This Dark Horse Exchange Reports Absurd 90% of PAX/USDT Trading

Transaction mining? Fake volumes? One crypto exchange is showing an insane volume of traded PAX?USDT. | Source: Shutterstock

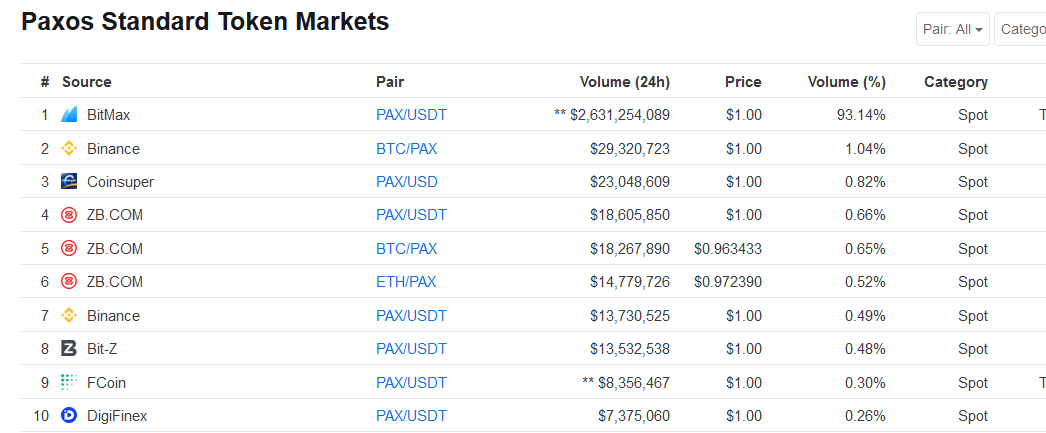

By CCN.com: Although its volume is excluded, BitMAX reported over $2.5 billion in trades between Paxos Standard and USDT in the 24 hours at the time of writing.

One Exchange Reports over 10x Market Cap Traded

This is an absurd amount of money changing hands, with some entering USDT and others leaving it.

By comparison, Binance’s BTC/PAX market was around $29 million. Most markets were far less than this. As a whole, Paxos Standard reports a market capitalization of $166 million.

Therefore the tokens on the exchange would have had to change hands numerous times. Likely, BitMAX engages in transaction mining , and people are wash trading to earn rewards. As we said, the volume is excluded from the actual reported volume of Paxos Standard.

It still shows on the markets page, however, and it’s remarkable.

If it were even 20% true, it would still be the largest market for Paxos Standard at this point. Other exchanges that see a lot of PAX volume are Binance, ZB, and OKEx.

New Users Won’t Know a World Without Stablecoins

Several of the exchanges where Paxos Standard is popular are newer.

One thing to consider is that people coming in the next wave of crypto traders will have access to a variety of stablecoins, wherever they are.

If they choose to trade on Binance, for example, they’ll have access to a wide variety of stablecoins. They can even soon trade in a GBP stablecoin issued by Binance themselves.

The volume of some exchanges is questionable due to various practices, including transaction mining. Transaction mining encourages users to make as many trades as possible in return for rewards.

This increases the volume, but several information outlets no longer include volume from these exchanges. It might as well be considered fake volume.

Fake Crypto Volume Still a Key Concern

If we consider the more than $2 billion in Paxos Standard that changed hands, with a market that only contains $165 million or so in assets, we can see the effect of transaction mining.

Therefore, it makes sense to exclude the results from individual exchanges, at least on the face of things.

But overall, in some cases, at least, people are taking risks, even if they’re “wash trading.” Many markets don’t have the liquid leverage to walk in and out without paying a premium or taking a loss.

Newer users are likely to take a bath in this regard. Earning rewards may or may not make up for small losses of this kind, but it’s something to consider when looking at the whole transaction mining scheme.

The validity of exchange data is part of the problem holding crypto back from things like an exchange-traded fund.

Regulatory bodies are reluctant to issue a license for an industry which has so many people making false claims. The routine lawsuits and high drama don’t help things much.

It’s an inconvenient truth for traditional financiers that exposure to crypto is going to be a pain for a while.

Bitcoin is a repellent for regulators. It doesn’t much care what they think. It has to perform its function, and that’s all. Wherever you stand, if you want greater exposure, you’re going to need some education. Traditional traders who were hoping for easy and maximum access to crypto will have to settle for the current scenarios.