Danish Tax Authority Cracks Down on ‘Crypto Tax Avoiders’

Given the complex nature of reporting gains, Danish crypto traders are most worried about overpaying on their taxes. | Credit: Quatrox Production/Shutterstock.com

Danish regulators are targeting crypto traders in a tax avoider crackdown. Skattestyrelsen, or Skat, Denmark’s tax agency, has issued warning letters to “20,000 cryptocurrency tax avoiders,” according to European crypto tracking and tax reporting startup Koinly . The move comes months after regulators were sniffing around at a trio of local exchanges for information on crypto investors, placing trading activity from the years 2016-2018 in their sights. Koinly Founder Robin Singh told CCN.com:

The letters are not exactly a shock as the Danish tax authorities had received info on the crypto traders back in August so people were kind of expecting something to happen. At this stage Skattestyrelsen isn’t treating them as serious offenders as cryptocurrencies are new and they don’t want to start fining people right away. However, recipients have been asked to present a number of documents from all exchanges that they traded on along with bank statements from any regular bank accounts that they own – failure to do so will lead to fines or even prosecution.

While the writing may have been on the wall, it doesn’t mean the letters haven’t triggered a certain amount of anxiety among crypto traders. This is especially true considering the complexity surrounding the reporting of capital gains in the tiny Scandinavian country. Singh went on to explain:

We have been getting a lot of queries from Danish crypto investors and [the] biggest fear for them is getting overtaxed as they are not able to accurately determine their capital gains manually. This is something that we are helping them with.

Recipients of the letter have until mid-December to respond or else. And according to Koinly in a blog post, the regulatory spotlight on potential crypto investor tax evaders is only going to intensify.

U.S. Crypto Tax Ambiguity

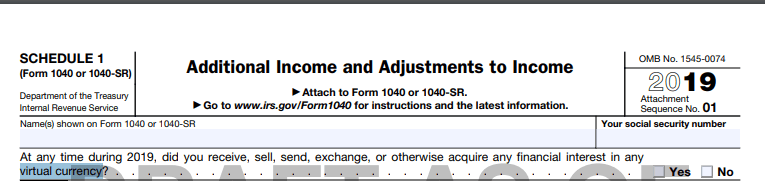

Most recently, the U.S. Internal Revenue Service (IRS) has added a field in its 2019 Schedule 1 document for “virtual currency” holdings:

Notice the lack of the clarity in the document? Crypto investors move funds from one wallet to another frequently, and there’s no distinction about whether this type of activity qualifies as sending virtual currencies.

Danish regulators must have taken a page out of the IRS’ book. Earlier this year, U.S. regulators similarly sent out letters to thousands of crypto investors, targeting those who didn’t report or pay taxes on crypto-fueled gains. While the letters were framed as educational material , the recipients reportedly interpreted them more like a threat .