Cryptocurrency Hedge Funds Lose Their Luster in the Bear Market

The prolonged cryptocurrency market downturn is beginning to manifest in the once white-hot cryptocurrency hedge fund industry.

It seems like only yesterday that these funds — targeted at accredited and institutional investors and devoted exclusively to cryptoassets — were the taking the investment world by storm.

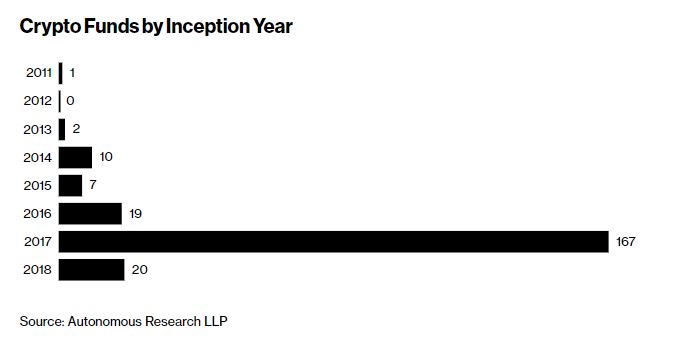

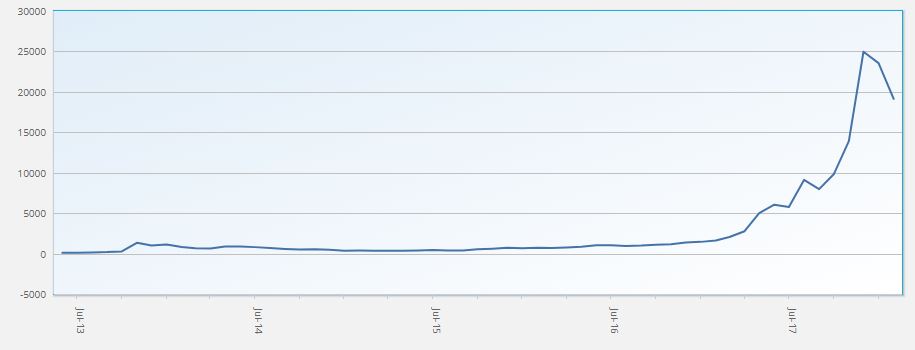

Mesmerized by stories of 25,000 percent single year-returns , traders quit well-paying jobs in finance en masse to seek their fortune in cryptoassets. More than 165 cryptocurrency hedge funds opened in 2017 alone, up from 19 the year prior.

However, new cryptocurrency hedge fund launches have slowed to a crawl in 2018. According to Bloomberg , just 20 funds launched during the first quarter, while nine others have closed amid the downturn — which has seen these funds decline by an average of 23 percent so far this year.

The climate is not just affecting smaller funds. Well-known funds report difficulty attracting new investors, as well as convincing current ones to enlarge their positions.

“New capital has slowed, even for a higher-profile fund like ours,” Kyle Samani, co-founder of Austin, Texas-based Multicoin Capital, told the publication.

Cryptocurrency hedge funds made astronomical returns across the board last year, perhaps making it difficult for investors to evaluate funds. Prospective investors are likely approaching these funds with much more skepticism.

Hedge funds also generally charge large management fees. Investors may be willing to overlook these fees in a booming market, but few find paying a three percent management fee palatable when the fund itself is down more than 20 percent for the year.

However, there’s at least one other factor at play. The US Securities and Exchange Commission (SEC) — along with securities regulators in other countries — have begun targeted investigations into initial coin offerings (ICOs), one of the primary types of assets these funds hold.

The SEC’s ICO probe recently expanded to include cryptocurrency hedge funds as well, perhaps making fund managers hesitant to launch funds until the regulators provide more clarity.

Nevertheless, while fickle investors and fund managers are mulling heading for the exit, some bulls are doubling down in preparation for the next rally. Morgan Creek Capital Management, for instance, is reportedly seeking to raise $500 million for what would likely be the industry’s largest cryptocurrency hedge fund.

Featured image from Shutterstock.