Bitcoin Price to Likely Avoid Drop Below $3k as Crypto Loses $14 Billion in 1 Week

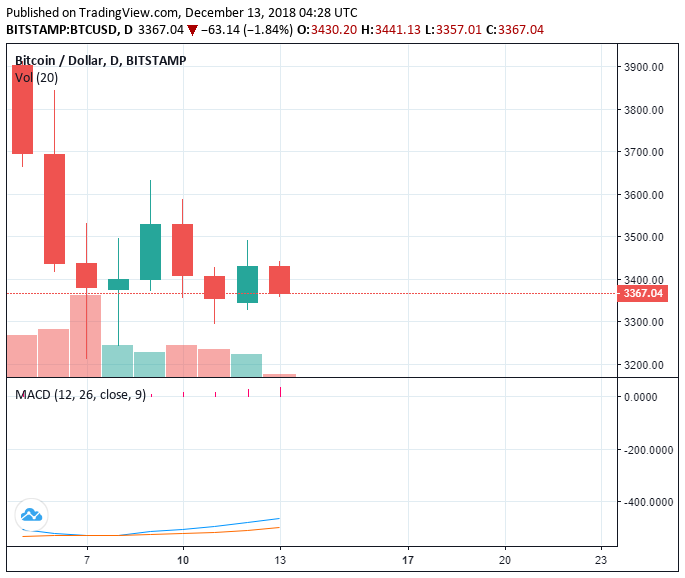

Over the past 48 hours, the Bitcoin price has stabilized at around $3,400 after dropping to a new yearly low at $3,210 on December 7.

On a weekly basis, Bitcoin (BTC) is up six percent from $3,210 to $3,400 but the cryptocurrency market has lost $14 billion of its valuation against the U.S. dollar mostly due to the underwhelming performance of major digital assets and the plunge in the value of ERC20 tokens.

The Ethereum price has also recovered slightly by a similar magnitude as Bitcoin, with Ethereum (ETH) recording an eight percent increase from $83 to $90. But, the Bitcoin Cash price remains at its all-time low at $94.

Big Bitcoin Buy Wall

According to Su Zhu, the CEO at Three Arrows Capital, buy walls on fiat-to-crypto exchanges like Coinbase and Bitstamp for Bitcoin at $3,300 have risen significantly within the last several weeks.

Rising buy walls on major digital asset trading platforms suggest that a small group of investors is beginning to accumulate Bitcoin while it remains highly volatile in a tight but low price range.

Zhu explained :

“10% down from here ($3,300), buy walls on @Coinbase are now the largest (in BTC notional ) since mid-2015. Similar for Bitstamp.”

He further emphasized that to break below the $3,300 level, more investors on Know Your Customer (KYC)-enabled exchanges, which are essentially fiat-to-crypto trading platforms, will need to get through the large buy wall at $3,300 and lead an intense sell-off.

“To break lower will require filling these fiat-backed bids. Either 1) more BTC borrow to come online 2) KYC-able off-ramp selling. Derivatives selling will just lead to funding becoming very negative as it has been,” he said.

If a large unforeseen sell-off is to happen, the daily volume of Bitcoin that hovers at around $4 billion, would have to spike above its monthly high at just over $6.5 billion.

Throughout the past seven days, the volume of the dominant cryptocurrency has continued to fall as the price of the asset stabilized in the range of $3,300 to $3,500. The decline in the volume of BTC mainly shows that the selling pressure on the currency has dropped following its drop to a new yearly low.

As a cryptocurrency trader and technical analyst with an online alias “Hsaka” said, until BTC breaks out of major resistance, it is likely to stay in the range between $3,300 to $3,500. Several resistance exist in north of $3,000, at around $3,500 and $3,700.

The analyst said :

“Quite the slow grind up from the corn. Coming into range resistance now. A clean break and close of the $3,480 resistance, and I’m eyeing a move back towards the grey supply. Invalidation on a move back below $3,400.”

Is a Short-Term Rally For Bitcoin in Play?

Currently, based on the trend of the market since early December, it is becoming more likely that Bitcoin will extend its negative sentiment into 2019. Until the currency begins to demonstrate signs of prolonged stability and the initiation of a consolidation period, volatility in a low price range is expected.

Featured Image from Shutterstock. Charts from TradingView .