Bitcoin Surging 19% Only the Beginning, Halving Will Propel to Meteoric Gains

Bitcoin price is due to surge again as halving approaches. | Source: Shutterstock

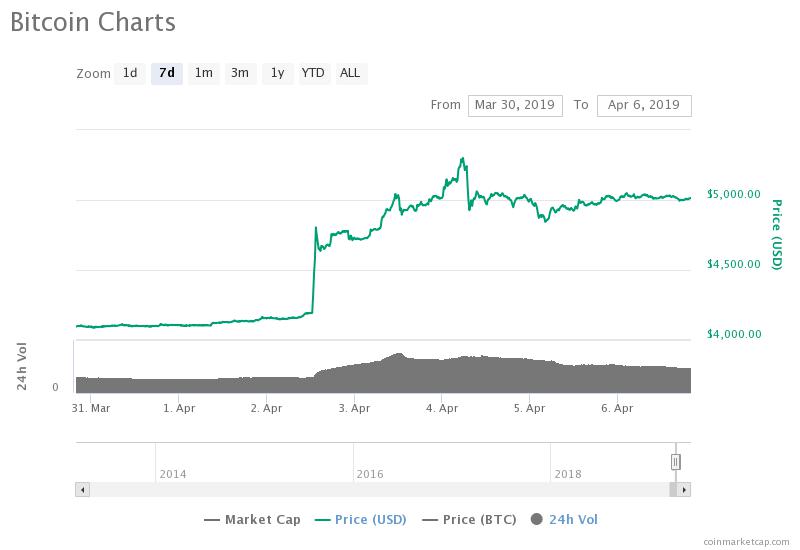

On April 1, the bitcoin price initiated a large 19 percent rally from $4,200 to $5,000, peaking at $5,300 the next day across several major crypto exchanges.

The rapid upside movement of bitcoin, which occurred in minutes, is said to have been triggered by two major factors. At $4,200, there were around $80 million worth of sell orders. As the sell orders were absorbed by buyers, it liquidated $500 million worth of short contracts.

The absorption of massive sell orders, a short squeeze of bitcoin contracts, and the lack of resistance above $4,200 are considered as the main catalysts of the recent bullish movement of the dominant cryptocurrency.

Only Just a Start For Bitcoin

According to a cryptocurrency analyst, the 19 percent price increase of bitcoin was triggered by buy orders amounting to about 20,000 bitcoin, worth nearly $100 million.

Technically, if the absorption of sell orders at the $4,200 resistance level, which bitcoin failed to test for more than three months in the first quarter of 2019, the orders would amount to well over $200 million.

But, if the rest of the movement from $4,200 to the $5,000 level was triggered by 7,000 bitcoin, the analyst said that a promising rally is expected as block reward halving approaches.

“Three 7,000 BTC buy orders were the catalyst for this recent pump. That’s 0.1% of the supply bought up instantly. In 416 days the number of bitcoin created every 24 hours cuts in half. 328,500 LESS bitcoin will be created per year. This pump was just the start. Be ready,” the analyst said.

The 7,000 BTC figure came from a Reuters report, which cited Oliver von Landsberg-Sadie, CEO of cryptocurrency firm BCB Group.

Earlier this week, Landsberg-Sadie said :

There has been a single order that has been algorithmically-managed across these three venues, of around 20,000 BTC. If you look at the volumes on each of those three exchanges – there were in-concert, synchronized, units of volume of around 7,000 BTC in an hour.

Why is Halving So Important?

Analysts are carefully observing the price movement of bitcoin ahead of its scheduled block reward halving in 2020 because historically, bitcoin has tended to surge in price a year before its halving starts.

Large price orders prior to a block reward halving can be considered as a sign of confidence because the rate in which bitcoin is produced through mining drops following each halving.

Accumulation of bitcoin before a halving would imply that investors foresee the price of the asset rising as its circulating supply becomes more restricted over time.

In consideration of all factors, Peter Brandt, a widely recognized technical analyst, said that it would not surprise him if bitcoin enters a new parabolic phase during which it recovers beyond $20.000.

Whales are Buying Too

On Thursday, on CNBC’s Squawk Box, Fundstrat Global Advisors head of research Thomas Lee said that whales, or large bitcoin holders, began to accumulate the asset once again in recent weeks.

Lee cited various positive developments pertaining to the crypto industry and fundamental indicators such as improving infrastructure and rising volume.

“Bitcoin had a rough 2018 and for much of 2019, it’s been steadily climbing, and from what we can gather, it’s because there have been positive things taking place. You know a lot of the old whale wallets are buying bitcoin so it’s been slow accumulation,” he said.

Whales, most of whom sold relatively large portions of their holdings at $20,000, could be accumulating more BTC in anticipation of positive price movements ahead of the block reward halving.