Crypto Markets Flying: Litecoin up 30%, Bitcoin Surges 8%, Ethereum 12%, What’s Pushing it?

Led by Bitcoin, the cryptocurrency market is flying high. | Source: Shutterstock

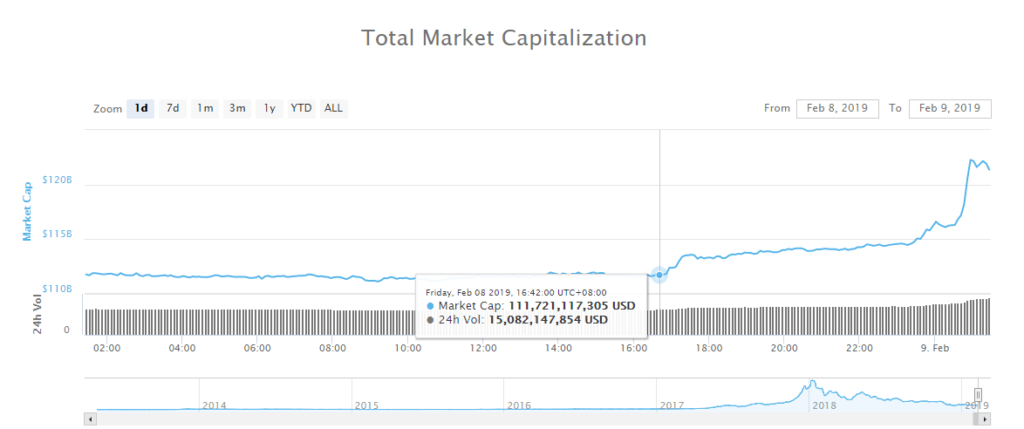

The crypto market has added more than $10 billion in the past several hours as all major crypto assets including Bitcoin, Litecoin, and Ethereum jumped by massive margins.

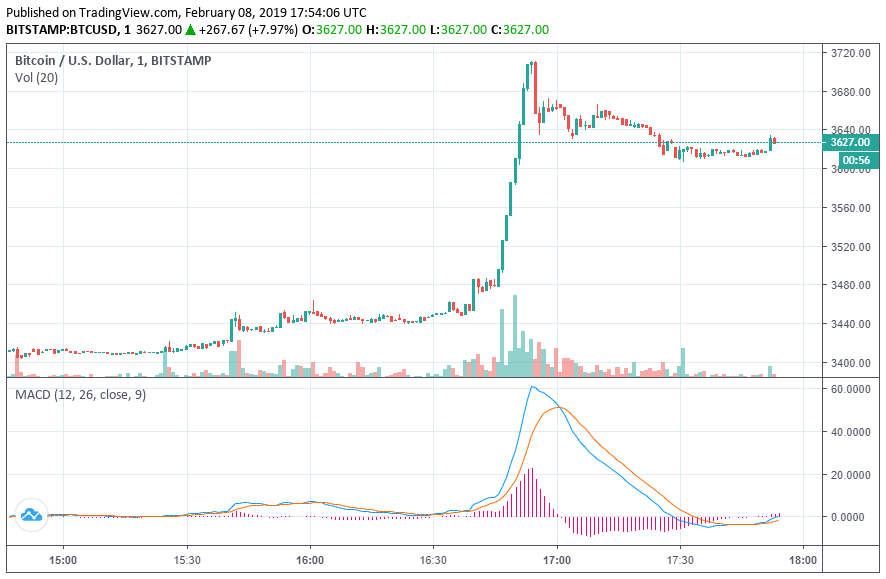

Bitcoin, which struggled to demonstrate any major movement in the past two weeks, surged by well over 8 percent, recovering to the high $3,000 region.

Litecoin, which CCN.com reported rose 10 percent overnight, increased by an additional 20 percent, adding more than half a billion dollars to its valuation.

What’s Causing the Corrective Rally?

On February 8, following a long period of stability and a lack of volatility in a tight price range, traders said that they foresee a strong corrective rally playing out.

Some traders such as DonAlt publicly disclosed the filing of long contracts on Bitcoin and Ethereum, expecting the value of the dominant cryptocurrency to jump higher.

Luke Martin, a cryptocurrency technical analyst, said prior to the 8 percent rise of BTC that a breakout above the $3,480 resistance level could allow the asset to recover beyond key resistance levels.

“Small 1% jump on $BTC causing most majors to move 3-10%. We are still inside the boring, tight, low volume, consolidating range of the past 7 days. Crossing above previous support at 3430 or breakout of 3480 would be exciting + probably lead to bigger jumps on alternative cryptocurrencies,” Martin said.

Following the short-term surge in the price of BTC, DonAlt, a cryptocurrency trader, added that the convincing rebound above the mid-$3,000 level could lead the asset to test $4,000 in the days to come.

The trader said:

“Okay, let’s calm down the euphoria for a second. We just hit the top of the trading range – time to take profits & derisk on both ETH and BTC. That said the violence with which this happened makes me think $4,000 is coming.”

As it is with most cryptocurrency downturns and upward movements, crypto assets are more influenced by technical factors rather than fundamental ones. It is possible that buy walls below the $3,300 mark for Bitcoin and other key levels like $100 on Ethereum pushed the market to recover speedily.

However, Alex Krüger, an economist and a cryptocurrency analyst, said that the support of the approval of a Bitcoin exchange-traded fund (ETF) by a U.S. Securities and Exchange Commission (SEC) commissioner Robert Jackson could be considered as one of the fundamental factors that fueled the recent momentum of the market.

“On the fundamentals side, SEC commissioner [Robert] Jackson hinting towards eventual support for a Bitcoin ETF is big. On the technicals side, once BTC moved above $3450, it turned into a classic squeeze. Zooming into an intraday chart allows to observe the latter,” the analyst said.

On February 8, SEC commissioner Robert Jackson said that he sees a Bitcoin ETF ultimately being approved in the long run.

In an interview with Roll Call, the commissioner emphasized that if an ETF proposal meets the requirements and the standards established by the SEC, a Bitcoin ETF will eventually be approved.

Is it a False Flag?

Bitcoin is still below $4,000. As positive the corrective rally is, the asset has to test a major resistance level at $4,000 which it has not been able to surpass for weeks.

It remains to be seen whether the market can sustain the current level of momentum. But, based on the magnitude in which most cryptocurrencies rallied, the corrective rally the crypto market demonstrated in the last 6 hours could provide the asset class with short-term strength.

Major crypto assets such as Litecoin, EOS, Ethereum, and Cardano performed particularly well. A strong performance by these assets was expected after suffering a poor few months throughout 2019.

From their all-time highs, most cryptocurrencies remain down by more than 90 percent on average against the U.S. dollar. Still, the short-term corrective rally eased pressure on the market.

Featured Image from Shutterstock. Price Charts from TradingView .