Bitcoin’s Transaction Backlogs Are Now Becoming Common

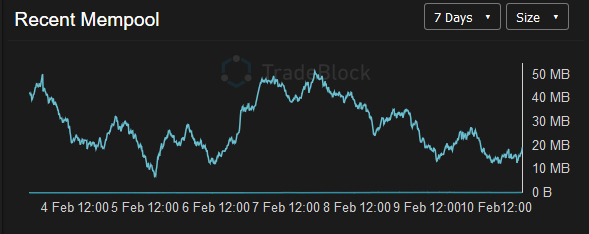

For the first time ever, bitcoin has been running above capacity for more than a week as transaction backlogs are now becoming a common experience with no indication of any solution in the near future.

On the 4th of February 2017, almost $1billion worth of bitcoin was stuck. It gradually went down, but never cleared, with around 300,000 bitcoins waiting to move. Yesterday, that went up again to almost 900,000. The mempool is usually full and the network now runs at around 3-4 txs per second when it can only handle around 2.5.

This complete transformation has had an effect on everyone. In public forums, on social media, at bitcoin businesses, at mining farms, nothing is given more attention for a prolonged period than transaction capacity. Even occasional bitcoin users and traders who never cared about scalability now bring it up everywhere with different individuals periodically complaining about still waiting for a confirmation after many hours.

Some try to help. ViaBTC, a new pool that strongly supports Bitcoin Unlimited – a grassroots client which increases transaction capacity by turning the maxblocksize limit of 1MB into a soft limit – launched a Transaction Accelerator which prioritizes any transaction that has paid more than 0.0001 BTC/KB, up to 100 transactions per hour, but it only solves one bitcoiner’s problem at the expense of another.

That’s because transaction space has now become even worse than a zero-sum game as block variance – one block might not be found in an hour – and difficulty adjustments, means that, sometimes, all transactions are suddenly sent to the back of the queue because newer transactions, with higher fee estimates, take their place.

This isn’t a coincidence. The unspoken plan (publicly implied if not at times expressly stated) is for the current situation to continue so that higher fees reduce demand for on-chain transactions to the point where everyone, but financial institutions, are priced out, thus “solving” the problem.

Bitcoin – The Banks Clearing House?

According to proponents of bitcoin as a settlement, fees should be so high that no one can afford to pay them unless they are extremely wealthy or a bank. Ordinary transactions are “spam.” – they say. Implying that only bank transactions are genuine. Bitcoin’s blockchain is not for everyday purchases, – they argue. Implying that bitcoin’s public blockchain should be reserved only for banks.

They are trying to replicate the current financial system which uses clearing houses – centralized, usually private, for profit, institutions that act as a buyer to every seller and a seller to every buyer. The most known example being the SWIFT network.

Ordinary users cannot access this network – they have to go through a bank (a trusted intermediary). Banks then move their money by first sending it to SWIFT, which confirms its veracity and validity, and once it does so sends it to its destination – usually another bank.

In practice, it is far more complex with clearing houses within clearing houses, but the settlement idea suggests that we should replicate it with bitcoin by using bitbanks – now known as Lightning Network hubs – with its very different trust model. Then, bitbanks, instead of using SWIFT, use bitcoin’s public blockchain purely as a clearing house only.

That public blockchain would have fees that are so high – maybe $400, perhaps $10,000 or even in the hundreds of thousands – that no ordinary user or company would pay.

It has some benefits over the current system because it would increase efficiency compared to centralized, largely non-automated SWIFT, but there would be added direct costs as third-parties are re-introduced and many indirect costs.

Bitbanks would act as gatekeepers, free to censor transactions, deny service, close “accounts,” and – eventually – be fully regulated, require a license, etc. As on-chain fees would be so high – at a world scale probably in the hundreds of thousands – smaller bitbanks would not really be able to compete. A Wikileaks friendly bitbank might not be able to rise, allowing for a successful cut-off of all monetary functions.

This is clearly not a peer to peer system, it’s a bank to bank system. The current bitcoin network allows anyone to send a transaction to anyone in a direct peer to peer fashion without permission from anyone and for any reason. No one can censor it, no one can ask for the creation of an “account,” no one can deny service. No one can withhold this money for any period of time.

But, if the public blockchain remains accessible to all – as is currently the case – running a node might be more expensive if technology does not keep up with demand for transactions.

The Bitcoin Nodes

Each bitcoin node has to store and verify every transaction made on bitcoin’s public blockchain. That would not directly change under bitbanks, but the growth of the blockchain would be slower and, as technology progresses, it may require less direct resources for a full node while requiring added resources for hubs.

Under direct public blockchain access, as technology progresses, node costs might reduce, but not to the same extent as under bitbanks. More likely, they remain around the same or even slightly increase.

The proponents of bitbanks argue we can not have that because of a potential increase in the costs of running a node would lead to their reduction. That implies a decrease in costs would lead to an increase in nodes. A factual question which can, to a great extent (while trying to eliminate external one-off factors), be answered by a scientific study as the bitcoin network has been running for more than eight years.

As such, it is relatively easy to research bandwidth, storage, etc., costs in a four years’ time period (or whenever lightnodes became prominent) and compare it to the number of full nodes, but this hasn’t been done despite almost two years of very public debate.

From observation, the number of publicly reachable nodes has remained somewhat constant – there have been around 5,000 over the past three years. In the meantime, storage and bandwidth has become cheaper, potentially indicating that the number of full nodes is affected more by other factors than just monetary costs, such as inconvenience.

What’s in a Node?

