Bitcoin Price Targets $6,000 as Crypto Market Cap Crosses $170 Billion

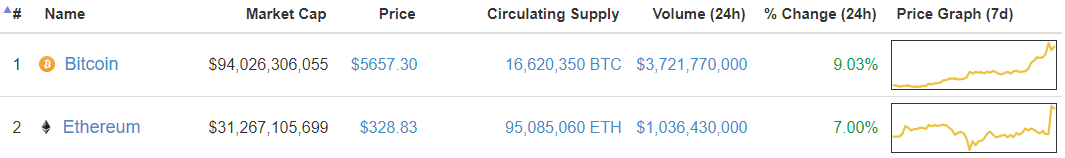

The bitcoin price continued its meteoric rise on Friday, climbing as high as $5,840 to make $6,000 seem like a near-term possibility. The wider crypto markets experienced a general upswing as well, with the ethereum price posting a 7% to gain to rise above $325 for the first time in more than a month.

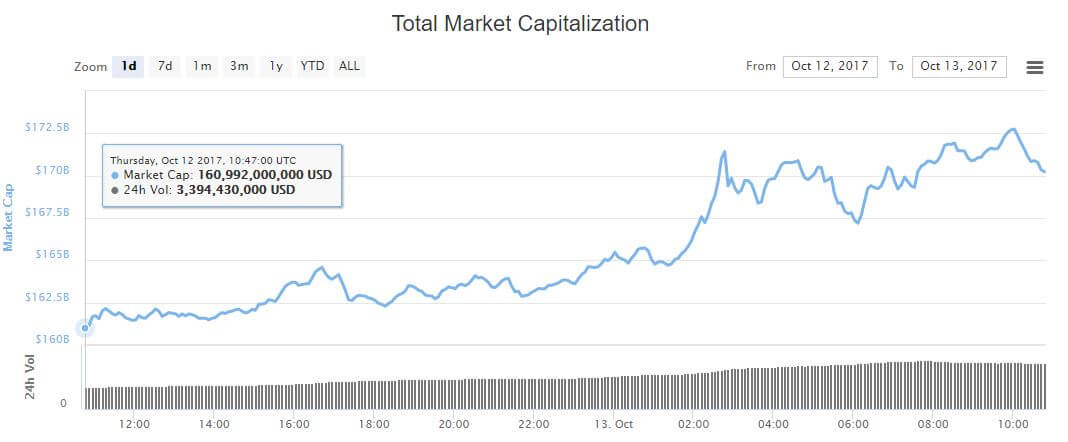

Altogether, the combined value of all cryptocurrencies rose by another $10 billion for the day. On Thursday, the crypto market cap hit $160 billion after the bitcoin price reached $5,000. It continued to rise throughout the day, eventually crossing $165 billion early Friday morning. Suddenly, the markets spiked above $170 billion for the first time since September 2. At present, the total cryptocurrency market cap weighs in at $171 billion, placing it less than $10 billion below its all-time high.

Bitcoin Price Targets $6,000

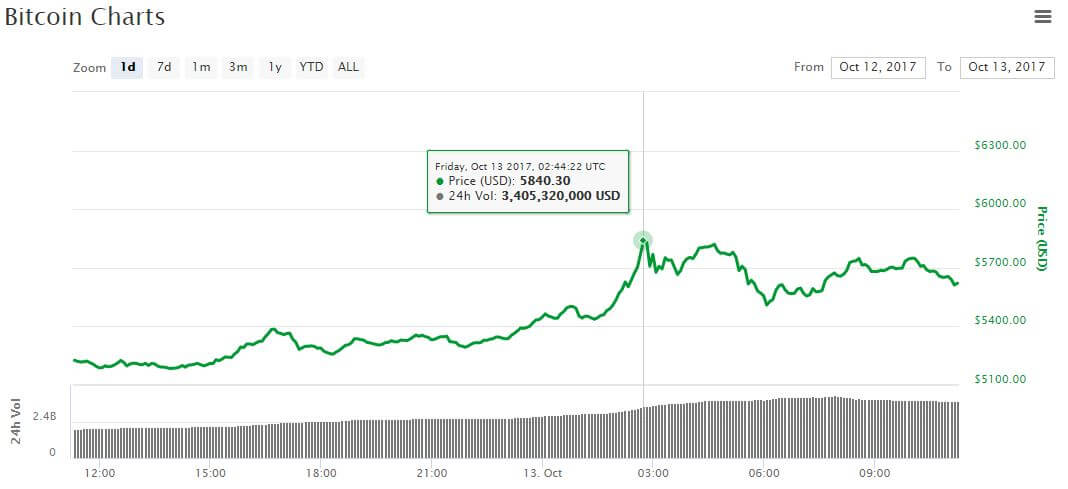

This week has seen bitcoin rise at an unprecedented pace. Less than a week ago, the bitcoin price was trading below $4,500. However, it has not looked back since it burst through that barrier, enabling it to cross $5,000 and set a new all-time high on Thursday. That forward momentum continued on Friday, and the global average bitcoin price surged as high as $5,840 — with one exchange pricing bitcoin as high as $5,920 — before tapering off to a present value of $5,657. This gives bitcoin a market cap of $94 billion, raising its total valuation about $1 billion higher than that of investment banking giant Goldman Sachs.

