Bitcoin Moves Staggering $8.9 Billion USD in Single Record-Setting Hour

The bitcoin network peaked an all-time in on-chain volume, processing nearly $9 billion in value in a single hour. | Source: Shutterstock.com

- Bitcoin processed $8.9 billion in a single hour, highest in its history.

- It shows how BTC can grow as an established store of value.

- VC investors foresee BTC evolving into a major asset due to its ability to transfer value.

In a single hour, the Bitcoin network processed $8.9 billion in transactions. While most of it was change in addresses, it showed a glimpse of how BTC could perform as an established medium of exchange in the long-term.

According to Glassnode co-founder Rafael Schultze-Kraft, it was the highest hourly volume of bitcoin (BTC) in terms of USD in its 11-year history.

Large Transactional Capacity Shows Potential of Bitcoin as Store of Value

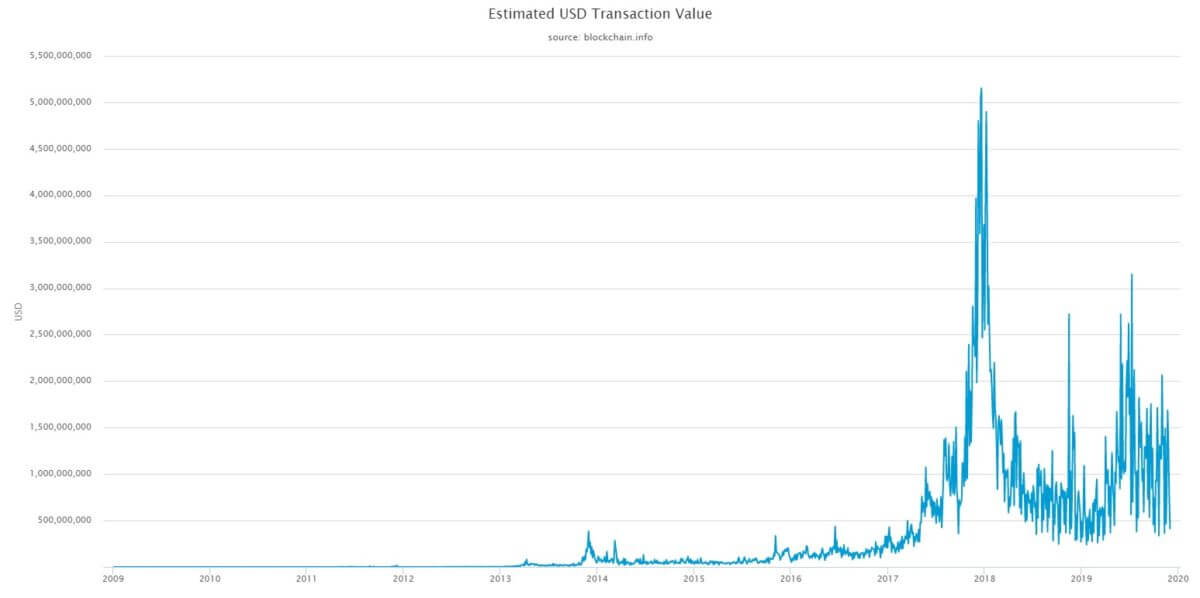

Based on on-chain data from Blockchain.com, the total daily USD transaction value of bitcoin increased from around $250 million in 2017 to over $1.5 billion in 2019.

The Bitcoin network is starting to process a significant amount of transactions on a daily basis, which is set to rise even higher over time if the BTC price rises.

The sudden movement of nearly $9 billion in transactions on December 4 does not reflect the current price trend of BTC or the state of the market.

Large bitcoin holders tend to switch addresses or use new addresses regularly as a practical security measure.

What it shows is the ability of the Bitcoin network to settle billions of dollars in value in a short period of time, a characteristic that would position BTC to compete against traditional safe-haven assets.

Venture capital investors like Blockchain Capital’s Spencer Bogart have said in recent months that the strong fundamentals of bitcoin as a medium of exchange and store of value will fuel its long-term prosperity.

Earlier this week, CCN.com reported that despite China’s crackdown on cryptocurrency exchanges, Bogart sees BTC rising in the years ahead as it continues to grow as a store of value.

A long way to go

Although bitcoin’s capacity is growing and more USD value is being processed on a daily basis, infrastructure supporting the asset class has to strengthen.

Bakkt and other institutional platforms have only emerged in 2019, and a variety of custodians are necessary to support bitcoin’s growth as an established safe haven asset.