relaunched we had a rush of miners join causing a huge spike of coin production without it being able to adjust the difficulty quick enough, we just ended up spilling out coins. Retargeting happened every 576 blocks and could only increase the difficulty by four times, so it took about six retargets to get to a difficulty that was near 2.5 minutes per block.

Later on, after the difficulty evened out we realized that there was a serious problem with the block reward calculation… I soon fixed this issue at block 4500, but none of us realized the amount of coins that had been issued at the time. At that point we didn’t even have a block explorer yet.”

As we all know, block explorers work by magic (they don’t), but even assuming he is not aware of how to run node commands and even taking him fully on his words, he appears to admit incompetence. Which is probably why he rebranded to Darkcoin.

As some of you may remember, DRK was constantly hyped in all corners, with the currency rising to new heights in 2014, to then come crashing down following a breakdown in network consensus. Duffield stated back then:

“Since launching masternode payments the network has kept randomly forking. We’re not exactly sure what is the cause, but to stop this and restore stability we are going to fork to remove masternode payments.”

It’s not clear whether he ever found the cause, but this led to the currency being largely dismissed as its so called anonymous payments were not really that anonymous and its masternodes layer had problems. It kept dwindling in market cap with most forgetting about it, until recently.

Who Needs Innovation?

The currency rebranded again from Darkcoin to Dash, presumably because the former had too much baggage and the later could perhaps swipe it under the carpet. It boasts two main features. Instapayments and a governance layer, with anonymity – which was taunted front and center in 2014 – now seemingly very much in the background.

On instapayments, the currency appears to mainly apply bitcoin’s first seen mechanism which used to work perfectly well until recently. That is, a transaction first seen by a node is highly likely to be confirmed as it propagates exponentially. A delay of even miliseconds is sufficient for the first transaction to be successful. This can be gamed, but in practice, it worked perfectly well for bitcoin until full blocks.

Dash’s governance model is interesting, but not binding. Masternodes – which are actually limited peer nodes despite the name’s implication – act as mixers and vote.

On voting, there are two aspects. Firstly, they vote to fund projects with 10% of monthly reward, which, if approved, is automatically sent to the proposer’s address. That is interesting on the surface, but what happens once the funds are approved? No one can sue the proposer for not delivering or for being incompetent, therefore, why should they deliver or do so competently?

Moreover, these funds are paid by all token holders, yet only a small part of them are able to afford the $30,000 required for a masternode, and thus have a vote.

Currently, their votes are mostly approving proposals by Taylor and Duffield who receive some 88% of the funds . Those funds, together with the almost 2 million dash mined in the first 48 hours, can be used to run a masternode and thus “vote,” since the system is in no way Sybil resistant.

Moreover, although masternodes barely provide any security, with their main service being a Coinjoin-like mixer, they nonetheless receive 45% of each block, paid by the coin holders. That translates to almost $40,000 a day.

Considering that actual miners, who secure the network, have to pay for hardware and electricity, logically, it doesn’t make sense to pay some mixers $40,000 a day, but, looked from a different perspective, it is a fairly smart design if you have a lot of coins.

The second function of these masternodes – to vote on protocol proposals – is fairly redundant. Duffield put forward a suggestion to increase the blocksize from 1MB to 2MB, even though their blocks are usually just ten transactions or less.

It was approved within 48 hours – a fairly amazing feat if these nodes are individuals. However, although Duffield is a Dash core developer, he hasn’t actually put forward a bigger block client for approval by miners whose vote actually matters.

In other words, there is no way of enforcing votes by masternodes since they hardly perform any other real function but to act as mixers – a service which is available for free rather than at a cost of $40,000 per day.

The Vacant Third Place

That means Dash will probably go back where it came from since it offers little, if anything, interesting. There is hardly any real innovation and the way it was launched can’t just be dismissed. Nor the potential, if not likelihood, that much of those almost two million coins might be running the vast majority of masternodes.

The third place, therefore, remains vacant. There is space for it, but so far, no currency fits the bill. Zec comes close, but bitcoin fills that niche fairly well. Moreover, ethereum plans to add much of Zec’s anonymity offers. Monero is a contender, but again it’s a niche already served.

You could say that due to bitcoin’s high fees and transaction backlogs, a bitcoin clone with some minor improvements might take the third place, but a more rational bet in those circumstances would be to go with the second biggest currency due to network effects and use eth which has retained the second place for quite some time.

The third place needs to be something innovative, something new, with a competent development team that radiates professionalism and thoroughness. Something substantial and different from bitcoin or Ethereum.

Perhaps a token, who know. It’ll be obvious when we see it. For now, personally, I don’t think it’s here and, in my view, it’s certainly not Dash.

Image from Shutterstock.