Cryptocurrency Traders Skittish Ahead of US Congressional Hearing

Traders don’t like uncertainty, and there’s more than a dose of that going around in the cryptocurrency markets currently. Not helping, the crypto community is bracing for a Congressional meeting of the minds today on Capitol Hill with lawmakers and regulators on the topic of cryptocurrency trading.

The chiefs of both the Securities and Exchange Commission and the Commodity Futures Trading Commission, Jay Clayton and J. Christopher Giancarlo, respectively, were readying their testimony before lawmakers. Based on an early glimpse of their prepared remarks, the regulators are expected to testify that the cryptocurrency markets are in need of more stringent federal oversight versus the patchwork state-based rules that currently exist. Chief among the concerns are investor protection issues surrounding bitcoin and altcoins.

The call for greater regulatory oversight is adding fuel to a fire that has already been flamed by a clampdown on crypto trading in other countries, such as China, India and South Korea, all of which has been exacerbated by the ban that top US banks placed on bitcoin purchases via credit cards in recent days.

Regulators Request Greater Authority

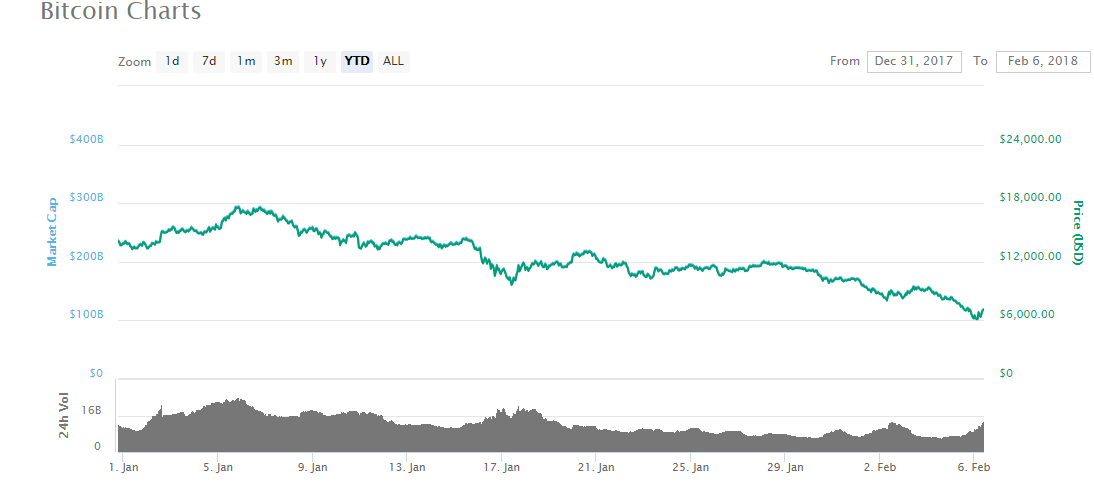

Based on his prepared remarks, the CFTC’s Giancarlo is expected to say that while there’s no shortage of opinion on bitcoin, much of it boils down to perspective. He compares the market cap of bitcoin, which has shrunk in recent sessions to less than that of McDonald’s $132 billion, not to mention the total size of the gold market at some $8 trillion. Nonetheless, the attention on “virtual currencies far outweighs “its size and magnitude in today’s global economy.”

Despite its relative size, the current regulatory framework can’t contain cryptocurrency trading, as per Clayton, who is expected to say:

“The currently applicable regulatory framework for cryptocurrency trading was not designed with trading of the type we are witnessing in mind.”

Till now, and with the exception of fraudulent activity that’s been uncovered, Congress has been largely mum on cryptocurrencies, leaving regulators to do their jobs. But the SEC and CFTC have their hands tied when it comes to protecting investors from illegal cryptocurrency activity based on the current laws, they suggest. New legislation would likely have to be crafted in order for the scope of regulators’ jurisdiction on virtual currencies to be expanded.

Meanwhile, the ability of exchanges such as Chicago’s CME and CBOE to launch new products such as bitcoin futures without the CFTC’s interference is now being questioned for “novel” assets like bitcoin, which could lead to more hand-holding and data sharing between the exchanges and regulators.

An already jittery bitcoin bunch are closely monitoring the response on Capitol Hill to Clayton’s and Giancarlo’s testimony, both of whom have already admitted to being “disturbed” about the current state of the market.

Featured image from Shutterstock.