This Chinese Crypto Mining Guru Predicts the Bitcoin Price Will Surge 20,000%

One Chinese crypto titan said that the Bitcoin price could eclipse 5 million yuan during the next bull run. | Source: Shutterstock

A Chinese crypto mining pool founder predicted that the next bull run would unleash the market’s full potential, enabling the Bitcoin price to ascend to unfathomable heights before the euphoria cools down.

Bitcoin Market Cap To $12 Trillion?

News 8BTC’s Lylian Teng reports :

“Zhu Fa, co-founder of crypto mining pool Poolin, recently made a bullish statement on bitcoin’s price, predicting that bitcoin would surge to new highs at 5 million Chinese yuan (roughly US$740,000).”

“From record high above $17,000 to year lows near $3,000, Bitcoin’s year-long turbulence has not discouraged crypto bulls. The operator of the world’s fourth-largest mining pool with over 11% of global hashrate still goes hyperbolic on bitcoin price forecast despite the current sluggish climate.”

Zhu said:

“Bitcoin price will be in the range of 500,000 yuan – 5,000,000 yuan ($74K-$740K) in the next round of bull run.”

If Bitcoin were to rise so dramatically as Zhu Fa suggests, he’s predicting its future market cap will be USD$12 trillion.

The Flagship Cryptocurrency’s Current All-Time High

Bitcoin’s current price peak occurred on December 17, 2017 when buyers had to fork over 200 Benjamins (USD$20,089) to purchase 1 BTC. At that time, the coin had a market cap of USD$326,141,280,256.

Time Table For His Prediction?

Zhu didn’t give a time frame more specific than “next round of bull run” in his recent comment on another crypto influencer’s remarks on instant messaging platform WeChat.

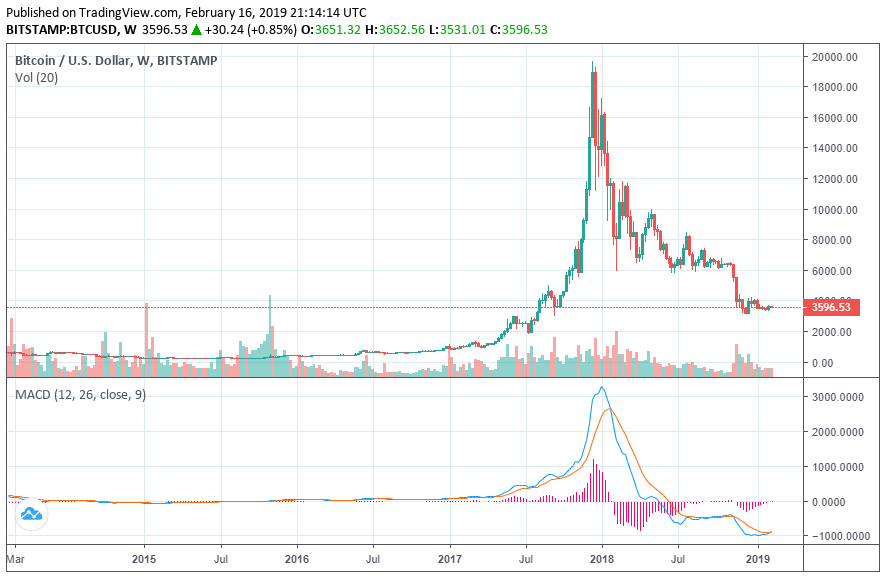

Eyeballing the graph of Bitcoin’s last bull run, the price seems relatively level until the beginning of 2017, and that’s where it “goes parabolic,” rocketing straight up by the end of the year when it peaked at its all-time high.

Winklevoss Twins Predicted $4 Trillion in December

Cameron and Tyler Winklevoss predicted in December that the world’s most highly valued private currency could appreciate against the U.S. Dollar by as much as 4,000% to a total market value of $4 trillion:

“The twins have often compared Bitcoin favorably to gold, forecasting that the digital asset will disrupt the yellow metal, and Cameron Winklevoss said that the recent Bitcoin price decline has not caused him to waver from this optimistic prediction.”

The Brothers Winklevoss were the first verified Bitcoin billionaires. They invested massively in Bitcoin early on when 1 BTC was priced at USD$120, and they are hodling on tight.

Tim Draper: Bitcoin to $250K By 2022, $80 Trillion Market By 2033

In September, American tech billionaire, venture capitalist, and crypto bull Tim Draper stood by his April prediction that Bitcoin would reach $250,000 by 2022, which would put the total market cap of the cryptocurrency comfortably above $4 trillion.

He also predicted that the overall cryptocurrency market cap would be $80 trillion by 2033.

These People Are Just Saying Numbers

It seems to me that people are flashing around big numbers but not saying very much of substance to justify these figures. Of course, it’s tough to put together solid assumptions to make specific predictions, but if they’re going to say the figure, I think they should elaborate some solid ground to make the numbers they’re stating at least meaningful and to be more precise about what they do know and – more importantly – what they don’t.

Featured Image from Shutterstock