Bitcoin’s dominant market share has swelled to 55% this week, and many analysts expect that number to continue to grow in the coming months, with the bitcoin price extending past $6,000 — or perhaps even to $10,000 — within the near- to mid-term.

Ethereum Price Reaches Monthly High

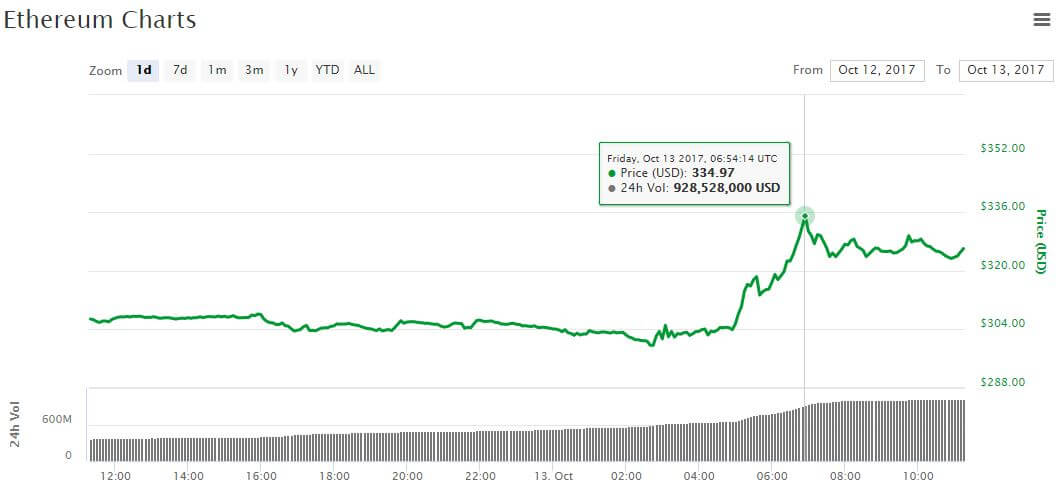

The ethereum price joined bitcoin in its Friday rally, climbing 7% and extending as far north as $335, its highest mark in one month. At present, the ethereum price is trading at $328, which translates into a market cap of $31.3 billion.

Part of the reason for ethereum’s climb is that Coinbase announced that it will begin rolling out instant purchases for transactions paid for with a U.S. bank account, making it far more convenient for U.S. investors to obtain ethereum, bitcoin, and litecoin.

Litecoin Price Leads Altcoin Advance

The altcoin markets experienced a general upswing on Friday, although many coins lost value against bitcoin.

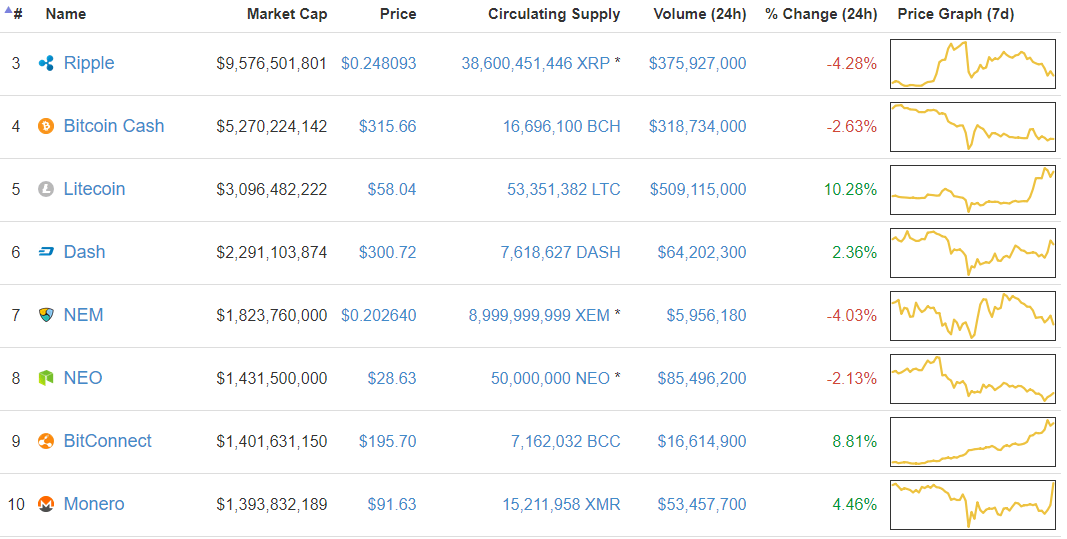

Ripple posted another disappointing day following its dramatic rise earlier in the month. The ripple price declined 4% to $0.248, reducing its market cap to $9.6 billion. Bitcoin cash fared slightly better, posting a 3% decline to $316

The litecoin price, meanwhile, leaped by 10% to $58, raising its market cap to $3.1 billion. Like ethereum, litecoin benefits from the Coinbase announcement, which is a likely contributor to its present rally.

Sixth-ranked dash rose 3%, bringing its price across the $300 threshold once again, but NEM and NEO each declined for the second-straight day. BitConnect added another 9% to its swelling market cap, enabling it to leap over monero and claim the ninth spot in the market cap rankings. BitConnect is now just $30 million behind eighth-place NEO. Although it lost ground to bitconnect, monero experienced a 5% increase of its own, raising its price to $92 to round out the top 10.

Featured image from Shutterstock.