A node is a computer software program that applies a number of rules to validate transactions. It rejects, for example, the attempt of a rouge miner to send you fake bitcoins. It can also provide you information on whether someone is trying to double spend.

If all nodes are applying the same rules, they enforce honesty. On the other hand, if all mining nodes are applying different rules to all non-mining nodes, the latter stop working. We can change the distribution to some or a majority of non-mining/mining nodes, but the main objective analysis remains the same.

That is, nodes, by themselves, have no power where genuine network wide differences of opinions on the applicable rules are concerned. That would be a question for miners in non-dishonest situations. But, nodes do have a say where actual and objective dishonesty is concerned.

This can allow for the formation of some sort of objective conclusion. Where there is a publicly discussed difference of opinion on potential directions, rationally and objectively, as well as according to the whitepaper, it cannot be anyone else but the miners who must be the judges as they are best incentivized and positioned to make the decision.

Where there is no public discussion and the action is secretive, covert or dishonest, then almost all network wide nodes are in agreement, therefore the software both denies the invalid transaction and informs you of it, allowing you to act on a coordinated basis.

Both of the above have exceptions. Non-mining nodes can be turned by human action into mining nodes by splitting off from the network. A full node, even if all of them are in agreement, cannot protect from the double spending of a rogue miner with more than 50% control of the network hashrate.

Beyond rare exceptions, as nodes perform no function where there is a publicly discussed and genuine disagreement, their function of ensuring honesty – whether directly by rejecting invalid transactions or indirectly by providing information when almost all nodes are in agreement – can be provided, to a large extent, by light nodes which connect to full nodes.

Lightnodes require almost no resources, making them the primary choice over full nodes for two main reasons. Firstly, you can’t run a full node on a smartphone. Secondly, running a full node on a laptop makes your computer clunky, heavy, requiring much CPU, slowing down performance, and an overall hassle.

As such, most bitcoin users show no interest in operating a full node as, for an ordinary bitcoiner, there is little to gain by doing so and much inconvenience. It is also unnecessary as far as they individually are concerned because lightnodes provide to a great extent a fully acceptable service.

On the other hand, bitcoin related businesses need to run a node as they deal with so many transactions they require information as soon as possible. This suggests that increasing bitcoin businesses should, in theory, increase the number of nodes, but, since 2013, their numbers appear to have remained somewhat stable with falling businesses replaced by new ones entering the bitcoin market from developing countries .

Corporate Bitcoin?

Proponents of bitbanks argue that if running a node becomes so expensive only a few multinational co-operations can afford it, no one can say whether they are colluding and secretly breaching the rules to, for example, print bitcoins out of thin air. That is, even if all nodes are in agreement, they would not be able to perform their primary function of rejecting objectively dishonest behavior because they could all change their code to dishonest behavior and no one would know.

This argument requires the exercise of imagination in an attempt to predict the future – an impossible task, but let us try. A world where multinationals are running huge servers which only perform the function of acting as a node is a world where almost everyone is transacting in bitcoin. The value of the network would be so many trillions. Every house purchase, every sale, every coffee, would be in bitcoin.

Any business that accept many payments would need to run a bitcoin node. Every university that claims some reputation would need one too so that future developers can gain the required knowledge. Independent businesses which provide node access would rise. Within banks, many developers would be required to man the nodes. Governments would probably consider them as vital infrastructure for the nation’s security.

Even if we do not imagine the other incredible transformations and the clear benefits bitcoin would have provided to so many to reach such scale, a global co-ordination between all countries and businesses, for profit and non-profit, which necessarily would include so many people, appears impossible if the intentions are dishonest. If the intentions are honest, how on earth can we possibly form any opinion considering it would be a global co-ordination, enemy governments agreeing, their citizens too, all businesses, etc.

But, since this is just an imaginative exercise with very limited information and a mountain of unknown unknowns, different scenarios can be portrayed as one pleases. The exercise, therefore, is subjective, speculative, not based on scientific thinking and just a mere opinion with no facts.

To illustrate, if we look back just thirty years ago, we would find ourselves in a time with no cell-phones – let alone smart phones – when computers were nearly as big as houses and, later on, when 640KB was enough for everyone. More concretely, what 80s adult would have even remotely imagined the current discussion?

Bitcoin – The Payment Network

We cannot predict the future. What we do know is that the bitcoin community has in fact reached wide consensus on what affects today and the near future.

Every reasonable and objective bitcoiner agrees that a fourfold increase of transaction capacity is “safe.” Segregated Witnesses, a proposal supported by many Bitcoin Core developers, increases transaction capacity to 4MB in attack scenarios. A Cornell study found that 4MB would largely retain the current number of nodes. Miners have agreed to 8MB.

This is consensus. Therefore, the current stalemate has nothing to do with technology. It is, instead, a needless and very harmful division of bitcoin’s community. Its effect has been to hamper bitcoin’s current function as a payment network. An effect that proponents of the bitbank network will readily admit or willingly imply by calling ordinary transactions “spam”, thus seemingly stating that only bitbank transactions are not spam. Or stating that bitcoin is not for “ordinary transactions,” thus implying its only for the use of banks.

Nonetheless, around 46% of miners do not seem to care. Although bitcoin has now become even slower than cross-border payments within Europe, as well as an experience far more inconvenient than a bank transfer, while at the same time providing no added benefit save for an easily replicated limited number of coins, they do not act.

“This makes me sad. [I] Still remember 2013 when people were excited about using bitcoin as a currency.” – co-founder of the Bitcoin Magazine.

Image from Shutterstock.