Bitcoin up 7% and Ethereum Surges 19%, Good 2019 Start For Crypto

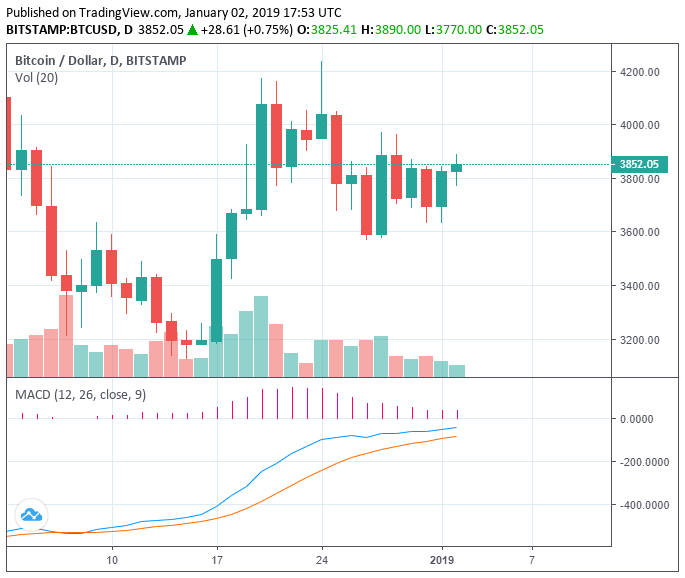

Over the last 48 hours, the Bitcoin price increased from $3,629 to $3,890, by more than seven percent.

The Ethereum price has also surged by 19 percent since January 2 from $143 to $160, recording a substantial increase in value prior to its highly anticipated Constantinople hard fork.

Not a Bad Year For Bitcoin

Bitcoin ended 2018 with an 80 percent drop in its price from its all-time high at $19,500. However, Jameson Lopp, the chief technical officer at Casa and a former BitGo executive, has said based on several metrics, it can be argued that Bitcoin has performed relatively well.

In terms of scalability, the growth of nodes, hash rate, influence in academics, and daily volume, Bitcoin recorded a significant improvement from early 2018. Lopp said:

A couple things are clear: 2018 was the worst year for Bitcoin. Also, 2018 was the best year for Bitcoin. It just depends upon which metrics you’re focused.

The Casa executive noted that despite the fall in the price of Bitcoin, the number of reachable nodes has not fallen by a large margin, suggesting that individuals are using Bitcoin nodes for economic purposes and will not suspend them in the short-term.

With academic interest in Bitcoin growing rapidly and the amount of venture capital investment steadily increasing as well, he said:

Yes, Bitcoin fared poorly in terms of exchange rate in 2018. But by almost any other metric the system is improving and growing. Those of us who are dedicated to this system shall continue to BUIDL and add value; we have no control over the market but I expect that it will catch up to us sooner or later.

In the cryptocurrency market, the value of crypto assets move by cycles, and it is minimally affected by developments in the industry.

As the industry establishes the foundation for the next wave of investors and users in the cryptocurrency ecosystems, analysts believe the price of Bitcoin and other major cryptocurrencies will follow.

Can the Momentum of Crypto Assets be Sustained?

Digital assets in the likes of Ethereum, EOS, and Bitcoin Cash have recorded large gains over the past week, with Ethereum increasing by over 19 percent in a 24-hour span against the U.S. dollar to take over Ripple (XRP).

Ethereum could continue to see an increase in its price over the long run, considering that the Constantinople hard fork is similar to the halvening of Bitcoin’s block reward in the sense that it decreases the potential supply in circulation of ETH throughout the months to come.

But, there still remains questions on whether the recent recovery of crypto assets could result in the end of a bear market for digital assets.

As of January 3, the valuation of the cryptocurrency market remains $90 billion down from November, and it has to increase by 69 percent to recover to November levels.

Until crypto assets reach a valuation of over $300 billion, it is not possible to conclusively state that the bear market of cryptocurrencies has come to an end.

Featured Image from Shutterstock. Price Charts from TradingView .