‘Coinbase Effect’ Makes Little-Known Cryptocurrency Go Bananas

A little-known cryptocurrency surged 60% after Coinbase said it was "exploring" listing it on its exchange. | Source: Shutterstock

Coinbase announced the potential addition of several new cryptocurrency assets this week. One of them, Matic Network (MATIC) jumped by over 60% in the 24 hours since the announcement.

Little-Known Cryptocurrency Gains Over 60% With $100 Million Volume

With a volume of nearly $100 million, the Matic price rose from just over 99 satoshis or 1 US cent to nearly $.017. Depending on how much you hold, that seemingly insignificant gain is a big deal – and perhaps a perfect selling opportunity.

Matic is a scaling solution built on the Plasma network.

Officially, it describes itself as:

“Matic Network is a Layer 2 scaling solution that achieves scale by utilizing sidechains for off-chain computation while ensuring asset security using the Plasma framework and a decentralized network of Proof-of-Stake (PoS) validators.”

The token incentivizes validators who live on the Matic Network. Its value apparently derives from demand for Matic network resources. To date, two decentralized applications work on Matic.

By Tuesday afternoon ET, Matic had already lost a chunk of its gains. It’s this arc that people refer to when they say the “Coinbase effect.”

Other cryptocurrency tokens being explored include Decred, Dash, and Algorand. The former two are older, while Algorand began within the last two years. Algorand (ALGO) had lost nearly 3% by Tuesday afternoon. Dash lost over 5%. Decred gained nearly 8%.

What Is the Coinbase Effect?

The Coinbase effect is one to be reckoned with in crypto markets. Coinbase users take great interest in anything the exchange offers – or even thinks about offering.

When Coinbase teased that it was considering listing Ripple (XRP), the price surged toward 50 cents, as CCN.com’s Josiah Wilmoth reported in September 2018.

“Importantly, the announcement seems to indicate that Coinbase — heretofore one of the most exclusive major exchanges — will list a cavalcade of new assets, which the firm identified as one of its customers’ chief requests.”

Nearly a year later, Ripple is listed on Coinbase, but the price has careened down to $0.31.

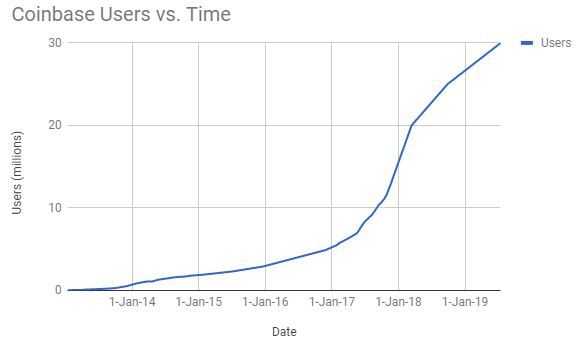

Hard data on the “Coinbase effect” is elusive. We know that the exchange has over 30 million users and acts as one of the most convenient on-ramps for the crypto-economy.

However, it’s unknown exactly what factors might need to be considered and excluded when drawing up the “Coinbase effect” on any chart.

For example, Coinbase may only have a sustained effect when it is the first major exchange to list a given asset.