Bitcoin Wallet App Abra, Now Available in the U.S. For Remittance

Abra, a non-custodial bitcoin wallet app that allows people to send money for free from their bank accounts, is now available in the U.S. and the Philippines, the Mountain View, Calif.-based company announced on its website . Abra is available on iPhone and Android in the U.S. The company’s goal is to be a global financial inclusion app for the expanding cross-border remittance market.

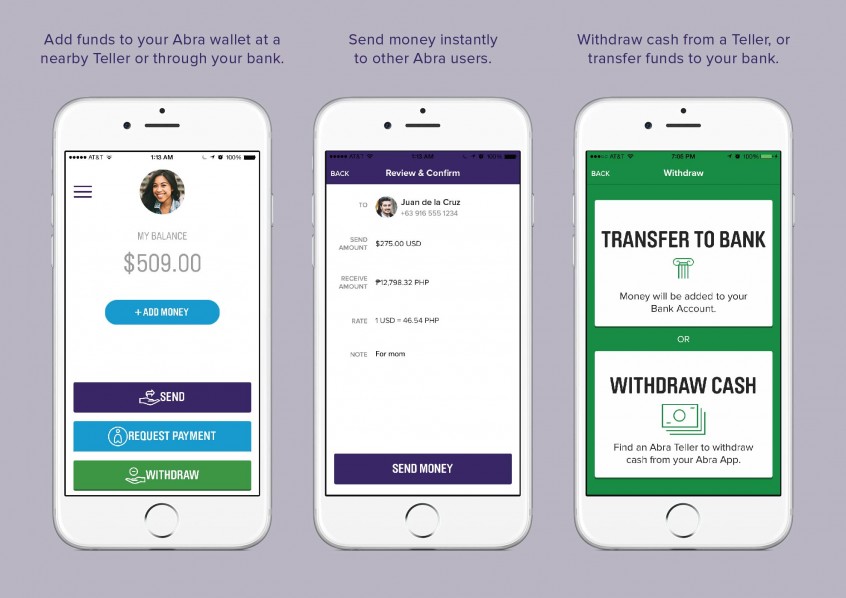

A U.S. user can add cash to their Abra wallet from any major bank account, then send it for free to any phone number in the U.S. or the Philippines via the bitcoin blockchain. Recipients can withdraw the digital cash to their bank account.

Philippines recipients can exchange digital cash for physical cash at “Abra Tellers,” users who have been authorized to exchange digital for physical cash.

How It Works

When sending money from one currency to another, Abra sets the foreign exchange rate. The company claims it offers the best available rates, and the rates are visible to the sender prior to sending.

Abra does not have access to private keys that reference user funds.

Abra Tellers can be digital currency exchanges or retailers that facilitate exchanging funds as licensed money services or private agents of money services where such licensing is required.

A Global Remittance App

Abra’s goal is to allow smartphone users to send money to one another regardless of currency, country or mobile phone operator, similar to what the WhatsApp messaging service does for messaging.

Abra recognizes the need for its service to meet the rising cross-border remittance market. The $500 billion annual remittance market generates $25 billion in fees, most of which moves from the developing world to the developed world.

Abra believes there are also undeveloped niches in the remittance market, such as students who study abroad.

Unlike traditional remittance providers that view the market in “corridors,” Abra visualizes one global network.

Another application for its service is global e-commerce, which analysts peg at above $1 trillion by 2020, despite the fact that most consumers do not have a credit card or bank account.

Further Expansion Planned

Abra plans to add more countries in the next few months. The company has begun its mission by providing service in largely banked countries to establish itself as fast as possible. The banked consumers will have the option of becoming Abra Tellers. The company has preregistered Abra Tellers in more than 75 countries without doing any marketing.

The Abra Teller acts as a human ATM, allowing consumers to receive digital cash from their phone for a fee. Abra Tellers set their own fees.

Featured image from Shutterstock.