Crypto Invades the Nasdaq as Institutions Warm Up to Bitcoin

Ran NeuNer and CNBC Africa's Crypto Trader show will begin broadcasting from the Nasdaq just as bitcoin enters a bull market and institutions seemingly come off the sidelines. | Source: Shutterstock

By CCN.com: The Nasdaq has shown a growing affinity for bitcoin. That relationship has just gone to the next level with knowledge that CNBC Africa’s Crypto Trader will begin broadcasting from the Nasdaq studio. Ran NeuNer, the host of the show, tweeted that the next season will launch from Times Square on May 9. The Nasdaq studio is in the middle of all the action and could be visible to the tons of people passing by on their way to and from work, not to mention tourists. It thrusts crypto into the heart of Manhattan at a pivotal time for the industry and is sure to turn some heads.

Ran and his show will now have a front-row seat to this evolution as it plays out on global media. With the bitcoin price now poised above $5,700, crypto is about to get its time in the sun.

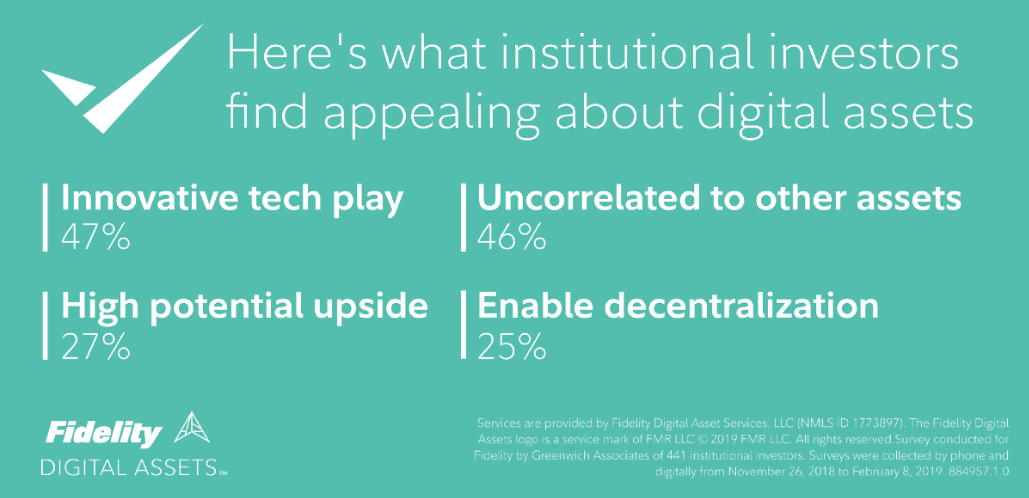

The timing of the move is surely no accident. Bitcoin bulls are back and institutional investors are now beginning to dip their toes into the crypto waters. Fidelity published a survey revealing that institutional investors’ crypto allocations are poised to rise over the next half-decade, which could open the floodgates to mainstream adoption.

Fidelity spoke to hundreds of hedge funds, pension funds, family offices, and more. They found that more than 20% of institutional investors already have “some exposure to digital assets,” allocations that were made since 2016. Nearly half of them “view digital assets as having a place in their investment portfolios.”

Bitcoin Is Becoming Famous

The timing of CNBC’s Crypto Trader arriving in New York also coincides with the recent bitcoin commercial released by Grayscale Investments. The campaign, which is entitled “Drop Gold,” is set on the streets of Manhattan. The ad mocks gold as an onerous investment, instead touting bitcoin as the future for features like security, borderless, and its utility.

Anecdotal evidence also suggests that institutional investments into bitcoin are on the rise. Bakkt, the regulated bitcoin futures exchange owned by NYSE-parent company ICE, will be launching soon. The exchange is headquartered in Atlanta and is expected to be a magnet for institutional capital.

Meanwhile, the Nasdaq is no stranger to crypto. They recently launched a new XRP Liquid Index. Also, a trader on Twitter suggested that the Nasdaq is already supporting bitcoin trading via TD Ameritrade.

https://twitter.com/cryptopolis_x/status/1120352266836426752

In the heart of Manhattan, Ran NeuNer and Crypto Trader will seemingly be sharing a studio with other CNBC shows. This means that traders and big investors who are there to discuss the stock market could also double as guests for Ran’s show. It creates an opportunity for both markets to collaborate and share information and guests, which is something that will help catapult bitcoin into the limelight.